PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858834

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858834

Automotive Graphene-Enhanced Components Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

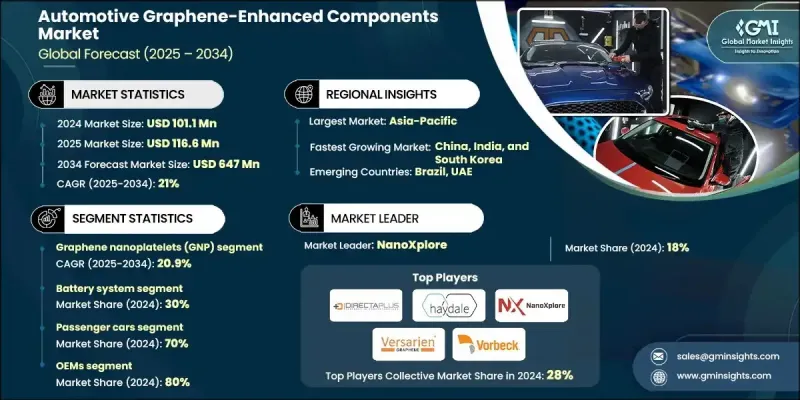

The Global Automotive Graphene-Enhanced Components Market was valued at USD 101.1 million in 2024 and is estimated to grow at a CAGR of 21% to reach USD 647 million by 2034.

This rapid growth is fueled by the increasing demand for materials that deliver strength, lightweight design, and superior energy performance. Graphene's exceptional conductivity, thermal regulation, and mechanical durability make it a preferred choice for automakers aiming to enhance efficiency and lower emissions. The industry is witnessing a shift from experimental usage to large-scale implementation as OEMs and Tier-1 suppliers ramp up investments. Electrification across major markets in Asia Pacific, North America, and Europe is a key catalyst, pushing the adoption of graphene-enhanced batteries, thermal systems, and structural components. Automotive manufacturers are actively engaging in R&D collaborations with material developers and research institutions to gain a competitive edge. Lightweight graphene-reinforced composites are gradually replacing traditional metal parts, directly contributing to better fuel economy and longer EV driving range. These trends align with stringent regulatory goals that promote sustainable automotive production and reduction in carbon emissions globally, reinforcing the long-term potential of graphene in next-generation vehicle manufacturing.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $101.1 Million |

| Forecast Value | $647 Million |

| CAGR | 21% |

The battery system segment held a 30% share in 2024. The rising penetration of electric vehicles is fueling demand for graphene-enabled battery solutions, as they offer superior conductivity and energy density. These advancements support features such as ultra-fast charging, enhanced battery life, and improved thermal safety. As a result, the segment continues to see strong engagement from automakers and suppliers focused on performance improvement.

The graphene nanoplatelets (GNP) segment will grow at a CAGR of 20.9% between 2025 and 2034. GNPs are used for their affordability, scalability, and balanced mechanical and thermal performance. They are gaining traction in a broad array of applications, including structural composites, battery electrodes, and functional coatings. Their cost-effective profile and multi-functional performance make them a preferred choice for large-scale automotive integration.

United States Automotive Graphene-Enhanced Components Market reached USD 23.3 million in 2024, emerging as a key market for automotive graphene-enhanced components. Growth is supported by strong EV adoption and strict emissions and fuel efficiency regulations. American manufacturers are rapidly deploying graphene-based battery packs, electronics, and thermal systems to meet performance benchmarks in both commercial and passenger vehicle segments.

Prominent companies shaping the Global Automotive Graphene-Enhanced Components Market include Vorbeck Materials, First Graphene, Graphene Nanochem, NanoXplore, Graphenea, Directa Plus, Applied Graphene Materials (AGM), Nanotech Energy, Versarien, and Haydale Graphene Industries. To solidify their position in the Automotive Graphene-Enhanced Components Market, leading companies are adopting key strategies focused on innovation, scalability, and partnerships. Many are prioritizing the development of tailored graphene formulations for specific automotive functions such as battery efficiency, thermal regulation, and structural strength. Firms are also investing in advanced manufacturing technologies to support mass production, while optimizing the cost-performance balance. Strategic collaborations with automotive OEMs, research universities, and materials suppliers are helping accelerate product testing and commercial rollout.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Graphene material

- 2.2.4 Vehicle

- 2.2.5 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing EV production and battery adoption

- 3.2.1.2 Lightweighting and fuel efficiency targets

- 3.2.1.3 Rise in high-performance electronics

- 3.2.1.4 Strong investments in nanomaterials R&D

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production cost of graphene materials

- 3.2.2.2 Limited large-scale supply chain

- 3.2.3 Market opportunities

- 3.2.3.1 Next-gen EV batteries and supercapacitors

- 3.2.3.2 Adoption in thermal management systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 Pestel analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Sustainability & environmental aspects

- 3.9.1 Sustainable practices

- 3.9.2 Waste reduction strategies

- 3.9.3 Energy efficiency in production

- 3.9.4 Eco-friendly Initiatives

- 3.9.5 Carbon footprint considerations

- 3.10 Use cases and applications

- 3.11 Best-case scenario

- 3.12 Cost-benefit analysis & roi optimization

- 3.12.1 Material cost vs performance trade-offs

- 3.12.2 Manufacturing cost impact assessment

- 3.12.3 Total cost of ownership models

- 3.12.4 Value engineering strategies

- 3.13 Intellectual property & technology licensing

- 3.13.1 Patent landscape analysis

- 3.13.2 Technology licensing models

- 3.13.3 Protection strategies

- 3.13.4 Freedom-to-operate assessments

- 3.14 Market adoption & customer acceptance

- 3.14.1 OEM decision-making criteria

- 3.14.2 Consumer perception & acceptance

- 3.14.3 Market education & awareness programs

- 3.14.4 Competitive differentiation strategies

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Under-hood components

- 5.2.1 Foam covers

- 5.2.2 Fuel rail covers

- 5.2.3 Pump covers

- 5.3 Structural composites

- 5.4 Battery system components

- 5.5 Thermal management systems

- 5.6 Electronic components

Chapter 6 Market Estimates & Forecast, By Graphene Material, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Graphene nanoplatelets (GNP)

- 6.3 Graphene oxide (GO)

- 6.4 Reduced graphene oxide (RGO)

- 6.5 CVD graphene films

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Passenger cars

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial vehicles

- 7.3.1 Light commercial vehicles (LCV)

- 7.3.2 Medium commercial vehicles (MCV)

- 7.3.3 Heavy commercial vehicles (HCV)

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 OEMs

- 8.3 Aftermarket & Service Providers

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Applied Graphene Materials

- 10.1.2 Directa Plus

- 10.1.3 First Graphene

- 10.1.4 Graphenea

- 10.1.5 Haydale Graphene Industries

- 10.1.6 Nanotech Energy

- 10.1.7 NanoXplore

- 10.1.8 Versarien

- 10.1.9 Vorbeck Materials

- 10.1.10 XG Sciences

- 10.2 Regional Players

- 10.2.1 Angstron Materials

- 10.2.2 Black Swan Graphene

- 10.2.3 Graphene NanoChem

- 10.2.4. Graphene 3D Lab

- 10.2.5 Global Graphene Group

- 10.2.6 Nanocyl

- 10.2.7 Skeleton Technologies

- 10.2.8 Talga Resources

- 10.2.9 Graphmatech

- 10.3 Emerging Players / Disruptors

- 10.3.1 Archer Materials

- 10.3.2 Avancis Graphene

- 10.3.3 Cnano Technology

- 10.3.4 Elcora Advanced Materials

- 10.3.5 Garmor Graphene

- 10.3.6 Grolltex

- 10.3.7 NanoGraphene

- 10.3.8 Zap & Go

- 10.3.9. 2 D Carbon Tech