PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858876

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858876

Automotive Edge AI Accelerators Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

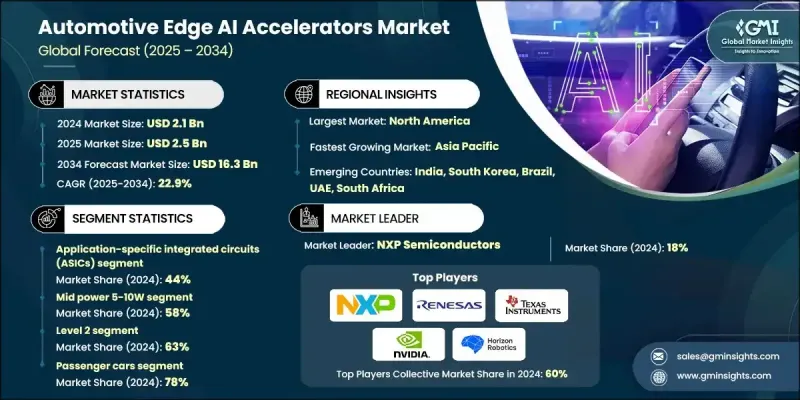

The Global Automotive Edge AI Accelerators Market was valued at USD 2.1 billion in 2024 and is estimated to grow at a CAGR of 22.9% to reach USD 16.3 billion by 2034.

The market's expansion is tied to the growing implementation of real-time processing capabilities in modern vehicles. Edge AI accelerators ranging from GPUs and FPGAs to ASICs and NPUs are becoming indispensable in enabling complex in-vehicle systems such as ADAS, driver awareness monitoring, intelligent infotainment, and voice interaction features. As vehicles transition into software-defined, connected platforms, the demand for fast, efficient, localized AI computation has accelerated sharply. The shift toward electric, semi-autonomous, and autonomous vehicles further intensifies the need for edge-based AI acceleration. Handling massive data flows from sensors like LiDAR, radar, and cameras with ultra-low latency is critical to safety and vehicle performance. Additionally, regulatory requirements tied to cybersecurity, functional safety, and real-time over-the-air software updates are reinforcing the need for high-performance AI hardware at the edge. The increasing demand for battery-optimized processors in electric vehicles further drives innovation in this space.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.1 Billion |

| Forecast Value | $16.3 Billion |

| CAGR | 22.9% |

The application-specific integrated circuits (ASICs) segment held a 44% share in 2024 and is anticipated to grow at a 24.1% CAGR through 2034. These chips are engineered to deliver task-specific AI processing with maximum energy efficiency and minimal delay. Their tailored architecture supports seamless handling of tasks such as perception modeling, decision-making, and real-time sensor data processing, making them highly suitable for advanced automotive applications.

The mid-power (5-10W) segment held 58% share in 2024 and will grow at a CAGR of 23.8% through the forecast period. This power range hits the sweet spot between performance, efficiency, and thermal balance. It offers adequate capacity for advanced driver assistance functions like multi-camera input handling and live object detection while maintaining heat and power consumption levels manageable within vehicle design constraints. The segment is well-positioned to cater to rising demands from modern vehicle architectures that prioritize both performance and energy savings.

North America Automotive Edge AI Accelerators Market held a 34% share and generated USD 703.4 million in 2024. This leadership stems from a combination of evolving regulatory frameworks, substantial investments in AI development, and a highly mature automotive technology ecosystem. Strong institutional support and aggressive innovation by tech and automotive players in the region have accelerated the deployment of edge AI hardware across both commercial and passenger vehicle segments.

Key players operating in the Global Automotive Edge AI Accelerators Market include Renesas Electronics, Qualcomm, NVIDIA, Arm, Horizon Robotics, Texas Instruments (TI), Infineon Technologies, NXP Semiconductors, STMicroelectronics, and Mobileye. Leading companies in the Global Automotive Edge AI Accelerators Market are focusing on integrated chip design, strategic collaborations, and performance optimization to gain a competitive edge. Many players are investing in custom AI chip development to maximize computing power while minimizing energy consumption, addressing the growing demand for edge processing in EVs and autonomous platforms. Partnerships with OEMs and Tier 1 suppliers are enabling co-development of platform-specific accelerators tailored to ADAS and infotainment systems.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Processor

- 2.2.3 Power

- 2.2.4 Level of autonomy

- 2.2.5 Vehicle

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future-outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factors affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for advanced driver assistance systems (ADAS)

- 3.2.1.2 Rising adoption of autonomous vehicles

- 3.2.1.3 Increased focus on vehicle safety and security

- 3.2.1.4 Government regulations promoting vehicle automation

- 3.2.1.5 Expansion of connected car technologies

- 3.2.1.6 Advancements in AI chip technology

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced AI hardware

- 3.2.2.2 Complexity in integrating edge AI systems

- 3.2.3 Market opportunities

- 3.2.3.1 Growing electric vehicle (EV) market

- 3.2.3.2 Rising demand for smart fleet management

- 3.2.3.3 Emerging markets investing in automotive AI

- 3.2.3.4 Collaborations between chipmakers and automakers

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Patent analysis

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Cost breakdown analysis

- 3.8 Technology landscape

- 3.8.1 Current technological trends

- 3.8.2 Emerging technologies

- 3.9 Regulatory landscape

- 3.9.1 ISO 26262 functional safety requirements

- 3.9.2 AUTOSAR adaptive platform compliance

- 3.9.3 ASPICE software development standards

- 3.9.4 Cybersecurity standards (ISO 21434)

- 3.10 Price trends

- 3.10.1 By region

- 3.10.2 By processor

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.12 Investment & funding trends analysis

- 3.13 Security & cybersecurity framework analysis

- 3.13.1 Hardware security module (HSM) integration

- 3.13.2 Secure boot & trusted execution environment

- 3.13.3 Over-the-air (OTA) update security

- 3.14 Ecosystem partnerships & alliance analysis

- 3.14.1 Chip-OEM strategic partnerships

- 3.14.2 Software platform collaborations

- 3.15 Total cost of ownership (TCO) analysis

- 3.15.1 Hardware acquisition costs

- 3.15.2 Software development & integration costs

- 3.15.3 Validation & certification expenses

- 3.15.4 Manufacturing & deployment costs

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Processor, 2021 - 2034 (USD Bn, Units)

- 5.1 Key trends

- 5.2 Central processing unit (CPU)

- 5.3 Graphics processing unit (GPU)

- 5.4 Application-specific integrated circuits (ASICs)

- 5.5 Field-programmable gate array (FPGA)

Chapter 6 Market Estimates & Forecast, By Power, 2021 - 2034 (USD Bn, Units)

- 6.1 Key trends

- 6.2 Low power <5W

- 6.3 Mid power 5-10W

- 6.4 High power >10W

Chapter 7 Market Estimates & Forecast, By Level of autonomy, 2021 - 2034 (USD Bn, Units)

- 7.1 Key trends

- 7.2 Level 1

- 7.3 Level 2

- 7.4 Level 3

- 7.5 Level 4

- 7.6 Level 5

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 (USD Bn, Units)

- 8.1 Key trends

- 8.2 Passenger cars

- 8.2.1 Hatchback

- 8.2.2 Sedan

- 8.2.3 SUV

- 8.3 Commercial vehicles

- 8.3.1 Light commercial vehicles (LCV)

- 8.3.2 Medium commercial vehicles (MCV)

- 8.3.3 Heavy commercial vehicles (HCV)

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 Indonesia

- 9.4.6 Philippines

- 9.4.7 Thailand

- 9.4.8 South Korea

- 9.4.9 Singapore

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Arm

- 10.1.2 Horizon Robotics

- 10.1.3 Infineon Technologies

- 10.1.4 MediaTek

- 10.1.5 Mobileye

- 10.1.6 NVIDIA

- 10.1.7 NXP Semiconductors

- 10.1.8 Qualcomm

- 10.1.9 Renesas Electronics

- 10.1.10 Samsung Electronics

- 10.1.11 STMicroelectronics

- 10.1.12 Texas Instruments (TI)

- 10.2 Regional Players

- 10.2.1 CEVA

- 10.2.2 GlobalFoundries

- 10.2.3 HiSilicon

- 10.2.4 Nextchip

- 10.2.5 SemiDrive

- 10.2.6 Socionext

- 10.2.7 Tsinghua Unigroup

- 10.2.8 Verisilicon

- 10.3 Emerging Players / Disruptors

- 10.3.1 Ambarella

- 10.3.2 Hailo Technologies

- 10.3.3 Kneron

- 10.3.4 Mythic

- 10.3.5 SiMa.ai