PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858972

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858972

Rehabilitation Robots Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

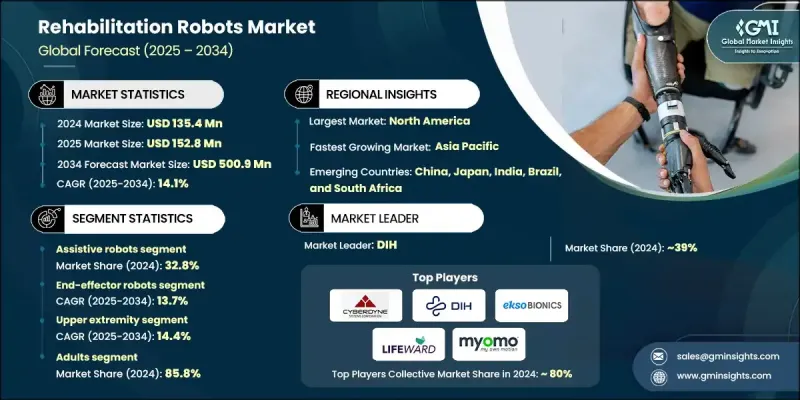

The Global Rehabilitation Robots Market was valued at USD 135.4 million in 2024 and is estimated to grow at a CAGR of 14.1% to reach USD 500.9 million by 2034.

The market's expansion is being driven by the rising number of individuals with physical impairments, a growing elderly population, increasing neurological and trauma-related cases, and the surging demand for robotic rehabilitation across clinical and home settings. Rehabilitation robots are reshaping how recovery is delivered after neurological disorders, spinal cord injuries, surgeries, or age-related mobility challenges. These robotic systems are increasingly adopted in outpatient centers, hospitals, and home care settings, offering targeted therapy that enhances motor recovery and mobility. Continuous improvements in sensor integration, real-time motion tracking, AI-driven response mechanisms, and cloud-enabled therapy data are transforming traditional rehabilitation into a highly personalized and effective process. Integration with telehealth platforms and electronic medical systems is also enabling therapists and clinicians to tailor and monitor treatments remotely. As demand grows, companies are introducing more ergonomic, patient-centric robotic devices built with biocompatible materials and enhanced user interface designs. Increased funding, favorable healthcare policies, and ongoing product innovations continue to support long-term growth across developed and emerging economies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $135.4 Million |

| Forecast Value | $500.9 Million |

| CAGR | 14.1% |

The upper extremity segment will grow at a CAGR of 14.4% through 2034. Its growth is propelled by the effectiveness of robotic-assisted rehabilitation in improving limb coordination and strength. These systems are being widely implemented in clinical and residential settings to support quicker and more targeted recovery of the arms, shoulders, and hands. Their growing popularity is closely tied to rising awareness of personalized therapy benefits and improved outcomes in stroke and orthopedic rehabilitation.

The exoskeleton robots segment is expected to grow at a CAGR of 14.8% during 2034. Increasing focus on wearable robotic systems for mobility support, coupled with the growing incidence of spinal cord injuries and neurological conditions, is pushing the adoption of exoskeletons. These systems offer enhanced strength, gait training, and posture support, and their use is steadily rising in aging care, physical therapy, and post-injury rehabilitation. Rapid advancements in lightweight material design and adaptive AI capabilities are making them more accessible for widespread clinical deployment.

North America Rehabilitation Robots Market held 43.8% share in 2024. The region benefits from an advanced healthcare ecosystem, high investment in robotics innovation, and broad awareness of robotic therapy's benefits. The United States plays a key role in this regional dominance, with substantial insurance coverage, rising rates of neuromuscular disorders, and strong institutional support for integrating robotic technologies into rehabilitation programs. Partnerships between technology developers and medical research institutions continue to foster breakthroughs, while expanding use in long-term care and outpatient facilities further drives market momentum.

Leading companies in the Global Rehabilitation Robots Market are Cyberdyne, DIH, REX BIONICS, myomo, KINOVA, Ekso Bionics, FOURIER, tyromotion, BioXtreme, LIFEWARD, BIONIK, LEADERS REHAB ROBOT, and Rehab-Robotics. Companies in the Rehabilitation Robots Market are focusing on product innovation by integrating AI algorithms, smart sensors, and cloud-connected platforms to deliver personalized and data-driven therapy. Leading players are expanding their global footprint through strategic partnerships with healthcare providers, research institutions, and distributors. Investment in R&D remains a top priority to develop compact, user-friendly, and affordable devices suitable for diverse rehabilitation needs. Many firms are strengthening their home care offerings, targeting aging populations and long-term care markets.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Type trends

- 2.2.3 Robotic structure trends

- 2.2.4 Extremity trends

- 2.2.5 Patient trends

- 2.2.6 Application trends

- 2.2.7 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of brain-related disorders

- 3.2.1.2 Increase in the number of patients with physical disabilities

- 3.2.1.3 Technological advancements

- 3.2.1.4 Surging geriatric population, coupled with increasing trauma cases globally

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High device cost

- 3.2.2.2 Lack of awareness in developing countries

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into emerging markets

- 3.2.3.2 Integration of AI

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technological landscape

- 3.5.1 Current technologies

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Consumer behavior analysis

- 3.8 Number of rehabilitation robots (units), by region, 2021 - 2034

- 3.8.1 North America

- 3.8.2 Europe

- 3.8.3 Asia Pacific

- 3.8.4 Latin America

- 3.8.5 MEA

- 3.9 Pipeline analysis

- 3.10 Investment landscape

- 3.11 Start-up scenario

- 3.12 Pricing analysis, 2024

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

- 3.15 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 North America

- 4.3.2 Europe

- 4.3.3 Asia Pacific

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Assistive robot

- 5.3 Therapy robot

Chapter 6 Market Estimates and Forecast, By Robotic Structure, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 End-effector robots

- 6.3 Exoskeleton robots

Chapter 7 Market Estimates and Forecast, By Extremity, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Upper extremity

- 7.3 Lower extremity

Chapter 8 Market Estimates and Forecast, By Patient, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Adults

- 8.3 Pediatric

Chapter 9 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Neurological rehabilitation

- 9.3 Spinal cord injuries

- 9.4 Other applications

Chapter 10 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Hospitals & clinics

- 10.3 Rehabilitation centers

- 10.4 Other end use

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 BIONIK

- 12.2 BioXtreme

- 12.3 Cyberdyne

- 12.4 DIH

- 12.5 Ekso Bionics

- 12.6 FOURIER

- 12.7 KINOVA

- 12.8 LEADERS REHAB ROBOT

- 12.9 LIFEWARD

- 12.10 myomo

- 12.11 Rehab-Robotics

- 12.12 REX BIONICS

- 12.13 tyromotion