PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858829

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858829

Automotive Alternator and Starter Motor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

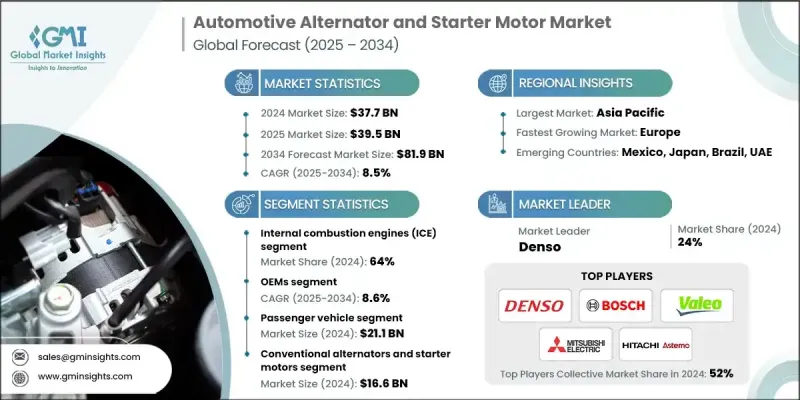

The Global Automotive Alternator and Starter Motor Market was valued at USD 37.7 billion in 2024 and is estimated to grow at a CAGR of 8.5% to reach USD 81.9 billion by 2034.

Market growth is accelerating as automakers respond to increasing vehicle electrification, rising demand for hybrid and electric vehicles, and tougher global emission norms. As battery technology continues to evolve and energy efficiency becomes central to vehicle design, automotive manufacturers are prioritizing electrical components that enhance powertrain performance while reducing emissions and fuel consumption. Integrated vehicle systems are placing greater demands on alternators and starter motors, pushing suppliers to innovate and deliver solutions that align with modern mobility trends. Technological enhancements and smart vehicle architectures are also contributing to this momentum. High-efficiency, lightweight, and intelligent systems are replacing older components to ensure compliance with global standards, improve reliability, and extend operational lifespan. Both automakers and suppliers are investing heavily in components that support complex electronic functions, optimize engine operations, and enhance energy management in modern vehicles, particularly as the industry transitions toward sustainable mobility. As these trends continue to evolve, alternator and starter motor technologies are becoming more central to overall vehicle performance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $37.7 Billion |

| Forecast Value | $81.9 Billion |

| CAGR | 8.5% |

In 2024, the internal combustion engine (ICE) segment held a 64% share. Despite the rise of electric vehicles, ICE-powered vehicles still dominate global production and sales. Automotive OEMs and fleet operators continue to rely on proven ICE technologies, requiring high-performance alternators and starter motors that support efficient energy use, engine reliability, and compatibility with increasingly electronic powertrains. Manufacturers are responding with durable and cost-optimized solutions engineered for seamless integration with traditional vehicle systems.

The OEM segment held a 71% share and is projected to grow at a CAGR of 8.6% through 2034. Demand from original equipment manufacturers remains strong, as automakers prioritize factory-installed, high-performance alternators and starter motors that meet stringent regulatory and efficiency standards. The focus remains on delivering robust, reliable components that comply with evolving emission norms, support vehicle electrification, and offer long-term durability. OEMs continue to partner with component suppliers to ensure quality integration, system compatibility, and sustained performance in next-generation vehicles.

North America Automotive Alternator and Starter Motor Market held 81.1% share in 2024, generating USD 8.2 billion. The country stands out due to its expansive automotive industry, widespread use of passenger and commercial vehicles, and increasing adoption of hybrid and electrified models. Strong regulatory frameworks around emissions and energy efficiency are creating new opportunities for manufacturers, as advanced alternators and smart starter motors become essential to meet both consumer expectations and government mandates.

Noteworthy companies in the Global Automotive Alternator and Starter Motor Market include Delphi Technologies, Robert Bosch, Hyundai Mobis, Hitachi Astemo, Mitsuba, Mitsubishi Electric, Lucas TVS, Denso, Valeo, and BorgWarner. Leading companies in the Global Automotive Alternator and Starter Motor Market are focusing on a blend of innovation, efficiency, and strategic alignment with OEM needs to strengthen their global footprint. Many are developing lightweight, compact, and high-efficiency components tailored for hybrid, ICE, and mild-hybrid vehicles. Strategic collaborations with automakers enable customization and seamless integration of advanced systems. Emphasis is also placed on smart features such as stop-start systems, regenerative energy capabilities, and predictive diagnostics.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Engine

- 2.2.3 Vehicle

- 2.2.4 Technology

- 2.2.5 Sales Channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factors affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising vehicle production & sales

- 3.2.1.2 Electrification & hybridization trends

- 3.2.1.3 Aftermarket demand from aging fleets

- 3.2.1.4 Technological advancements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Shifts toward full EVs reducing traditional demand

- 3.2.2.2 High R&D and transition costs

- 3.2.3 Market opportunities

- 3.2.3.1 Stricter global emission regulations

- 3.2.3.2 Intense price competition

- 3.2.3.3 Supply chain constraints

- 3.2.3.4 OEM consolidation and preference for integrated solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 SAE standards for automotive electrical systems

- 3.4.2 EPA emissions standards impact on electrical load

- 3.4.3 NHTSA safety standards for electrical components

- 3.4.4 International standards harmonization (ISO, IEC)

- 3.4.5 Cybersecurity regulations for connected vehicles

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation Landscape

- 3.7.1 Smart alternator development & variable output control

- 3.7.2 48v mild hybrid system integration

- 3.7.3 Brushless technology advancement

- 3.7.4 Integrated starter-alternator evolution

- 3.7.5 Energy management & battery integration

- 3.7.6 Predictive maintenance & IOT integration

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Risk Assessment Framework

- 3.14 Best Case Scenarios

- 3.15 Customer Analysis & Buying Behavior

- 3.15.1 OEM procurement criteria and decision frameworks

- 3.15.2 Aftermarket consumer preferences and pain points

- 3.15.3 Brand loyalty patterns

- 3.15.4 Price sensitivity analysis by customer segment

- 3.16 Trade Dynamics & Tariff Analysis

- 3.16.1 Import/export trends and trade flows

- 3.16.2 Tariff impacts by region

- 3.16.3 Trade policy changes and implications

- 3.16.4 Local content requirements

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Engine, 2021 - 2034 ($ Bn & Units)

- 5.1 Key trends

- 5.2 Internal Combustion Engine (ICE)

- 5.3 Hybrid Engines

- 5.4 Electric Vehicle (EV) Powertrains

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($ Bn & Units)

- 6.1 Key trends

- 6.2 Passenger Vehicles

- 6.2.1 SUV

- 6.2.2 Sedan

- 6.2.3 Hatchback

- 6.3 Commercial Vehicles

- 6.3.1 Light Commercial Vehicles (LCV)

- 6.3.2 Medium Commercial Vehicles (MCV)

- 6.3.3 Heavy Commercial Vehicles (HCV)

- 6.4 Two-Wheelers

- 6.5 Off-Road Vehicles

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 ($ Bn & Units)

- 7.1 Key trends

- 7.2 Conventional Alternators and Starter Motors

- 7.3 Smart Alternators and Starter Motors

- 7.4 Regenerative Braking Systems

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($ Bn & Units)

- 8.1 Key trends

- 8.2 OEMs

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($ Bn & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Belgium

- 9.3.7 Netherlands

- 9.3.8 Sweden

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 Singapore

- 9.4.6 South Korea

- 9.4.7 Vietnam

- 9.4.8 Indonesia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Global players

- 10.1.1 BorgWarner

- 10.1.2 Continental

- 10.1.3 Delphi Technologies

- 10.1.4 Denso

- 10.1.5 Hitachi Astemo

- 10.1.6 Lucas Electrical

- 10.1.7 Mitsuba

- 10.1.8 Mitsubishi Electric

- 10.1.9 Robert Bosch

- 10.1.10 Valeo

- 10.2 Regional players

- 10.2.1 ADVICS

- 10.2.2 ASIMCO Technologies

- 10.2.3 Cummins

- 10.2.4 DB Electrical

- 10.2.5 Guangzhou Sivco

- 10.2.6 Hella

- 10.2.7 Hyundai Mobis

- 10.2.8 Lucas TVS

- 10.2.9 Prestolite Electric

- 10.3 Emerging players

- 10.3.1 Broad-Ocean Technologies

- 10.3.2 Controlled Power Technologies

- 10.3.3 Ningbo Zhongwang AUTO Fittings

- 10.3.4 PHINIA

- 10.3.5 Unipoint