PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858817

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858817

Last Mile Delivery Vehicle Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

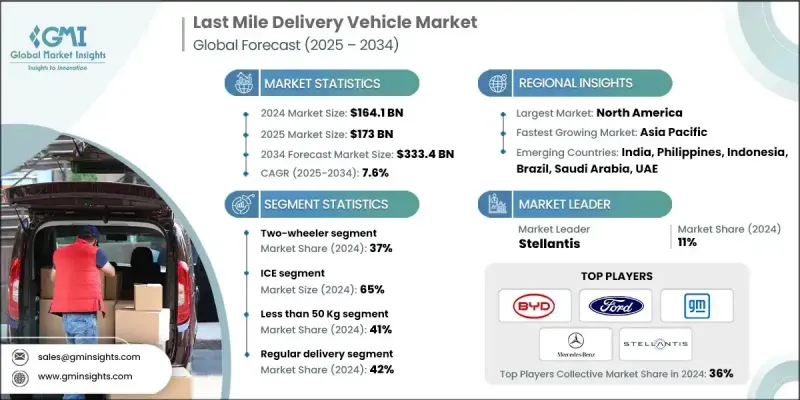

The Global Last Mile Delivery Vehicle Market was valued at USD 164.1 billion in 2024 and is estimated to grow at a CAGR of 7.6% to reach USD 333.4 billion by 2034.

Rising e-commerce activity, dense urbanization, and increasing demand for rapid delivery are transforming the market landscape. Vehicles like small trucks, light commercial vans, three-wheelers, and cargo two-wheelers are helping service providers enhance delivery speed, navigate traffic, and cut down on fuel and maintenance costs. Real-time vehicle tracking, advanced telematics, and predictive maintenance are key tools operators are turning to for optimizing performance. Strategically located refueling stations and depot hubs are also improving vehicle utilization and minimizing idle time. With consumer behavior favoring faster and more flexible options, market players are adapting quickly to meet growing logistics expectations in city centers and suburban areas alike.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $164.1 Billion |

| Forecast Value | $333.4 Billion |

| CAGR | 7.6% |

Despite manufacturing disruptions during the pandemic, the surge in online retail has sharply increased investments in delivery vehicle fleets. Subscription-based leasing, remote diagnostics, and fleet-sharing solutions are gaining momentum to ensure flexibility and operational reliability. Growing demand for healthcare, food, grocery, and e-commerce deliveries has driven the widespread use of compact delivery vehicles. Operators and OEMs are now embedding IoT platforms, micro-mobility innovations, and intelligent fleet systems to streamline logistics and support urban transportation strategies.

The two-wheeler segment held a 37% share in 2024 and is projected to grow at a CAGR of 6.8% through 2034. These vehicles are widely used due to their affordability, quick navigation in traffic, and low operating costs. Businesses involved in food delivery, parcel logistics, and grocery distribution continue to favor bikes and scooters for short-distance trips. In regions like Asia Pacific, they remain dominant due to cost advantages and easier maneuverability. With electric variants gaining traction, operators are also prioritizing sustainability and low emissions across fleets.

The internal combustion engines (ICE) segment held a 65% share in 2024 and is expected to grow at a CAGR of 7.1% through 2034. These vehicles remain favored by fleet operators thanks to their longer range, quick refueling, and strong payload capacity. ICE models are widely available and supported by global infrastructure, making them ideal for high-volume daily deliveries, especially in areas with limited charging networks.

The regular delivery services segment accounted for a 42% share in 2024. This segment includes routine logistics such as parcels, groceries, and household items. Its steady growth is driven by recurring demand, predictable delivery routes, and widespread consumer reliance on scheduled shipments. Companies prefer regular delivery schedules for their cost-effectiveness and easier route planning, keeping the segment at the forefront of vehicle utilization.

U.S. Last Mile Delivery Vehicle Market generated USD 53.5 billion in 2024 and held an 85% share. Its leadership is supported by a well-developed e-commerce ecosystem and increasing investment in green transportation. Major logistics providers are actively deploying electric vans, cargo bikes, and e-trikes as part of sustainable delivery strategies. Government policies, including tax breaks and grant programs for EVs, are accelerating fleet electrification and encouraging operators to transition from ICE to electric models.

Key players active in the Global Last Mile Delivery Vehicle Industry include Tata Motors, Mercedes-Benz, GreenPower Motor, Stellantis, Rivian, General Motors, Mahindra Electric, Ford, Xos, and BYD. To secure a stronger foothold in the last mile delivery vehicle market, companies are focusing on a mix of electrification, digitalization, and flexible business models. Strategic investments are being made in battery technology, real-time vehicle intelligence, and connected platforms to optimize fleet operations. Leading manufacturers are rolling out purpose-built EVs designed for short-haul deliveries, while also partnering with logistics firms for pilot deployments. Telematics systems are being integrated for predictive maintenance and route optimization. Subscription models and vehicle leasing plans are also being introduced to attract SMEs and gig-economy drivers looking for scalable, low-cost entry into delivery services.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicle

- 2.2.3 Payload Capacity

- 2.2.4 End Use

- 2.2.5 Delivery Mode

- 2.2.6 Propulsion

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growth of e-commerce & same-day deliveries

- 3.2.1.2 Government incentives & urban low-emission policies

- 3.2.1.3 Urban population growth & traffic congestion

- 3.2.1.4 Advancements in battery technology and fast-charging solutions.

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment in vehicles and infrastructure.

- 3.2.2.2 Limited charging infrastructure and restricted vehicle range.

- 3.2.3 Market opportunities

- 3.2.3.1 Rise in electrification and hybrid vehicle adoption.

- 3.2.3.2 Surge in connected fleet management solutions.

- 3.2.3.3 Rise in demand from emerging markets like Asia-Pacific and Latin America.

- 3.2.3.4 Increase in sustainability-focused partnerships between logistics providers and OEMs.

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Market adoption statistics

- 3.13.1 Electric delivery vehicle deployment rates

- 3.13.2 Fleet electrification progress

- 3.13.3 Charging infrastructure development

- 3.13.4 Technology feature adoption

- 3.13.5 Regional adoption patterns

- 3.13.6 Customer satisfaction metrics

- 3.13.7 Operational performance measurements

- 3.14 E-commerce & delivery market integration

- 3.14.1 Online retail growth impact

- 3.14.2 Last mile delivery vehicle demand analysis

- 3.14.3 Delivery speed & efficiency requirements

- 3.14.4 Customer expectation evolution

- 3.14.5 Peak season demand management

- 3.14.6 Urban delivery density optimization

- 3.14.7 Sustainability consumer preferences

- 3.15 Investment landscape analysis

- 3.15.1 Vehicle manufacturer investment

- 3.15.2 Fleet operator capital allocation

- 3.15.3 Government infrastructure funding

- 3.15.4 Private charging network investment

- 3.15.5 Venture capital in delivery technology

- 3.15.6 ROI analysis by investment type

- 3.15.7 Green bond & sustainable financing

- 3.16 Customer behavior analysis

- 3.16.1 Fleet operator decision factors

- 3.16.2 Vehicle selection criteria

- 3.16.3 Technology adoption preferences

- 3.16.4 Total cost of ownership priorities

- 3.16.5 Service & support requirements

- 3.16.6 Sustainability commitment influence

- 3.16.7 Regional preference variations

- 3.17 Business model evolution

- 3.17.1 Traditional vehicle sales models

- 3.17.2 Vehicle-as-a-service (VaaS) models

- 3.17.3 Leasing & financing solutions

- 3.17.4 Integrated fleet solutions

- 3.17.5 Charging-as-a-service models

- 3.17.6 Performance-based contracting

- 3.18 Performance & quality standards

- 3.18.1 Commercial vehicle performance metrics

- 3.18.2 Battery performance & durability

- 3.18.3 Charging speed & efficiency

- 3.18.4 Reliability & availability standards

- 3.18.5 Safety & security requirements

- 3.18.6 Environmental performance standards

- 3.19 Risk assessment framework

- 3.19.1 Technology adoption risks

- 3.19.2 Battery performance & degradation risks

- 3.19.3 Charging infrastructure availability risks

- 3.19.4 Regulatory compliance risks

- 3.19.5 Market demand volatility

- 3.19.6 Supply chain disruption risks

- 3.19.7 Competitive technology risks

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021-2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Two-Wheeler

- 5.2.1 Bikes/Bicycles

- 5.2.2 Scooters

- 5.2.3 Motorcycles

- 5.3 Three-Wheeler

- 5.3.1 Auto Rickshaws

- 5.3.2 Tricycles

- 5.3.3 Light Commercial Three-Wheelers

- 5.4 Four-Wheeler

- 5.41 Micro Commercial Vehicles

- 5.4.2 Light Commercial Vehicles (LCV)

- 5.4.3 Medium Commercial Vehicles

- 5.4.4 Specialized Four-Wheelers

- 5.5 Micro Mobility

- 5.5.1 Personal Mobility

- 5.5.2 Cargo Micro Mobility

Chapter 6 Market Estimates & Forecast, By End Use, 2021-2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Logistics & Transportation Services

- 6.3 Retail & E-commerce Companies

- 6.4 Food Service & Restaurant Industry

- 6.5 Healthcare & Pharmaceutical Industry

- 6.6 Government & Public Services

- 6.7 Utilities & Field Services

- 6.8 Others

Chapter 7 Market Estimates & Forecast, By Payload Capacity, 2021-2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Less than 50 Kg

- 7.3 50-500 Kg

- 7.4 500- 1500 Kg

- 7.5 More than 1500 Kg

Chapter 8 Market Estimates & Forecast, By Delivery Mode, 2021-2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Regular Delivery

- 8.3 Same-Day Delivery

- 8.4 Express Delivery

Chapter 9 Market Estimates & Forecast, By Propulsion, 2021-2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 ICE

- 9.3 Electric

- 9.4 Hybrid

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Philippines

- 10.4.7 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Arrival Limited

- 11.1.2 BYD

- 11.1.3 Ford

- 11.1.4 General Motors

- 11.1.5 GreenPower Motor Company

- 11.1.6 Mercedes-Benz

- 11.1.7 Nissan

- 11.1.8 Rivian

- 11.1.9 Stellantis

- 11.1.10 Workhorse

- 11.2 Regional Players

- 11.2.1 Bollinger Motors

- 11.2.2 Canoo

- 11.2.3 Chanje Energy

- 11.2.4 Isuzu Motors

- 11.2.5 Lightning eMotors

- 11.2.6 Mahindra Electric

- 11.2.7 Renault

- 11.2.8 Tata Motors

- 11.2.9 Volkswagen

- 11.3 Emerging Players

- 11.3.1 Alke

- 11.3.2 Cenntro Electric

- 11.3.3 Einride

- 11.3.4 Goupil

- 11.3.5 SEA Electric

- 11.3.6 StreetScooter

- 11.3.7 Tevva Motors

- 11.3.8 Volta Trucks

- 11.3.9 Xos