PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871073

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871073

Hydrogels for 3D Bioprinting Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

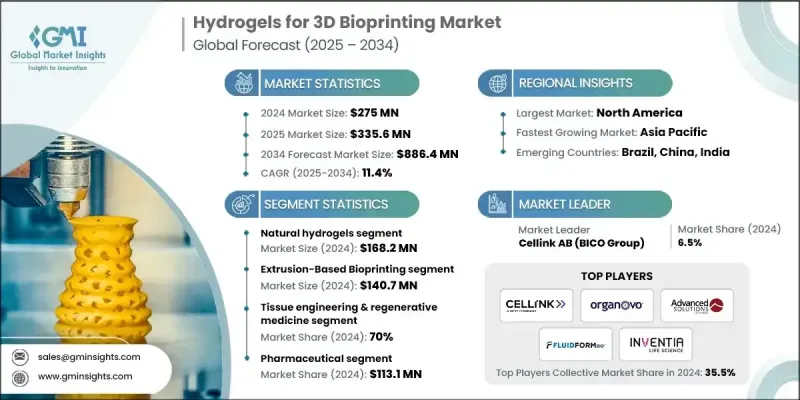

The Global Hydrogels for 3D Bioprinting Market was valued at USD 275 million in 2024 and is estimated to grow at a CAGR of 11.4% to reach USD 886.4 million by 2034.

Hydrogels are biocompatible, water-rich materials used as bioinks in 3D bioprinting to create complex biological structures that support living cells. These hydrogels mimic the natural tissue environment, retaining moisture and nutrients that promote cell survival and growth after printing. Their soft, gel-like nature allows them to be precisely shaped and layered using bioprinters to form tissues for drug testing, regenerative medicine, or medical research. Increasing demand for tissue engineering, organ regeneration, and personalized medicine is fueling the market's expansion. The ongoing progress in bioprinting technologies, coupled with growing investments from the biotechnology and healthcare industries, is broadening the potential of hydrogel-based bioinks. Developments in extrusion and laser-assisted bioprinting are enhancing accuracy in cell placement and tissue fabrication, while improved crosslinking processes, such as UV and ionic bonding, allow printed hydrogels to maintain structure and ensure high cell viability. Rising R&D collaborations and the continuous evolution of 3D bioprinting techniques are further accelerating market growth globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $275 Million |

| Forecast Value | $886.4 Million |

| CAGR | 11.4% |

The natural hydrogels segment generated USD 168.2 million in 2024. Their rapid growth is driven by their biocompatibility and resemblance to the body's natural extracellular environment. These hydrogels provide strong support for cellular functions such as adhesion, proliferation, and differentiation, which makes them ideal for applications in regenerative medicine and tissue reconstruction. Their compatibility with living systems gives them an advantage over synthetic alternatives, contributing to their growing use in bioengineering research and clinical applications.

The extrusion-based bioprinting segment reached USD 140.7 million in 2024. This technique is gaining traction for its ability to print highly detailed, stable tissue structures using a wide range of bioinks. It is cost-effective, user-friendly, and suitable for producing thick, complex biological models such as those used for tissue and organ reconstruction. While extrusion remains the dominant approach, droplet-based and laser-assisted printing technologies are also gaining attention for their precision in fabricating delicate biological structures and drug-testing models. Together, these printing techniques are enhancing the versatility and scalability of hydrogel-based bioprinting systems across medical and research fields.

U.S. Hydrogels for 3D Bioprinting Market accounted for USD 99.3 million in 2024. The country benefits from a strong biotechnology base, advanced research infrastructure, and major investments in regenerative medicine and 3D printing technologies. North America's market strength is further reinforced by active collaborations between pharmaceutical firms, universities, and startups focused on improving hydrogel properties for greater precision and biocompatibility. Increasing regulatory support and rising demand for personalized medical solutions are expected to drive the adoption of hydrogel-based bioprinting technologies throughout the region.

Key companies in the Global Hydrogels for 3D Bioprinting Market include Cellink AB (BICO Group), Biomason Inc., REGENHU, Nanoscribe, FluidForm Bio, Organovo Inc., Advanced Solutions, Lifecore Biomedical, Nordmark, Manchester BIOGEL, Aspect Biosystems, TissueLabs, Revotek Co. Ltd, 3DBio Therapeutics, Rousselot Biomedical, Mimixbio, Hangzhou Meizhuo Biotechnology Co. Ltd, Cellntec, Inventia Life Science Pty Ltd, ViscoTec / Puredyne, and XPECT INX. To strengthen their foothold in the Hydrogels for 3D Bioprinting Market, companies are pursuing strategies focused on innovation, collaboration, and expansion. Major players are investing heavily in R&D to enhance the biofunctionality, printability, and crosslinking efficiency of hydrogels. Partnerships between biotechnology firms, academic institutions, and healthcare organizations are being leveraged to develop next-generation bioinks and scalable bioprinting platforms. Firms are also expanding production capacities and focusing on customized hydrogel formulations to meet the growing demand for tissue-specific applications.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Hydrogel type

- 2.2.3 Bioprinting technology

- 2.2.4 Application

- 2.2.5 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for personalized medicine

- 3.2.1.2 Integration of advanced crosslinking techniques

- 3.2.1.3 Expansion of regenerative medicine applications

- 3.2.1.4 Development of multi-material bioprinting

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Maintaining cell viability during printing

- 3.2.2.2 Limited mechanical strength

- 3.2.3 Market opportunities

- 3.2.3.1 Development of smart hydrogels

- 3.2.3.2 Collaboration between biotech and healthcare

- 3.2.3.3 Expansion into Drug Testing and Cosmetics

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By technology type

- 3.8 Future market trends

- 3.9 Patent Landscape

- 3.10 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.10.1 Major importing countries

- 3.10.2 Major exporting countries

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.12 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Hydrogel Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Natural hydrogels

- 5.2.1 Alginate-based systems

- 5.2.2 Collagen & gelatin systems

- 5.2.3 Hyaluronic acid-based systems

- 5.2.4 Fibrin-based systems

- 5.2.5 Chitosan-based systems

- 5.2.6 Agarose-based systems

- 5.2.7 Decellularized ECM systems

- 5.3 Synthetic hydrogel

- 5.3.1 PEG-based systems

- 5.3.2 PEG-PCL triblock copolymers

- 5.3.3 Polyurethane-based systems

- 5.3.4 PLA & PCL systems

- 5.3.5 PVA-based systems

- 5.4 Hybrid systems

- 5.4.1 Natural-synthetic composites

- 5.4.2 Multi-material systems

- 5.4.3 Reinforced hydrogel networks

Chapter 6 Market Estimates and Forecast, By Biotechnology Printing, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Extrusion-based bioprinting

- 6.2.1 Pneumatic extrusion systems

- 6.2.2 Mechanical extrusion systems

- 6.2.3 Coaxial extrusion systems

- 6.2.4 Multi-material extrusion

- 6.3 Droplet-based bioprinting

- 6.3.1 Inkjet bioprinting

- 6.3.2 Drop-on-demand systems

- 6.3.3 Microvalve-based systems

- 6.4 Laser-assisted bioprinting

- 6.4.1 Laser-induced forward transfer

- 6.4.2 Matrix-assisted pulsed laser evaporation

- 6.4.3 Absorbing film-assisted laser-induced forward transfer

- 6.5 Stereolithography & light-based methods

- 6.5.1 Stereolithography (SLA)

- 6.5.2 Digital Light Processing (DLP)

- 6.5.3 Two-photon polymerization

- 6.5.4 Volumetric bioprinting

- 6.6 Emerging technologies

- 6.6.1 Acoustic

- 6.6.2 Magnetic

- 6.6.3 Electrohydrodynamic

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Tissue engineering & regenerative medicine

- 7.2.1 Cardiovascular tissue engineering

- 7.2.2 Neural tissue engineering

- 7.2.3 Skin & wound healing applications

- 7.2.4 Bone & cartilage engineering

- 7.2.5 Liver tissue engineering

- 7.2.6 Kidney tissue engineering

- 7.2.7 Lung tissue engineering

- 7.3 Drug delivery systems

- 7.3.1 Controlled release platforms

- 7.3.2 Targeted drug delivery

- 7.3.3 Personalized drug testing

- 7.3.4 Sustained release systems

- 7.4 Disease modeling & drug discovery

- 7.4.1 Organ-on-chip systems

- 7.4.2 Cancer research models

- 7.4.3 Disease pathology models

- 7.4.4 Toxicity testing platforms

- 7.5 Biosensors & diagnostics

- 7.5.1 Implantable biosensors

- 7.5.2 Wearable sensor systems

- 7.5.3 Point-of-care diagnostics

- 7.6 Other

- 7.6.1 Cosmetics testing

- 7.6.2 Food & agriculture

- 7.6.3 Environmental applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Pharmaceutical

- 8.1.1 Large

- 8.1.2 Specialty

- 8.1.3 Contract research organizations

- 8.2 Biotechnology

- 8.2.1 Tissue engineering

- 8.2.2 Cell therapy

- 8.2.3 Regenerative medicine

- 8.3 Academic & research institutions

- 8.3.1 Universities & research centers

- 8.3.2 Government research institutes

- 8.3.3 Non-profit research organizations

- 8.4 Clinical & healthcare providers

- 8.4.1 Hospitals & medical centers

- 8.4.2 Specialized clinics

- 8.4.3 Surgical centers

- 8.5 Other

- 8.5.1 Contract manufacturing

- 8.5.2 Material suppliers

- 8.5.3 Technology platform

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 3DBio Therapeutics

- 10.2 Advanced Solutions

- 10.3 Aspect Biosystems

- 10.4 Cellink AB (BICO Group)

- 10.5 Cellntec

- 10.6 FluidForm Bio

- 10.7 Hangzhou Meizhuo Biotechnology Co. Ltd

- 10.8 Inventia Life Science Pty Ltd

- 10.9 Lifecore Biomedical

- 10.10 Manchester BIOGEL

- 10.11 Mimixbio

- 10.12 Nanoscribe

- 10.13 Nordmark

- 10.14 Organovo Inc.

- 10.15 REGENHU

- 10.16 Revotek Co. Ltd

- 10.17 Rousselot Biomedical

- 10.18 TissueLabs

- 10.19 ViscoTec / Puredyne

- 10.20 XPECT INX