PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858969

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858969

Healthcare 3D Printing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

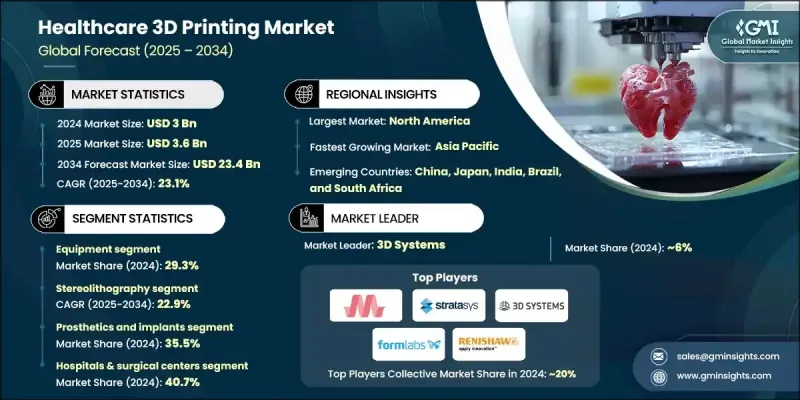

The Global Healthcare 3D Printing Market was valued at USD 3 billion in 2024 and is estimated to grow at a CAGR of 23.1% to reach USD 23.4 billion by 2034.

The rapid growth is fueled by increasing demand for personalized medical solutions, rising investments in research and development, and the growing range of clinical uses. As healthcare systems shift toward more patient-specific and precision-driven approaches, 3D printing continues to play a critical role across surgical planning, prosthetics, and regenerative medicine. The growing elderly population, coupled with advancements in bioprinting and implant customization, is accelerating the need for efficient, accurate, and cost-effective technologies. Healthcare institutions and academic centers are setting up in-house 3D printing labs, improving response times, and enhancing patient care. These efforts reflect a larger industry movement toward integrating digital design and additive manufacturing for improved diagnostics and treatment outcomes. As awareness increases around the value of 3D printed solutions in the healthcare setting, adoption is rising across hospitals, labs, and specialized care facilities, further solidifying the market's upward trajectory.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3 Billion |

| Forecast Value | $23.4 Billion |

| CAGR | 23.1% |

A typical healthcare 3D printing setup includes a 3D printer or bioprinter, dedicated software for design, and medically safe materials such as metals, polymers, or hydrogels. These systems transform imaging data from CT or MRI scans into precise physical models or patient-specific medical devices, allowing for highly tailored healthcare interventions.

In 2024, the equipment segment held a 29.3% share, driven by the growing installation of sophisticated 3D printers across healthcare settings. Hospitals and labs are increasingly adopting this technology to produce personalized tools, anatomical models, and implants in-house, significantly reducing wait times and improving surgical planning. The trend of point-of-care manufacturing is gaining momentum, positioning equipment as a central pillar in the healthcare 3D printing landscape. As the focus continues to shift toward personalized care and operational efficiency, demand for reliable and high-performance equipment is expected to grow consistently.

The stereolithography (SLA) segment is expected to grow at a CAGR of 22.9% through 2034. SLA is favored for its high-resolution output and exceptional accuracy, making it ideal for creating complex medical structures. Its use spans across multiple applications such as dental prosthetics, patient-specific guides, and anatomical models, making it the go-to technology for precise, detailed medical printing.

North America Healthcare 3D Printing Market held a 42% share in 2024. The region's growth is supported by advanced healthcare infrastructure, early adoption of innovative technologies, and consistent funding for medical research. A well-integrated ecosystem involving manufacturers, healthcare providers, and regulatory agencies makes North America a hotspot for 3D printing advancements in healthcare. Hospitals across the U.S. and Canada are embracing this technology for patient-specific implants, surgical modeling, and prosthetic design.

Key players shaping the Global Healthcare 3D Printing Market include: formLabs, OPM, nanoscribe, PROTOLABS, 3D Systems, stratasys, Axial3D, ExOne, EOS, RENISHAW, materialise, ETEC, and KONICA MINOLTA. Companies operating in the Healthcare 3D Printing Market are focusing on strategic R&D investments to improve material biocompatibility, print speed, and resolution. Many are expanding their product portfolios to include software, service solutions, and bioprinting capabilities. Collaborations with hospitals, research centers, and universities help to accelerate innovation and broaden clinical applications. Several players are also building region-specific partnerships to strengthen their distribution channels and improve access to point-of-care 3D printing. Customization is a major focus, with firms offering tailored solutions for implants, surgical planning, and dental applications. Regulatory compliance and certifications remain a priority, ensuring safe integration into medical settings.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Component trends

- 2.2.3 Technology trends

- 2.2.4 Application trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for custom implants

- 3.2.1.2 Increasing R&D investments from manufacturers and institutions

- 3.2.1.3 Extending clinical applications

- 3.2.1.4 Technological advancements

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Lack of skilled professionals

- 3.2.2.2 High price associated with 3D printing

- 3.2.3 Market opportunities

- 3.2.3.1 Rising adoption in emerging markets

- 3.2.3.2 AI & simulation integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technological landscape

- 3.5.1 Current technologies

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Consumer behavior analysis

- 3.8 Pipeline analysis

- 3.9 Investment landscape

- 3.10 Start-up scenario

- 3.11 Pricing analysis, 2024

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

- 3.14 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 North America

- 4.3.2 Europe

- 4.3.3 Asia Pacific

- 4.3.4 LAMEA

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Component, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Equipment

- 5.2.1 3D printers

- 5.2.2 3D bioprinters

- 5.3 Materials

- 5.3.1 Plastics

- 5.3.1.1 Thermoplastics

- 5.3.1.2 Photopolymers

- 5.3.2 Metals and metal alloys

- 5.3.3 Biomaterials

- 5.3.4 Ceramics

- 5.3.5 Paper

- 5.3.6 Wax

- 5.3.7 Other materials

- 5.3.1 Plastics

- 5.4 Services & software

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Stereolithography

- 6.3 Fused deposition modelling (FDM)

- 6.4 Selective laser sintering (SLS)

- 6.5 Metal printing

- 6.6 Other technologies

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Prosthetics and implants

- 7.3 Dental

- 7.4 Bioprinting

- 7.5 Tissue and organ generation

- 7.6 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals & surgical centers

- 8.3 Dental clinics

- 8.4 Medical device manufacturers

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 3D Systems

- 10.2 Axial3D

- 10.3 eos

- 10.4 ETEC

- 10.5 ExOne

- 10.6 formlabs

- 10.7 KONICA MINOLTA

- 10.8 materialise

- 10.9 nanoscribe

- 10.10 OPM

- 10.11 PROTOLABS

- 10.12 RENISHAW

- 10.13 stratasys