PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858832

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858832

Space Power Supply Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast

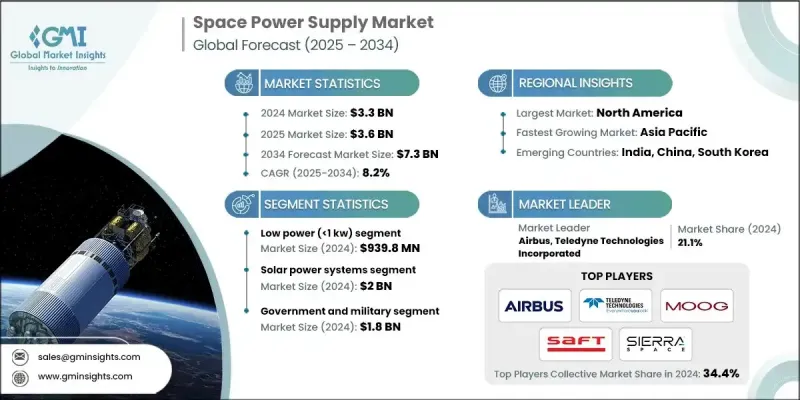

The Global Space Power Supply Market was valued at USD 3.3 billion in 2024 and is estimated to grow at a CAGR of 8.2% to reach USD 7.3 billion by 2034.

The market growth is propelled by increasing satellite launches, improvements in photovoltaic technologies, rising demand for CubeSats and small satellites, and the growing push toward sustainability. The acceleration of commercial missions and the demand for efficient power systems to support various types of satellite operations continue to create long-term opportunities. Rapid satellite deployment, especially in the form of large constellations for applications in communication, earth monitoring, and navigation, further fuels demand. North America leads the global landscape, owing to its advanced aerospace ecosystem, substantial funding support, cutting-edge research investments, and early adoption of AI in national defense infrastructure. The market is also gaining from strategic collaborations between public agencies and private space technology developers. Government investment in AI integration, especially in defense and intelligence systems, reinforces the region's leadership in next-generation space technologies and futureproofing of space assets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.3 Billion |

| Forecast Value | $7.3 Billion |

| CAGR | 8.2% |

The low power (1 kW) segment accounted for USD 939.8 million in 2024. This category continues to thrive due to its compatibility with compact satellites and short-term missions. It offers a lightweight and cost-efficient power solution, making it ideal for commercial and scientific missions operating under constrained resources. Manufacturers are focusing on enhancing power density and efficiency while keeping system costs under control. The design of reliable, compact systems remains a critical priority for developers targeting CubeSats and academic applications.

The solar power systems segment reached USD 2 billion in 2024. This growth is linked to the rising use of clean energy sources, maturing photovoltaic technologies, and the advantage of uninterrupted solar exposure in space. These systems are increasingly integrated into communication, defense, and research missions. Companies are focusing efforts on improving solar panel efficiency, reducing mass, and boosting system durability to handle harsh space conditions. These advances are key to extending mission lifespans and lowering overall deployment costs.

United States Space Power Supply Market generated USD 1.2 billion in 2024. This growth is supported by rapid upgrades in space infrastructure, rising emphasis on battery recycling, progressive space regulations, and increased demand for in-orbit services such as refueling. Manufacturers are aligning their designs to meet evolving needs by focusing on sustainable, modular, and advanced power technologies. These developments aim to support long-duration missions, ease regulatory transitions, and enable a future-ready space environment with a strong emphasis on mission flexibility and environmental stewardship.

Leading players driving innovation and growth in the Global Space Power Supply Market include L3Harris Technologies, Inc., Renesas Electronics Corporation, GomSpace, Moog Inc., Rocket Lab USA, Airbus, NanoAvionics, EnerSys, VPT, Inc., DHV Technology, Modular Devices Inc., ET SPACE POWER, INC., Teledyne Technologies Incorporated, Saft, Sierra Space Corporation, Apcon AeroSpace & Defence GmbH, GSYuasa Lithium Power, EaglePicher Technologies, AAC Clyde Space, Spectrolab, and AZUR SPACE Solar Power GmbH. Companies operating in the Space Power Supply Market are advancing through innovation, sustainability, and strategic alignment with global space missions. Many are investing heavily in R&D to develop high-efficiency, lightweight power systems suitable for both small and large spacecraft. A strong focus is placed on enhancing photovoltaic performance, increasing battery life, and reducing thermal loads in high-radiation environments. Modular system design is being embraced to support in-orbit servicing and reusability.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry snapshot

- 2.2 Key market trends

- 2.2.1 Power source trends

- 2.2.2 Power capacity trends

- 2.2.3 Platform trends

- 2.2.4 Application trends

- 2.2.5 End use trends

- 2.2.6 Regional

- 2.3 TAM Analysis, 2025-2034 (USD Million)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing Satellite Deployments

- 3.2.1.2 Advancements in Solar Panel Technology

- 3.2.1.3 Growth of Small Satellites and CubeSats

- 3.2.1.4 Rising Demand for Sustainable Energy Solutions

- 3.2.1.5 Expansion of Commercial Space Missions

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High Development and Deployment Costs

- 3.2.2.2 Technical Challenges and Reliability Issues

- 3.2.3 Market opportunities

- 3.2.3.1 Advancements in Battery Technologies

- 3.2.3.2 Miniaturization of Power Systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Defense Budget Analysis

- 3.13 Global Defense Spending Trends

- 3.14 Regional Defense Budget Allocation

- 3.14.1 North America

- 3.14.2 Europe

- 3.14.3 Asia Pacific

- 3.14.4 Middle East and Africa

- 3.14.5 Latin America

- 3.15 Key Defense Modernization Programs

- 3.16 Budget Forecast (2025-2034)

- 3.16.1 Impact on Industry Growth

- 3.16.2 Defense Budgets by Country

- 3.17 Supply Chain Resilience

- 3.18 Geopolitical Analysis

- 3.19 Workforce Analysis

- 3.20 Digital Transformation

- 3.21 Mergers, Acquisitions, and Strategic Partnerships Landscape

- 3.22 Risk Assessment and Management

- 3.23 Major Contract Awards (2021-2024)

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market Concentration Analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Power Source, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Solar power systems

- 5.3 Nuclear power systems

- 5.4 Battery systems

- 5.5 Fuel cells

- 5.6 Hybrid systems

Chapter 6 Market Estimates and Forecast, By Power Capacity, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Low power (<1 kw)

- 6.3 Medium power (1-20 kw)

- 6.4 High power (20-100 kw)

- 6.5 Very high power (>100 kw)

Chapter 7 Market Estimates and Forecast, By Platform, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 LEO (low earth orbit)

- 7.3 MEO (medium earth orbit)

- 7.4 GEO (geostationary orbit)

- 7.5 Deep space

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million)

- 8.1 Satellites

- 8.1.1 Communication

- 8.1.2 Earth observation

- 8.1.3 Navigation (GNSS)

- 8.1.4 Scientific & weather monitoring

- 8.1.5 Others

- 8.2 Space stations / habitats

- 8.2.1 ISS and planned commercial stations

- 8.2.2 Lunar gateway

- 8.2.3 Others

- 8.3 Spacecraft / deep-space probes

- 8.3.1 Interplanetary probes

- 8.3.2 Rovers

- 8.4 Launch vehicles

- 8.5 Others

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million)

- 9.1 Government and military

- 9.2 Commercial operators

- 9.3 Research institutions

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company profiles

- 11.1 Global Key Players

- 11.1.1 Airbus

- 11.1.2. L3 Harris Technologies, Inc.

- 11.1.3 Moog Inc.

- 11.1.4 EnerSys

- 11.1.5 Rocket Lab USA

- 11.2 Regional Key Players

- 11.2.1 North America

- 11.2.1.1 Teledyne Technologies Incorporated

- 11.2.1.2 GSYuasa Lithium Power

- 11.2.1.3 EaglePicher Technologies

- 11.2.1.4 VPT, Inc.

- 11.2.2 Europe

- 11.2.2.1 AAC Clyde Space

- 11.2.2.2 AZUR SPACE Solar Power GmbH

- 11.2.2.3 Apcon AeroSpace & Defence GmbH

- 11.2.2.4 DHV Technology

- 11.2.2.5 Saft

- 11.2.2.6 NanoAvionics

- 11.2.2.7 Modular Devices Inc.

- 11.2.2. 8 XP Semiconductor

- 11.2.3 Asia-Pacific

- 11.2.3.1 Renesas Electronics Corporation

- 11.2.3.2 GomSpace

- 11.2.1 North America

- 11.3 Disruptors / Niche Players

- 11.3.1 Sierra Space Corporation

- 11.3.2 Spectrolab

- 11.3.3 ET SPACE POWER, INC.