PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858852

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858852

Oatmeal Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

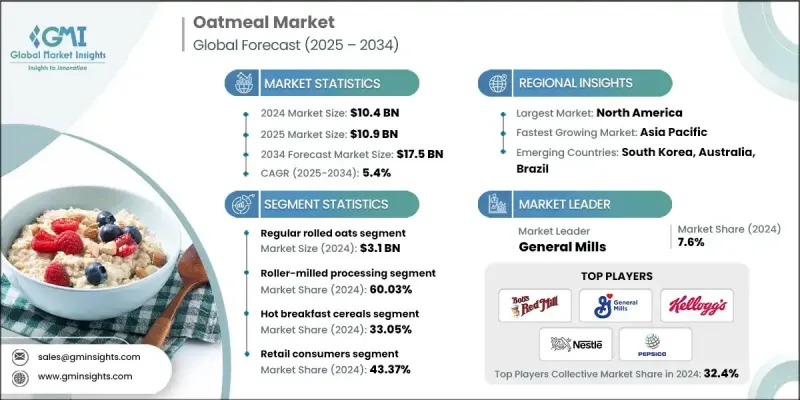

The Global Oatmeal Market was valued at USD 10.4 billion in 2024 and is estimated to grow at a CAGR of 5.4% to reach USD 17.5 billion by 2034.

The shift in consumer lifestyle toward healthier food choices continues to drive the demand for oatmeal, a nutrient-dense whole grain product made from ground oats. With a growing focus on wellness, consumers are embracing oatmeal for its heart-healthy fiber content, digestive benefits, and adaptability across meals. Health-conscious individuals are turning to whole grains for daily nutrition, and oatmeal is at the forefront due to its clean-label appeal and minimal processing. Increasing adoption of functional foods has also boosted oatmeal's position in the market, especially as fortified variants containing antioxidants and added nutrients gain popularity. Rising interest in plant-based nutrition and allergen-free options has positioned oatmeal as a go-to solution for sustainable, dairy-free breakfasts. Policy-level support for plant-derived and environmentally friendly food systems is further reinforcing the role of oatmeal in consumers' diets. As the wellness trend spreads globally, oatmeal is no longer viewed solely as a breakfast staple but rather as a flexible, wholesome food choice suitable for varied lifestyles and eating habits.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.4 Billion |

| Forecast Value | $17.5 Billion |

| CAGR | 5.4% |

In 2024, the regular rolled oats generated USD 3.1 billion. These oats are steamed and rolled flat to create a recognizable flaked texture that retains nutritional integrity while offering faster preparation. Their widespread appeal lies in the balance they strike between convenience and nutrition, making them suitable for cooking into porridge, blending into baked recipes, or using in cold meal options. Consumers favor these oats for their consistency and compatibility with various dietary preferences.

The hot breakfast cereals segment accounted for a 33.05% share in 2024, and is expected to grow at a CAGR of 5.3% through 2034. This segment maintains its relevance thanks to traditional consumption habits and the long-standing reputation of oatmeal as a warm, comforting breakfast. Its popularity is also supported by flavor innovations, instant preparation options, and on-the-go packaging that aligns with evolving consumer lifestyles. The strong cultural association with breakfast across key regions like North America and Europe contributes to this category's sustained growth.

North America Oatmeal Market is projected to grow at a CAGR of 5.5% from 2025 to 2034. Increasing awareness around the health-promoting properties of oats is shaping product development in the region. A growing number of consumers are seeking oat-based offerings that cater to dietary preferences such as gluten-free, organic, and superfood-enhanced varieties. This trend is reflected in the rising demand for innovative oatmeal formulations that meet clean-label expectations while delivering functional health benefits.

Leading brands active in the Global Oatmeal Market include Nestle, Tate & Lyle, PepsiCo, Shantis Oats, My Captain Oats, Kellogg, Nordic Oats, Post Consumer Brands, Fazer Mills, Bob's Red Mill, Grain Millers, General Mills, and Buhler. Companies in the oatmeal market are reinforcing their competitive edge by embracing innovation, health-centric product development, and sustainable sourcing. Key players are diversifying their offerings with fortified, high-fiber, and protein-enriched oat variants tailored to meet evolving dietary preferences. They are actively launching organic, gluten-free, and superfood-infused products that appeal to health-aware consumers seeking functional nutrition. Many brands are leveraging clean-label positioning, focusing on minimal processing and natural ingredients.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product trends

- 2.2.2 Processing method trends

- 2.2.3 Application trends

- 2.2.4 End use industry trends

- 2.2.5 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising health consciousness & functional food demand

- 3.2.1.2 Plant-based diet trends & dairy alternative growth

- 3.2.1.3 Convenience food innovation & instant product demand

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Declining oat production acreage in key markets

- 3.2.2.2 Raw material price volatility & supply chain constraints

- 3.2.3 Market opportunities

- 3.2.3.1 Functional ingredient applications beyond breakfast

- 3.2.3.2 Emerging snack food applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Future market trends

- 3.10 Technology and Innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent Landscape

- 3.12 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Steel-cut oats

- 5.3 Regular rolled oats

- 5.4 Quick cooking oats

- 5.5 Instant oatmeal

- 5.6 Oat bran

- 5.7 Oat flour

Chapter 6 Market Estimates and Forecast, By Processing Method, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Traditional stone-ground processing

- 6.3 Roller-milled processing

- 6.4 Steam-treated processing

- 6.5 Enzyme-processed products

- 6.6 Freeze-dried processing

Chapter 7 Market Estimates and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Hot breakfast cereals

- 7.3 Ready-to-eat cereals

- 7.4 Food ingredients & additives

- 7.5 Plant-based beverages

- 7.6 Snack foods

- 7.7 Bakery products

- 7.8 Sports nutrition

- 7.9 Infant & baby foods

- 7.10 Animal feed

- 7.11 Pharmaceutical

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Retail consumer

- 8.3 Food service operators

- 8.4 Food & beverage manufacturers

- 8.5 Industrial processing companies

- 8.6 Healthcare & nutrition sector

- 8.7 Child nutrition programs

- 8.8 Sports & fitness industry

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Bob's Red Mill

- 10.2 Buhler

- 10.3 Fazer Mills

- 10.4 General Mills

- 10.5 Grain Millers

- 10.6 Kellogg

- 10.7 My Captain Oats

- 10.8 Nestle

- 10.9 Nordic Oats

- 10.10 PepsiCo

- 10.11 Post Consumer Brands

- 10.12 Shantis Oats

- 10.13 Tate & Lyle