PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858975

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858975

Industrial Heat Pump Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

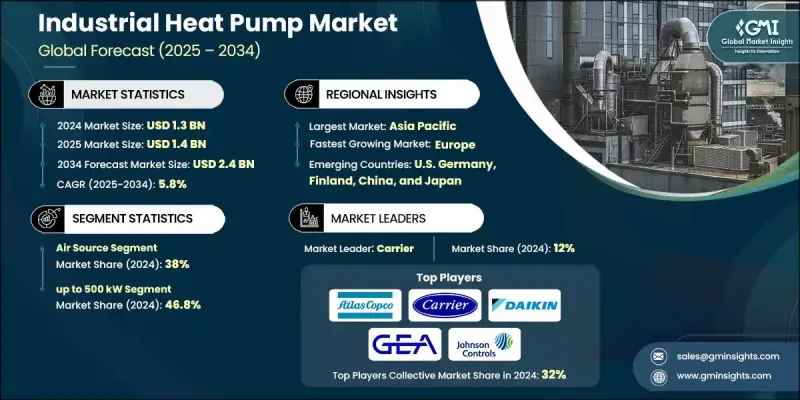

The Global Industrial Heat Pump Market was valued at USD 1.3 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 2.4 billion by 2034.

Rising environmental concerns and increased efforts to cut carbon emissions in industrial operations are pushing the demand for energy-efficient technologies. Industrial heat pumps have emerged as a key solution for capturing and repurposing low-temperature waste heat, enhancing both efficiency and sustainability. As more industries prioritize reducing reliance on fossil fuels, the adoption of these systems is accelerating. Supportive regulatory policies, combined with increasing energy costs and growing pressure to align with sustainability targets, are reshaping how industries manage thermal energy. The need for efficient heating and cooling across industrial plants, along with growing interest in phasing out outdated systems, continues to boost market momentum. Industrial players are recognizing the potential of heat pumps to improve energy performance while cutting operational expenditures. Coupled with rising investments in clean technologies and smart infrastructure, especially across emerging economies, the market is set to witness robust expansion in the years ahead.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 Billion |

| Forecast Value | $2.4 Billion |

| CAGR | 5.8% |

The water-source segment will reach USD 150 million by 2034, as it gains traction for its high efficiency and ability to draw from stable water temperatures. These systems are particularly suited for large-scale industrial environments located near consistent water sources. Increased focus on recovering waste heat, improving energy utilization, and complying with emission-reduction regulations is elevating demand for water-based systems across energy-intensive sectors.

In 2024, the heat pumps with capacities up to 500 kW accounted for a 46.8% share and are expected to register a CAGR of 6.5% through 2034. Industries are steadily shifting toward tailored, high-efficiency thermal systems to optimize energy use and reduce environmental impact. This segment is seeing rapid development due to its versatility in sectors such as chemical production, food processing, and paper manufacturing, where scalable, application-specific technologies are in high demand.

U.S. Industrial Heat Pump Market held 85.3% share in 2024, generating USD 262.1 million. This strong market position is supported by the growing deployment of reliable thermal systems in manufacturing, coupled with evolving regulations focused on reducing carbon footprints. Adoption of high-capacity heat pumps that align with decarbonization goals continues to increase, as industry leaders aim to move away from fossil fuel-dependent technologies and transition to more sustainable thermal solutions.

Key players shaping the competitive landscape of the Industrial Heat Pump Market include Turboden S.p.A., Ecop, MAN Energy Solutions, Carrier, Qvantum Energi AB, Oilon Group Oy, Dalrada Climate Technology, Armstrong International Inc., Johnson Controls, Atlas Copco AB, GEA Group Aktiengesellschaft, Hien New Energy Equipment Co., Ltd., Daikin Applied Europe S.p.A., Trane Technologies International Limited, Swegon Ltd, Enerin AS, OCHSNER, Emerson Electric Co., Baker Hughes Company, and Piller Blowers & Compressors GmbH. To strengthen their positioning, companies in the industrial heat pump space are prioritizing strategic investments in product innovation and R&D to offer higher efficiency systems compatible with modern industrial demands. Several players are expanding global manufacturing capabilities and establishing local partnerships to cater to region-specific requirements. Firms are also aligning their portfolios with low-carbon and renewable energy trends, introducing systems capable of integrating with waste heat recovery and hybrid setups.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Product trends

- 2.4 Capacity trends

- 2.5 Temperature trends

- 2.6 Application trends

- 2.7 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Key factors affecting the value chain

- 3.1.3 Disruptions

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of industrial heat pumps

- 3.8 Emerging opportunities & trends

- 3.8.1 Digital transformation with IoT technologies

- 3.8.2 Emerging market penetration

- 3.9 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiatives

- 4.3.1 Key partnerships & collaborations

- 4.3.2 Major M&A activities

- 4.3.3 Product innovations & launches

- 4.3.4 Market expansion strategies

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Air source

- 5.3 Ground source

- 5.4 Water source

- 5.5 Closed cycle mechanical heat pump

- 5.6 Open cycle mechanical vapor compression heat pump

- 5.7 Open cycle mechanical thermocompression heat pump

- 5.8 Closed cycle absorption heat pump

Chapter 6 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Up to 500 kW

- 6.3 > 500 kW to 2 MW

- 6.4 2 MW - 5 MW

- 6.5 > 5 MW

Chapter 7 Market Size and Forecast, By Temperature, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 80 - 100 °C

- 7.3 100 - 150 °C

- 7.4 150 - 200 °C

- 7.5 > 200 °C

Chapter 8 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Industrial

- 8.2.1 Paper

- 8.2.2 Food & Beverages

- 8.2.3 Chemical

- 8.2.4 Iron & Steel

- 8.2.5 Machinery

- 8.2.6 Non-Metallic minerals

- 8.2.7 Other industries

- 8.3 District heating

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Norway

- 9.3.3 Denmark

- 9.3.4 Finland

- 9.3.5 Sweden

- 9.3.6 Germany

- 9.3.7 Spain

- 9.3.8 Austria

- 9.3.9 Poland

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 South Korea

- 9.4.4 Australia

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 Turkey

- 9.5.3 South Africa

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Mexico

Chapter 10 Company Profiles

- 10.1 Armstrong International Inc.

- 10.2 Atlas Copco AB

- 10.3 Baker Hughes Company

- 10.4 Carrier

- 10.5 Daikin Applied Europe S.p.A.

- 10.6 Dalrada Climate Technology

- 10.7 Ecop

- 10.8 Emerson Electric Co.

- 10.9 Enerin AS

- 10.10 GEA Group Aktiengesellschaft

- 10.11 Hien New Energy Equipment Co., Ltd.

- 10.12 Johnson Controls

- 10.13 MAN Energy Solutions

- 10.14 OCHSNER

- 10.15 Oilon Group Oy

- 10.16 Piller Blowers & Compressors GmbH

- 10.17 Qvantum Energi AB

- 10.18 Swegon Ltd

- 10.19 Trane Technologies International Limited

- 10.20 Turboden S.p.A.