PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858973

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858973

Underfloor Heating Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

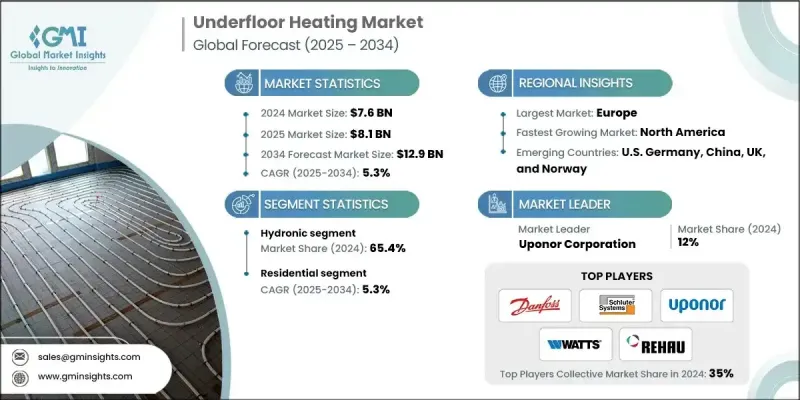

The Global Underfloor Heating Market was valued at USD 7.6 billion in 2024 and is estimated to grow at a CAGR of 5.3% to reach USD 12.9 billion by 2034.

Growing emphasis on reducing carbon emissions, coupled with rising demand for reliable and energy-efficient indoor heating systems, is fueling widespread adoption across various regions. Consumers and industries alike are shifting toward sustainable heating alternatives that offer both comfort and compliance with environmental standards. Underfloor heating solutions help reduce dependence on fossil fuels by improving energy efficiency and integrating seamlessly with renewable sources. As countries face colder climates and stricter energy regulations, the demand for advanced heating systems such as electric radiant and hydronic setups is witnessing strong momentum. These systems deliver uniform warmth while contributing to energy conservation goals. The broader push for greener technologies across residential and commercial sectors, along with the trend toward uniform temperature control and reduced operational costs, is accelerating the adoption of floor heating products. Increasing urbanization, infrastructure modernization, and the growing appeal of smart, low-maintenance heating options continue to enhance the market outlook across global regions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.6 Billion |

| Forecast Value | $12.9 Billion |

| CAGR | 5.3% |

The hydronic underfloor heating segment generated USD 5 billion in 2024, driven by rising demand for advanced and efficient heating solutions across commercial and residential applications. Expanding green building practices and a growing number of sustainable construction projects are playing a key role in boosting product demand. Continuous population growth, particularly in developing regions, combined with the rise of smart cities, is expected to support long-term industry expansion.

The residential segment held a 60.4% share in 2024 and will grow at a CAGR of 5.3% through 2034. This growth is primarily fueled by the increasing consumer shift toward modern home technologies and enhanced energy-saving solutions. Rising awareness of long-term savings, lower maintenance costs, and improved comfort levels is pushing homeowners to adopt underfloor heating systems at a faster rate. The appeal of consistent heating and improved indoor air quality further strengthens residential adoption across both new builds and renovation projects.

U.S. Underfloor Heating Market held 77.9% share, generating USD 1.5 billion in 2024. North America is expected to maintain its strong market position due to rising renovation activities, evolving building codes, and increased focus on energy-efficient living standards. Harsh winter conditions, in combination with rising population density and tightening energy mandates, are fueling the adoption of underfloor heating technologies. A growing preference for advanced comfort solutions, paired with modernizing infrastructure and improved living standards, supports the expansion of the U.S. market.

Key companies shaping the competitive landscape of the Underfloor Heating Market include: nVent, Uponor Corporation, Warmboard, Inc., Warmup, Schluter Systems, REHAU, ThermaRay, Watts, HEATCOM CORPORATION, Gaia Climate Solutions, Amuheat, Danfoss, Polypipe, Robert Bosch, H2O Heating, ETHERMA Elektrowarme GmbH, Resideo Technologies, Hunt Commercial, Thermogroup, Hemstedt, Thermo-Floor UK Limited, and Therma-HEXX Corporation. To strengthen their presence in the Global Underfloor Heating Market, leading players are focusing on innovation, sustainability, and regional expansion. Many are investing in R&D to enhance system efficiency, introduce smart heating controls, and develop low-energy solutions compatible with renewable power sources. Partnerships with construction firms and real estate developers help drive early adoption in new housing and commercial projects. Companies are also expanding their product lines to offer modular and retrofit-friendly solutions that cater to older buildings.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Technology trends

- 2.4 Facility trends

- 2.5 Application trends

- 2.6 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Key factors affecting the value chain

- 3.1.3 Disruptions

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of underfloor heating systems

- 3.8 Emerging opportunities & trends

- 3.8.1 Digital transformation with IoT technologies

- 3.8.2 Emerging market penetration

- 3.9 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiatives

- 4.3.1 Key partnerships & collaborations

- 4.3.2 Major M&A activities

- 4.3.3 Product innovations & launches

- 4.3.4 Market expansion strategies

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Electric

- 5.3 Hydronic

Chapter 6 Market Size and Forecast, By Facility, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 New buildings

- 6.3 Retrofit

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Residential

- 7.2.1 Single Family

- 7.2.2 Multi Family

- 7.3 Commercial

- 7.3.1 Education

- 7.3.2 Healthcare

- 7.3.3 Retail

- 7.3.4 Logistics & Transportation

- 7.3.5 Offices

- 7.3.6 Hospitality

- 7.3.7 Others

- 7.4 Industrial

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Finland

- 8.3.7 Norway

- 8.3.8 Sweden

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Mexico

Chapter 9 Company Profiles

- 9.1 Amuheat

- 9.2 Danfoss

- 9.3 ETHERMA Elektrowarme GmbH

- 9.4 Gaia Climate Solutions

- 9.5 H2O Heating

- 9.6 HEATCOM CORPORATION

- 9.7 Hemstedt

- 9.8 Hunt Commercial

- 9.9 nVent

- 9.10 Polypipe

- 9.11 REHAU

- 9.12 Resideo Technologies

- 9.13 Robert Bosch

- 9.14 Schluter Systems

- 9.15 Therma-HEXX Corporation

- 9.16 ThermaRay

- 9.17 Thermo-Floor UK Limited

- 9.18 Thermogroup

- 9.19 Uponor Corporation

- 9.20 Warmboard, Inc.

- 9.21 Warmup

- 9.22 Watts