PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858811

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858811

Insect Protein Processing Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

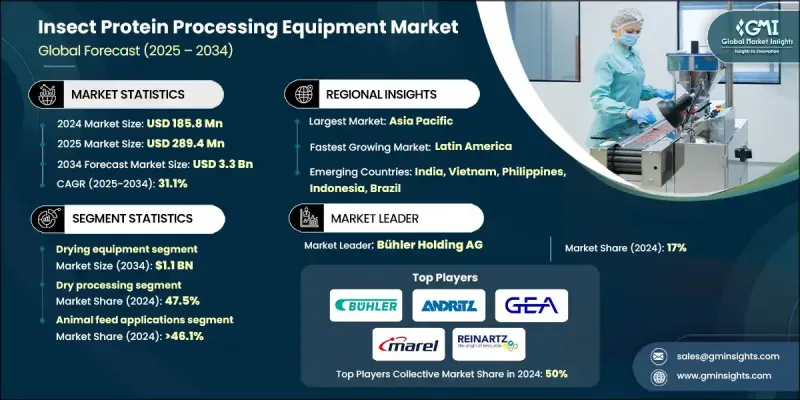

The Global Insect Protein Processing Equipment Market was valued at USD 185.8 million in 2024 and is estimated to grow at a CAGR of 31.1% to reach USD 3.3 billion by 2034.

Rapid expansion across sectors such as aquaculture, animal feed, pet food, and human consumption is creating significant demand for scalable, efficient insect protein processing systems. Equipment providers are receiving increased orders from both emerging startups and established agro-industrial groups as insect-based nutrition continues gaining ground. This growth closely mirrors broader sustainability trends in agriculture and food production. Advanced processing equipment is becoming essential as the sector shifts toward safe, high-yield, and quality-driven insect-based ingredients. Manufacturers are responding to the need for systems that deliver precision, reduce energy consumption, and comply with strict safety and traceability protocols, particularly in markets such as Japan and the EU. As automation, AI, and energy-monitoring features are integrated into next-gen machines, facilities are becoming more efficient, sustainable, and economically viable.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $185.8 Million |

| Forecast Value | $3.3 Billion |

| CAGR | 31.1% |

The drying equipment segment generated USD 65.1 million in 2024 and is projected to reach USD 1.1 billion by 2034, with a CAGR of 31.2%. This segment leads due to its critical function in preserving protein integrity, microbial safety, and overall product shelf life. Vacuum and freeze dryers are seeing high demand for their ability to maintain bioactivity and protein concentration, especially in products targeted for human nutrition and high-value applications. Though energy-intensive, these systems support superior output quality and longer shelf stability, justifying their growing use in nutraceuticals and food-grade insect products.

The animal feed applications segment held 46.1% share in 2024, remaining the most mature and commercialized segment. As livestock nutrition markets adopt insect protein at scale, installations of oil recovery, grinding, and drying equipment in feed manufacturing plants continue to rise.

Canada Insect Protein Processing Equipment Market held a significant share in 2024, driven by the insect protein processing through focused government support. Investments in R&D and sustainable food systems are prompting the expansion of insect protein facilities across the country. Consumer preferences for clean-label and sustainable protein sources are also accelerating the development of human-grade insect protein production systems, like trends seen in the United States.

Leading companies in the Insect Protein Processing Equipment Market include GEA Group AG, Buhler Holding AG, ANDRITZ Group, Maschinenfabrik Reinartz GmbH & Co. KG, and Marel. Key players in the insect protein processing equipment industry are focusing on integrating smart automation, AI-based monitoring, and energy-efficient systems to enhance process yields and sustainability. Companies are designing modular systems that can be tailored for different insects and scale levels, ensuring flexibility for both large manufacturers and emerging players. There is growing investment in solvent-free oil separation and closed-loop extraction systems to preserve nutrient quality in insect-derived oils and peptides.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Equipment type

- 2.2.3 Processing method

- 2.2.4 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By equipment type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries( Note: the trade statistics will be provided for key countries only)

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Equipment Type, 2021 - 2034 (USD Million) (Units)

- 5.1 Key trends

- 5.2 Drying equipment

- 5.2.1 Belt dryers & forced-air systems

- 5.2.2 Vacuum dryers & freeze drying systems

- 5.2.3 Spray dryers & specialized thermal systems

- 5.3 Grinding & milling equipment

- 5.3.1 Hammer mills & impact grinders

- 5.3.2 Conical mills & particle size reduction

- 5.3.3 Specialized communication systems

- 5.4 Separation & filtration systems

- 5.4.1 Centrifuges & decanter systems

- 5.4.2 Membrane filtration & ultrafiltration

- 5.4.3 Vibratory screens & mesh separation

- 5.5 Extraction & processing equipment

- 5.5.1 Protein extraction systems

- 5.5.2 Oil separation & defatting equipment

- 5.5.3 Solvent recovery & purification systems

- 5.6 Automation & control systems

- 5.6.1 Process control & monitoring equipment

- 5.6.2 Quality assurance & testing systems

- 5.6.3 Traceability & data management platforms

- 5.7 Other equipment categories

- 5.7.1 Packaging & storage systems

- 5.7.2 Sterilization & sanitization equipment

- 5.7.3 Material handling & conveying systems

Chapter 6 Market Estimates and Forecast, By Processing Method, 2021 - 2034 (USD Million) (Units)

- 6.1 Key trends

- 6.2 Dry processing

- 6.3 Wet processing

- 6.4 Hybrid processing

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Units)

- 7.1 Key trends

- 7.2 Animal feed applications

- 7.2.1 Aquaculture feed processing

- 7.2.2 Poultry feed applications

- 7.2.3 Pet food & specialty feed

- 7.2.4 Livestock feed integration

- 7.3 Human food applications

- 7.3.1 Protein powder & ingredient processing

- 7.3.2 Snack food & bar manufacturing

- 7.3.3 Meat analog & alternative protein processing

- 7.3.4 Functional food & nutraceutical applications

- 7.4 Industrial & other applications

- 7.4.1 Pharmaceutical & bioactive compound extraction

- 7.4.2 Cosmetic & personal care applications

- 7.4.3 Fertilizer & frass processing

- 7.4.4 Research & development applications

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Alfa Laval AB

- 9.2 ANDRITZ Group

- 9.3 Aspire Food Group

- 9.4 Beta Hatch

- 9.5 Better Insect Solution

- 9.6 Buhler Holding AG

- 9.7 Cricket One

- 9.8 FarmInsect

- 9.9 GEA Group Aktiengesellschaft

- 9.10 Heat and Control Inc.

- 9.11 Hosokawa Micron B.V.

- 9.12 InnovaFeed

- 9.13 INSPRO SCIENCE

- 9.14 JBT Corporation

- 9.15 Key Technology

- 9.16 Krones AG

- 9.17 Marel

- 9.18 Maschinenfabrik Reinartz GmbH & Co. KG

- 9.19 Protix

- 9.20 Russell Finex Ltd.

- 9.21 Tebrio

- 9.22 Tetra Pak

- 9.23 The Dupps Company

- 9.24 Urschel Laboratories

- 9.25 Ynsect