PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871080

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871080

Neuromorphic Chips for Autonomous Vehicles Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

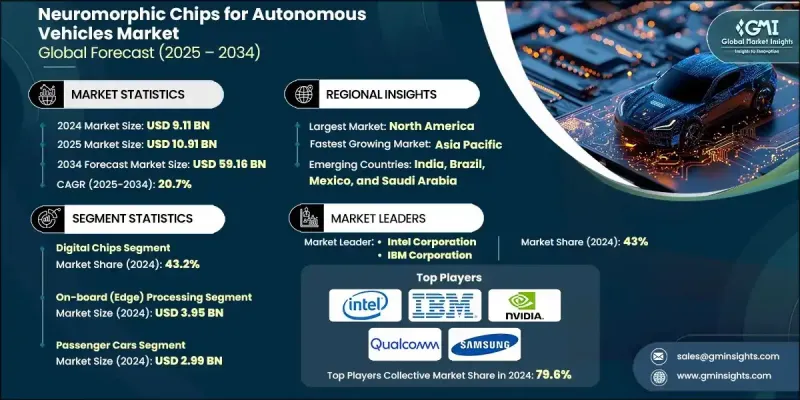

The Global Neuromorphic Chips for Autonomous Vehicles Market was valued at USD 9.11 Billion in 2024 and is estimated to grow at a CAGR of 20.7% to reach USD 59.16 Billion by 2034.

The accelerating demand for self-driving vehicles is driving the need for advanced computing systems that can rapidly process vast amounts of sensory input. Neuromorphic chips, which emulate the human brain's structure, enable faster decision-making and greater energy efficiency than traditional processors. As vehicles integrate multiple cameras, LiDAR, and radar technologies to enhance safety and reliability, the requirement for instantaneous data processing continues to rise. With the evolution of electric and autonomous vehicles, energy optimization and heat management have become key concerns. Conventional GPUs and CPUs often face thermal throttling during continuous AI tasks, which limits scalability. In contrast, neuromorphic processors handle only relevant data using parallel, event-driven computation, which significantly reduces power consumption and improves battery performance in electric vehicles. The growing adoption of neuromorphic technology is further supported by advancements in sensor systems. Next-generation bio-inspired and event-based sensors produce data streams optimized for neuromorphic processing, enabling asynchronous and spike-driven data handling that is not possible with conventional architectures.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.11 billion |

| Forecast Value | $59.16 billion |

| CAGR | 20.7% |

In 2024, the digital neuromorphic chips segment accounted for a 43.2% share. Their dominance stems from seamless integration with existing automotive AI systems and electronic control units, allowing automakers to implement them without major redesigns. Their compatibility with current AI frameworks, along with strong support from top semiconductor manufacturers, ensures scalability, reliability, and consistent innovation in this segment.

The on-board (edge) deployment model generated USD 3.95 Billion in 2024, owing to its critical role in real-time sensor data processing. Edge computing allows vehicles to analyze information locally, eliminating latency and enabling instantaneous response to road and traffic conditions. This architecture is crucial for safety applications that require split-second decision-making, such as automated braking and collision prevention.

United States Neuromorphic Chips for Autonomous Vehicles Market generated USD 2.5 Billion in 2024. The U.S. continues to benefit from robust investment in artificial intelligence and autonomous driving technologies, supported by both public and private sectors. A strong innovation ecosystem and the presence of key technology firms contribute to ongoing research in neuromorphic computing for high-speed, real-time decision-making. The nation's growing focus on intelligent and energy-efficient vehicle systems further accelerates the integration of neuromorphic chips in the automotive industry.

Key companies active in the Global Neuromorphic Chips for Autonomous Vehicles Market include Accenture, Applied Brain Research Inc., Aspinity Inc., BorgWarner Inc., BrainChip Holdings Ltd., Cadence Design Systems Inc., Figaro Engineering Inc., General Vision Inc., Grayscale AI, Gyrfalcon Technology Inc., Hewlett Packard Enterprise Development LP, IBM Corporation, Intel Corporation, MemryX Inc., Micron Technology Inc., Mythic Inc., NVIDIA Corporation, Polyn Technology, Prophesee SA, Qualcomm Technologies Inc., Samsung Electronics Co. Ltd., and Sony Corporation. To strengthen their position, leading companies in the Neuromorphic Chips for Autonomous Vehicles Market are prioritizing strategic collaborations, product innovation, and scalable manufacturing. Many are investing heavily in R&D to enhance chip efficiency, reduce power usage, and improve data processing accuracy. Partnerships between semiconductor firms and automotive manufacturers are accelerating integration and testing within next-generation vehicle systems. Several players are also focusing on expanding their geographic reach and forming alliances with AI software developers to align neuromorphic technology with emerging automotive standards.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Chip Architecture trends

- 2.2.2 Deployment trends

- 2.2.3 Vehicle Category trends

- 2.2.4 End use trends

- 2.2.5 Regional trends

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Advanced Autonomous Vehicle Adoption

- 3.2.1.2 Energy-Efficient Computing & Edge AI

- 3.2.1.3 Automotive Sensor Integration

- 3.2.1.4 Industry-Academia Collaborations & R&D

- 3.2.1.5 Advanced Autonomous Vehicle Adoption

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High Development and Implementation Costs

- 3.2.2.2 Complex System Integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Consumer sentiment analysis

- 3.11 Patent and IP analysis

- 3.12 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital Transformation Initiatives

- 4.5 Emerging/ Startup Competitors Landscape

Chapter 5 Market Estimates & Forecast, By Chip Architecture, 2021-2034 (USD Billion)

- 5.1 Key trends

- 5.2 Analog

- 5.3 Digital

- 5.4 Mixed-Signal

Chapter 6 Market Estimates & Forecast, By Deployment, 2021-2034 (USD Billion)

- 6.1 Key trends

- 6.2 On-Board (Edge) Processing

- 6.3 Cloud-Assisted Processing

- 6.4 Hybrid Processing

Chapter 7 Market Estimates & Forecast, By Vehicle Category, 2021-2034 (USD Billion)

- 7.1 Key trends

- 7.2 Passenger Cars

- 7.2.1 Commercial Vehicles

- 7.2.2 Trucks

- 7.2.3 Buses

- 7.3 Autonomous Shuttles & Robo-Taxis

- 7.4 Off-Road & Specialized Vehicles

- 7.4.1 Agriculture

- 7.4.2 Mining

- 7.4.3 Construction

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion)

- 8.1 Key trends

- 8.2 Automotive OEMs

- 8.3 Tier-1 Suppliers

- 8.4 Aftermarket Solution Providers

- 8.5 Research & Development Entities

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Accenture

- 10.2 Applied Brain Research Inc.

- 10.3 Aspinity Inc.

- 10.4 BorgWarner Inc.

- 10.5 BrainChip Holdings Ltd.

- 10.6 Cadence Design Systems, Inc.

- 10.7 Figaro Engineering Inc.

- 10.8 General Vision Inc.

- 10.9 Grayscale AI

- 10.10 Gyrfalcon Technology Inc.

- 10.11 Hewlett Packard Enterprise Development LP

- 10.12 IBM Corporation

- 10.13 Innatera Nanosystems BV

- 10.14 Intel Corporation

- 10.15 MemryX Inc.

- 10.16 Micron Technology, Inc.

- 10.17 Mythic Inc.

- 10.18 NVIDIA Corporation

- 10.19 Polyn Technology

- 10.20 Prophesee SA

- 10.21 Qualcomm Technologies, Inc.

- 10.22 Samsung Electronics Co., Ltd.

- 10.23 Sony Corporation

- 10.24 SynSense AG

- 10.25 Syntiant Corp.

- 10.26 Vicarious Corp.

- 10.27 Vivum Computing