PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1859010

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1859010

Logistics Robots Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

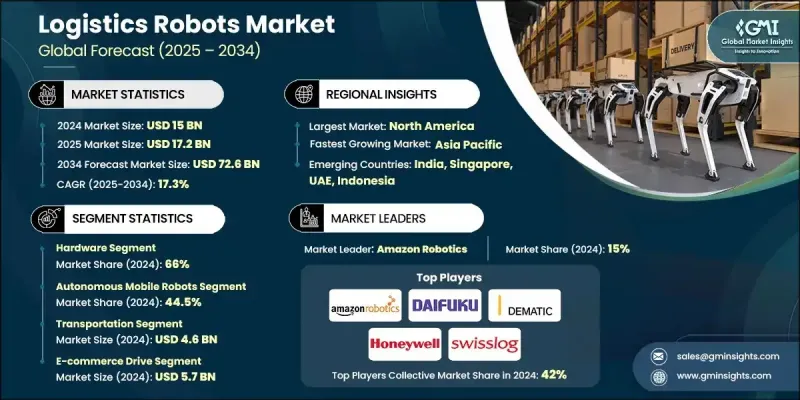

The Global Logistics Robots Market was valued at USD 15 billion in 2024 and is estimated to grow at a CAGR of 17.3% to reach USD 72.6 billion by 2034.

This sector is evolving rapidly, shaped by growing demand for automation, tighter delivery timelines, and advanced supply chain digitization. The industry is defined by its intricate ecosystem, which is marked by geographic clustering, strategic supplier relationships, and strong vertical integration. As robotics technologies mature, logistics firms are increasingly transitioning toward autonomous systems to meet rising consumer expectations and reduce operational inefficiencies. Accelerated ROI and shrinking payback windows are prompting broader deployment of intelligent robotics systems across warehouse and distribution centers. This wave of automation is reshaping logistics infrastructure by enabling higher throughput, improved accuracy, and leaner workforce dependencies, ultimately fueling growth across developed and emerging markets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15 Billion |

| Forecast Value | $72.6 Billion |

| CAGR | 17.3% |

In 2024, the hardware segment held a 66% share and is expected to grow at a CAGR of 16.4% through 2034. Robotic platforms, mechanical components, and mobility systems form the foundational layer of logistics robotics solutions, enabling seamless operation in warehouse and last-mile environments. Technological advancements and research initiatives into robotics power systems are reshaping the hardware cost structures, although human involvement in logistics operations still accounts for a large portion of total expenses.

The autonomous mobile robots (AMRs) segment held a 44.5% share in 2024 and is forecasted to grow at a CAGR of 17.9% between 2025 and 2034. AMRs offer significant efficiency gains over traditional automated guided vehicles due to advanced navigation systems powered by artificial intelligence, visual SLAM, and adaptive sensor technology. These capabilities allow for real-time decision-making in complex, dynamic environments, moving the segment from pilot phases into large-scale commercial deployments.

U.S. Logistics Robots Market held 65% share in 2024, generating USD 4.6 billion. Despite relatively low penetration compared to global benchmarks, growth in the U.S. is underpinned by labor shortages, technological readiness, and federal support for automation. Robust infrastructure and government-funded innovation programs continue to strengthen the country's position in the global robotics landscape, creating a favorable environment for the large-scale implementation of robotic solutions in logistics.

Key industry players shaping the competitive landscape of the Global Logistics Robots Market include ABB, Yaskawa Electric, Toyota/Bastian, Omron, Daifuku, Amazon Robotics, KUKA/Swisslog, KION/Dematic, Honeywell, and AutoStore. To reinforce their position, logistics robotics companies are prioritizing AI-powered automation, real-time data analytics, and modular system designs tailored to various logistics use cases. Strategic mergers and partnerships are enabling technology sharing and geographic expansion, while R&D investments are yielding scalable platforms for multi-application functionality. Leading firms are also customizing robotic fleets to suit e-commerce, third-party logistics, and retail warehouse environments, ensuring long-term client retention and improved operational ROI. Global players are further strengthening their presence through localized production, expanded service networks, and integrated digital platforms that enable seamless logistics orchestration and predictive maintenance.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.6.1 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Type

- 2.2.4 Application

- 2.2.5 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Autonomous mobile robot manufacturers

- 3.1.1.2 Automated storage and retrieval system providers

- 3.1.1.3 Robotics software & AI platform developers

- 3.1.1.4 Warehouse infrastructure & material handling equipment suppliers

- 3.1.1.5 Systems integrators & solution provider

- 3.1.2 Cost structure

- 3.1.3 Profit margin

- 3.1.4 Value addition at each stage

- 3.1.5 Factors impacting the supply chain

- 3.1.6 Disruptors

- 3.1.1 Supplier landscape

- 3.2 Impact on forces

- 3.2.1 Growth drivers

- 3.2.1.1 Developments in e-commerce sector for picking applications

- 3.2.1.2 Advancements in robotics technology

- 3.2.1.3 Increasing popularity of autonomous warehouses

- 3.2.1.4 Growing awareness towards sustainability practices in logistic handling

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High cost of purchasing and implementing logistics robots

- 3.2.2.2 Lack of employee skills to operate and maintain advanced robotic systems

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of AI and IoT in logistics robots

- 3.2.3.2 Adoption of collaborative robots

- 3.2.1 Growth drivers

- 3.3 Technology trends & innovation ecosystem

- 3.3.1 Current technologies

- 3.3.1.1 Computer vision & object recognition

- 3.3.1.2 Predictive analytics & maintenance

- 3.3.1.3 Polyfunctional robot development

- 3.3.1.4 Human-robot collaboration advancement

- 3.3.2 Emerging technologies

- 3.3.2.1 5G connectivity & communication systems

- 3.3.2.2 Digital twin & simulation technologies

- 3.3.2.3 Blockchain & supply chain transparency

- 3.3.2.4 Sustainability & green technology integration

- 3.3.1 Current technologies

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 Federal safety standards framework

- 3.5.1.1 ANSI/RIA R15.06 requirements

- 3.5.1.2 ANSI R15.08 mobile robot standards

- 3.5.1.3 ISO 10218 global harmonization

- 3.5.2 OSHA compliance requirements

- 3.5.2.1 General duty clause application

- 3.5.2.2 Machinery & machine guarding standards

- 3.5.2.3 Electrical safety requirements

- 3.5.3 Industry-Specific Regulatory Requirements

- 3.5.3.1 FDA healthcare regulations

- 3.5.3.2 Food safety & HACCP compliance

- 3.5.3.3 Automotive industry standards

- 3.5.4 International standards harmonization

- 3.5.4.1 ISO technical committee 299

- 3.5.4.2 European standards integration

- 3.5.4.3 Regional adaptation requirements

- 3.5.1 Federal safety standards framework

- 3.6 Cost breakdown analysis

- 3.6.1 Hardware cost components

- 3.6.2 Software & integration expenses

- 3.6.3 Infrastructure modification requirements

- 3.6.4 Maintenance & service costs

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Sustainability and environmental aspects

- 3.9.1 Environmental impact assessment & lifecycle analysis

- 3.9.2 Social impact & community relations

- 3.9.3 Governance & corporate responsibility

- 3.9.4 Sustainable technological development

- 3.10 Risk assessment framework

- 3.10.1 Interoperability & standardization gaps

- 3.10.2 Legacy system compatibility challenges

- 3.10.3 Regulatory & compliance risks

- 3.10.4 Financial risk mitigation strategies

- 3.11 Performance & quality standards

- 3.11.1 Risk assessment methodologies

- 3.11.2 Accuracy & precision standards

- 3.11.3 Industry-specific quality requirements

- 3.11.4 Safety testing requirements

- 3.12 Use Cases

- 3.12.1 Amazon robotics implementation model

- 3.12.2 Multi-SKU handling & sorting

- 3.12.3 Automotive manufacturing integration

- 3.12.4 Healthcare & pharmaceutical applications

- 3.12.5 Third-party logistics optimization

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

- 4.5 Key developments

- 4.5.1 Mergers & acquisitions

- 4.5.2 Partnerships & collaborations

- 4.5.3 New product launches

- 4.5.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Robotic platforms & chassis

- 5.2.2 Sensors & perception systems

- 5.2.3 Actuators & manipulation systems

- 5.2.4 Others

- 5.3 Software

- 5.3.1 Robot operating systems

- 5.3.2 Fleet management software

- 5.3.3 Warehouse management integration

- 5.3.4 Others

- 5.4 Services

- 5.4.1 Professional

- 5.4.2 Managed

Chapter 6 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn & Units)

- 6.1 Key trends

- 6.2 Automated guided vehicles

- 6.3 Autonomous mobile robots

- 6.4 Robot arms

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn & Units)

- 7.1 Key trends

- 7.2 Palletizing & de-palletizing

- 7.3 Pick & place

- 7.4 Transportation

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By End use, 2021 - 2034 ($Bn & Units)

- 8.1 Key trends

- 8.2 E-commerce

- 8.3 Healthcare

- 8.4 Retail

- 8.5 Food & beverages

- 8.6 Automotive

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn & Units)

- 9.1 North America

- 9.1.1 US

- 9.1.2 Canada

- 9.2 Europe

- 9.2.1 UK

- 9.2.2 Germany

- 9.2.3 France

- 9.2.4 Italy

- 9.2.5 Spain

- 9.2.6 Belgium

- 9.2.7 Netherlands

- 9.2.8 Sweden

- 9.3 Asia Pacific

- 9.3.1 China

- 9.3.2 India

- 9.3.3 Japan

- 9.3.4 Australia

- 9.3.5 Singapore

- 9.3.6 South Korea

- 9.3.7 Vietnam

- 9.3.8 Indonesia

- 9.4 Latin America

- 9.4.1 Brazil

- 9.4.2 Mexico

- 9.4.3 Argentina

- 9.5 MEA

- 9.5.1 South Africa

- 9.5.2 Saudi Arabia

- 9.5.3 UAE

Chapter 10 Company Profiles

- 10.1 Global players

- 10.1.1 ABB

- 10.1.2 Amazon Robotics

- 10.1.3 AutoStore

- 10.1.4 Daifuku

- 10.1.5 Honeywell

- 10.1.6 KION/Dematic

- 10.1.7 KUKA/Swisslog

- 10.1.8 Omron

- 10.1.9 Toyota/Bastian

- 10.1.10 Yaskawa Electric

- 10.2 Regional players

- 10.2.1 Bastian Solutions

- 10.2.2 Geek+

- 10.2.3 GreyOrange

- 10.2.4 Locus Robotics

- 10.2.5 Vecna Robotics

- 10.3 Emerging players

- 10.3.1 VisionNav Robotics

- 10.3.2 Berkshire Grey

- 10.3.3 Covariant

- 10.3.4 Exotec

- 10.3.5 River Systems