PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1859015

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1859015

Biostimulants Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

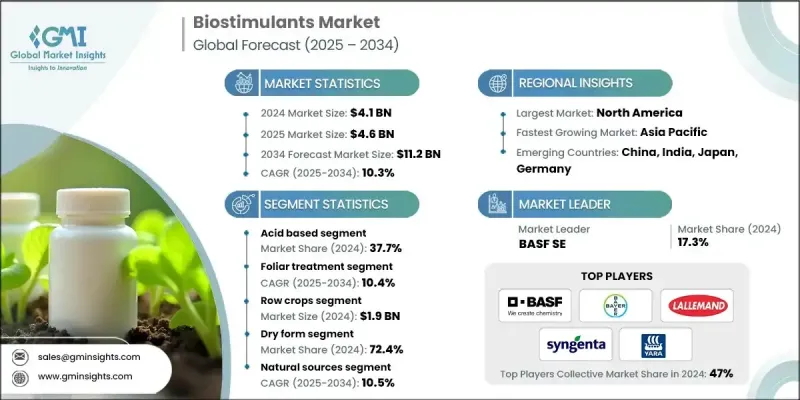

The Global Biostimulants Market was valued at USD 4.1 billion in 2024 and is estimated to grow at a CAGR of 10.3% to reach USD 11.2 billion by 2034.

This growth is fueled by the rising awareness of sustainable agricultural practices and the increasing need for higher crop yields. Biostimulants are natural substances or microorganisms applied to plants or soils to boost nutrient uptake, improve stress tolerance, and enhance overall plant health. These products play a crucial role in modern farming by optimizing plant growth through natural processes that aid in nutrient absorption, root development, and resilience to environmental stress. As they help improve crop performance with less reliance on chemical fertilizers and pesticides, biostimulants contribute to more sustainable farming methods, promoting soil health and reducing environmental impact. Additionally, biostimulants can improve crop tolerance to abiotic stress factors such as drought, salinity, and extreme temperature challenges that are increasingly becoming common due to climate change. The adoption of biostimulants spans a wide range of agricultural practices, including crop production, horticulture, turf management, and organic farming, offering significant benefits like better seed germination, root development, and flowering.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.1 Billion |

| Forecast Value | $11.2 Billion |

| CAGR | 10.3% |

In 2024, the acid-based biostimulants segment held a 37.7% share and is expected to grow at a CAGR of 10.4% by 2034. Humic and fulvic acids are especially popular for their proven ability to improve soil structure, nutrient availability, and root development, making them an economical and effective solution for various agricultural applications.

The foliar treatment segment held a 71.2% share in 2024 and is expected to grow at a CAGR of 10.4% through 2034. This method is favored for its rapid absorption and targeted application, as well as its compatibility with the equipment commonly used by farmers. Foliar treatments are particularly effective in addressing nutrient deficiencies and stress responses, offering quick results, especially for high-value crops where time-sensitive responses are crucial.

Europe Biostimulants Market was valued at USD 1.7 billion in 2024 due to rising demand for sustainable agricultural practices and organic farming. Legislative support and innovation in product formulations are further accelerating the market's expansion. Key industry players are investing in research and development to create environmentally friendly products, while precision agriculture is also playing a significant role in the sector's growth.

Prominent players in the Global Biostimulants Market include Yara International, UPL, Syngenta, BASF SE, Bayer S.p.A., Micromix, Artal Agronutrients, Lallemand, Nutrien, Biostadt India Limited, Nutri-Tech Solutions Pty Ltd, Desarrollo Agricola Minero S.A., and Hello Nature. To strengthen their position, companies in the biostimulants industry are focusing on continuous innovation in product formulations to meet the growing demand for sustainable agricultural solutions. Many are also investing in strategic partnerships with research institutions and other industry players to expand their product offerings and improve their reach in emerging markets. In addition, these companies are leveraging precision agriculture technologies to enhance the efficiency and effectiveness of biostimulant applications.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Active ingredients

- 2.2.3 Application

- 2.2.4 Crop

- 2.2.5 Form

- 2.2.6 Source

- 2.2.7 Function

- 2.2.8 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By crop

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Active Ingredient, 2021-2034 (USD Billion & Kilo Tons)

- 5.1 Key trends

- 5.2 Acid based

- 5.2.1 Humic acid

- 5.2.2 Fulvic acid

- 5.2.3 Amino acid

- 5.3 Extract based

- 5.3.1 Seaweed extracts

- 5.3.1.1 Ascophyllum nodosum

- 5.3.1.2 Fucus vesiculosus

- 5.3.1.3 Laminaria

- 5.3.1.4 Others

- 5.3.2 Protein hydrolysates

- 5.3.2.1 Animal-derived

- 5.3.2.2 Plant-derived

- 5.3.3 Plant extracts

- 5.3.1 Seaweed extracts

- 5.4 Microbial based

- 5.4.1 Bacteria

- 5.4.1.1 Rhizobium

- 5.4.1.2 Azospirillum

- 5.4.1.3 Bacillus

- 5.4.1.4 Pseudomonas

- 5.4.1.5 Others

- 5.4.2 Fungi

- 5.4.2.1 Arbuscular mycorrhizal fungi

- 5.4.2.2 Trichoderma

- 5.4.2.3 Others

- 5.4.3 Yeast & yeast extracts

- 5.4.1 Bacteria

- 5.5 Inorganic based

- 5.6 Chitosan & biopolymers

- 5.7 Others

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Billion & Kilo Tons)

- 6.1 Key trends

- 6.2 Foliar treatment

- 6.3 Soil treatment

- 6.4 Seed treatment

- 6.5 Fertigation

- 6.6 Hydroponic systems

Chapter 7 Market Estimates and Forecast, By Crop, 2021-2034 (USD Billion & Kilo Tons)

- 7.1 Key trends

- 7.2 Row crops

- 7.2.1 Corn

- 7.2.2 Wheat

- 7.2.3 Rice

- 7.2.4 Soybeans

- 7.2.5 Rapeseed

- 7.2.6 Cotton

- 7.2.7 Sugarcane

- 7.2.8 Others

- 7.3 Fruits & vegetables

- 7.3.1 Fruits

- 7.3.1.1 Citrus fruits

- 7.3.1.2 Apples

- 7.3.1.3 Grapes

- 7.3.1.4 Berries

- 7.3.1.4.1 Strawberries

- 7.3.1.4.2 Blueberries

- 7.3.1.4.3 Raspberries

- 7.3.1.4.4 Others

- 7.3.1.5 Stone fruits

- 7.3.1.6 Tropical fruits

- 7.3.1.7 Others

- 7.3.2 Vegetables

- 7.3.2.1 Solanaceous crops

- 7.3.2.1.1 Tomatoes

- 7.3.2.1.2 Potatoes

- 7.3.2.1.3 Capsicum and Chilies

- 7.3.2.1.4 Eggplant

- 7.3.2.1.5 Root vegetables

- 7.3.2.1.6 Onions

- 7.3.2.1.7 Carrots

- 7.3.2.1.8 Others

- 7.3.2.2 Leafy Vegetables

- 7.3.2.2.1 Lettuce

- 7.3.2.2.2 Spinach

- 7.3.2.2.3 Cabbage

- 7.3.2.2.4 Cauliflower

- 7.3.2.2.5 Others

- 7.3.2.3 Cucurbitaceous crops

- 7.3.2.4 Leguminous vegetables

- 7.3.2.5 Others

- 7.3.2.1 Solanaceous crops

- 7.3.1 Fruits

- 7.4 Turf & ornamentals

- 7.4.1 Turf

- 7.4.2 Ornamental plants

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By Form, 2021-2034 (USD Billion & Kilo Tons)

- 8.1 Key trends

- 8.2 Liquid

- 8.2.1 Suspension concentrate

- 8.2.2 Emulsifiable concentrate

- 8.2.3 Soluble liquid

- 8.3 Dry

- 8.3.1 Powder

- 8.3.2 Granular

- 8.3.3 Wettable powder

Chapter 9 Market Estimates and Forecast, By Source, 2021-2034 (USD Billion & Kilo Tons)

- 9.1 Key trends

- 9.2 Natural

- 9.3 Synthetic

- 9.4 Semi-synthetic

Chapter 10 Market Estimates and Forecast, By Function, 2021-2034 (USD Billion & Kilo Tons)

- 10.1 Key trends

- 10.2 Nutrient use efficiency

- 10.3 Abiotic stress tolerance

- 10.4 Growth promotion

- 10.5 Crop quality enhancement

Chapter 11 Market Estimates and Forecast, By End Use, 2021-2034 (USD Billion & Kilo Tons)

- 11.1 Key trends

- 11.2 Commercial growers

- 11.2.1 Large-scale farms

- 11.2.2 Medium-scale farms

- 11.3 Smallholder farmers

- 11.4 Greenhouse operators

- 11.5 Nursery & landscaping

Chapter 12 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion & Kilo Tons)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Spain

- 12.3.5 Italy

- 12.3.6 Rest of Europe

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.4.6 Rest of Asia Pacific

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.5.4 Rest of Latin America

- 12.6 Middle East and Africa

- 12.6.1 Saudi Arabia

- 12.6.2 South Africa

- 12.6.3 UAE

- 12.6.4 Rest of Middle East and Africa

Chapter 13 Company Profiles

- 13.1 Artal Agronutrients

- 13.2 BASF SE

- 13.3 Bayer S.p.A

- 13.4 Biostadt India Limited

- 13.5 Desarrollo Agricola Minero S.A.

- 13.6 Hello Nature

- 13.7 Lallemand

- 13.8 Micromix

- 13.9 Nutrien

- 13.10 Nutri-Tech Solutions Pty Ltd

- 13.11 Syngenta

- 13.12 UPL

- 13.13 Yara International