PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858862

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858862

Electrochromic Materials for Automotive Glass Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

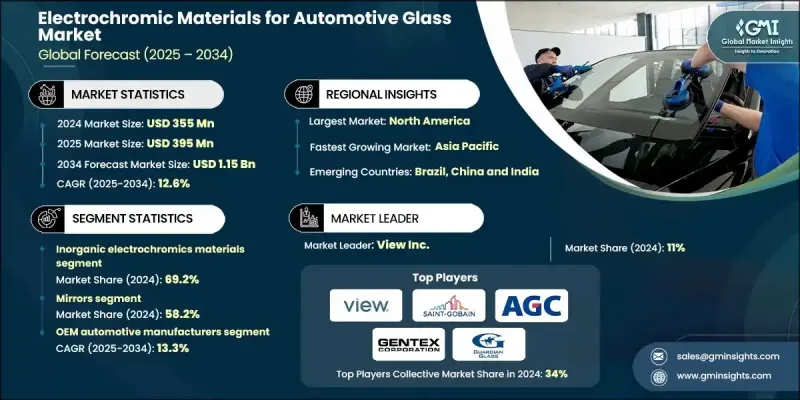

The Global Electrochromic Materials for Automotive Glass Market was valued at USD 355 million in 2024 and is estimated to grow at a CAGR of 12.6 % to reach USD 1.15 billion by 2034.

The market is undergoing transformation as automakers increasingly prioritize intelligent, energy-efficient, and user-centered technologies. Electrochromic materials offer dynamic control over light and heat transmission, directly enhancing passenger comfort by minimizing glare and regulating interior temperature. These materials support environmental goals by reducing the need for air conditioning, leading to improved fuel efficiency in conventional vehicles and extended battery range in EVs. As sustainability becomes integral to automotive strategy, electrochromic glass is seeing heightened adoption. North America currently leads the global market, driven by a mature automotive innovation landscape, strong electric and luxury vehicle adoption, and active collaboration between OEMs and material science firms. The region's favorable R&D environment makes it a stronghold for smart glass integration. Asia-Pacific follows closely, fueled by growing urban development, rising income levels, and a sharp increase in demand for electric mobility solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $355 Million |

| Forecast Value | $1.15 Billion |

| CAGR | 12.6% |

In 2024, the inorganic electrochromic materials held a 69.2% share and will grow at a CAGR of 11% through 2034. These metal oxide-based materials are favored for their excellent durability and visual stability. Their performance makes them ideal for large automotive surfaces like panoramic roofs and side windows. Manufacturers are working to improve switching speed and lower power consumption to align with the efficiency needs of hybrid and electric vehicles.

The mirrors segment held a 58.2% share in 2024 and is projected to grow at a CAGR of 9.7% through 2034. Rear-view and side mirrors continue to lead due to their cost-effectiveness, mature adoption, and consistent performance. These components are now standard in various mid-tier to premium vehicle models, offering enhanced driver visibility and automatic glare reduction.

North America Electrochromic Materials for Automotive Glass Market held a 36.1% share in 2024. The region benefits from strong consumer interest in smart and energy-saving automotive features. OEMs in North America have actively incorporated electrochromic glass into their vehicle platforms, integrating advanced technologies that align with modern comfort, efficiency, and design goals.

The companies driving the Global Electrochromic Materials for Automotive Glass Market include NSG Group (Pilkington), Pleotint LLC, Guardian Glass, Kinestral Technologies, View Inc., Smart Glass Country, SAGE Electrochromics Inc., Research Frontiers Inc., Vitro Architectural Glass, Gentex Corporation, AGC Inc., Saint-Gobain, and ChromoGenics AB. Companies competing in the Electrochromic Materials for Automotive Glass Market are focusing heavily on innovation, strategic partnerships, and scalable production capabilities. Major players are investing in next-gen material formulations that offer faster switching times, longer life cycles, and reduced energy usage. Collaborations between automakers and smart glass developers are key to integrating these materials into mainstream vehicle platforms.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology type

- 2.2.3 Application

- 2.2.4 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 FMVSS 205 compliance requirements

- 3.2.1.2 Electric vehicle market growth

- 3.2.1.3 Energy efficiency mandates

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High manufacturing costs

- 3.2.2.2 Switching speed limitations

- 3.2.3 Market opportunities

- 3.2.3.1 Multi-zone dynamic control systems

- 3.2.3.2 Autonomous vehicle integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By technology type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Technology Type, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Inorganic electrochromics

- 5.3 Organic electrochromics

- 5.4 Solid-state electrolytes

- 5.5 Nanocrystal systems

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Mirrors

- 6.3 Sunroofs & moonroofs

- 6.4 Side windows

- 6.5 Windshields

Chapter 7 Market Estimates and Forecast, By End Use, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 OEM automotive manufacturers

- 7.3 Aftermarket suppliers

- 7.4 Specialty vehicle manufacturers

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 View Inc.

- 9.2 Saint-Gobain

- 9.3 AGC Inc.

- 9.4 Gentex Corporation

- 9.5 Guardian Glass

- 9.6 NSG Group (Pilkington)

- 9.7 Guardian Glass

- 9.8 Vitro Architectural Glass

- 9.9 SAGE Electrochromics Inc.

- 9.10 ChromoGenics AB

- 9.11 Pleotint LLC

- 9.12 Smart Glass Country

- 9.13 Kinestral Technologies

- 9.14 Research Frontiers Inc.