PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1859023

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1859023

Dental CAD/CAM Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

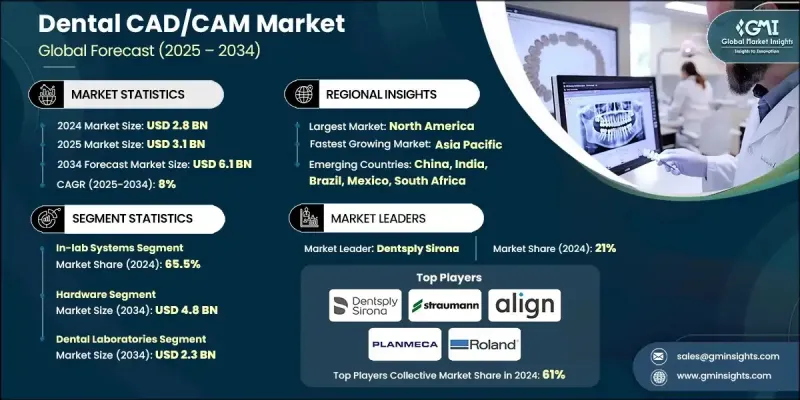

The Global Dental CAD/CAM Market was valued at USD 2.8 billion in 2024 and is estimated to grow at a CAGR of 8% to reach USD 6.1 billion by 2034.

The robust growth is driven by the rising number of dental procedures, the growing prevalence of dental diseases, and the increasing shift toward digital dentistry. As more people become aware of the importance of oral health, particularly among the aging population, dental professionals are increasingly adopting CAD/CAM technologies to provide faster, more accurate, and more patient-friendly treatments. These advanced systems significantly improve the design and manufacturing of dental restorations such as crowns, bridges, veneers, and dentures, enabling highly precise, efficient, and aesthetically pleasing outcomes. By minimizing human error and reducing treatment time, CAD/CAM solutions enhance patient satisfaction and clinical results. As the demand for superior dental restorations continues to rise, dental clinics and laboratories are moving away from traditional manual methods and adopting digital workflows. CAD/CAM systems have become a vital part of restorative and prosthetic dental care, offering an efficient alternative to conventional methods.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.8 Billion |

| Forecast Value | $6.1 Billion |

| CAGR | 8% |

The in-lab systems segment held a 65.5% share in 2024, due to their advanced capabilities to handle complex restorations with greater precision, scalability, and material versatility. These features make in-lab systems the preferred choice for large dental laboratories and multi-specialty clinics. The segment's dominance stems from its capacity to manage high-volume cases efficiently while ensuring top-quality results.

The hardware segment is expected to reach USD 4.8 billion by 2034. This dominance is driven by innovations in dental hardware, such as intraoral scanners, milling machines, and 3D printers, which are revolutionizing the production of dental impressions and restorations. Intraoral scanners, for instance, are replacing traditional physical impressions, offering a more comfortable and efficient experience for patients.

North America Dental CAD/CAM Market remains the largest regional market for dental CAD/CAM systems, supported by the widespread adoption of digital dentistry, a large pool of dental professionals, and substantial investments in advanced restorative technologies. The region's emphasis on precision, aesthetics, and efficient workflows continues to drive the demand for chairside CAD/CAM systems in both general and specialized practices. This growing trend is especially evident in dental service organizations, private clinics, and academic institutions, all of which are leveraging these technologies to reduce treatment times and enhance patient outcomes.

Leading players in the Global Dental CAD/CAM Market include Roland DGA, Planmeca Oy, Ivoclar Vivadent, Align Technologies, 3Shape, Dentsply Sirona, Zirkonzahn, Straumann AG, Jensen Dental, Dental Wings Inc., Schutz Dental Group, Amann Girrbach, Datron AG, Envista Holdings Corporation, Hexagon AB, and imes-icore GmbH. Companies in the Dental CAD/CAM Market are adopting a variety of strategies to strengthen their presence. These include continuous research and development efforts aimed at improving system precision, speed, and ease of use. Many are also forging strategic partnerships with dental clinics, laboratories, and research institutions to enhance product offerings and extend their market reach. Another key strategy is focusing on the integration of AI and machine learning technologies to improve the automation of dental restoration design and manufacturing processes.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Type trends

- 2.2.3 Component trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising number of dental procedures

- 3.2.1.2 Increasing prevalence of dental diseases

- 3.2.1.3 Growing adoption of CAD/CAM technology in dentistry

- 3.2.1.4 Rising geriatric population

- 3.2.1.5 Advantages of CAD/CAM restorations over conventional restorations

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of ownership of dental CAD/CAM devices

- 3.2.2.2 Less awareness and low affordability in underdeveloped regions

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with digital dentistry platforms

- 3.2.3.2 Development of compact and user-friendly systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Pricing analysis, 2024

- 3.8 Patent analysis

- 3.9 Reimbursement scenario

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 In-lab systems

- 5.3 In-office systems

Chapter 6 Market Estimates and Forecast, By Component, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hardware

- 6.2.1 Milling machines

- 6.2.2 Dental 3D printers

- 6.2.3 Scanners

- 6.3 Software

- 6.3.1 Cloud/Web-based

- 6.3.2 On premise

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Dental clinics

- 7.3 Dental laboratories

- 7.4 Dental milling centres

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 3Shape

- 9.2 Align Technologies

- 9.3 Amann Girrbach

- 9.4 Datron AG

- 9.5 Dental Wings Inc.

- 9.6 Dentsply Sirona

- 9.7 Envista Holdings Corporation

- 9.8 Hexagon AB

- 9.9 imes-icore GmbH

- 9.10 Ivoclar Vivadent

- 9.11 Jensen Dental

- 9.12 Planmeca Oy

- 9.13 Roland DGA

- 9.14 Schutz Dental Group

- 9.15 Straumann AG

- 9.16 Zirkonzahn