PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871083

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871083

Biocement for Construction Application Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

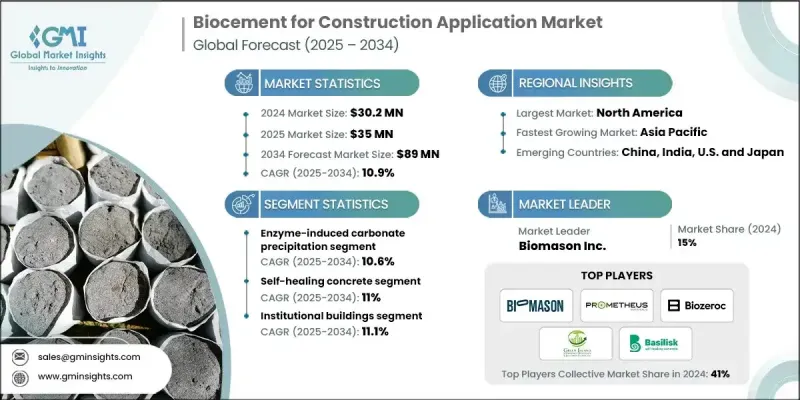

The Global Biocement for Construction Application Market was valued at USD 30.2 million in 2024 and is estimated to grow at a CAGR of 10.9% to reach USD 89 million by 2034.

The rising global focus on sustainable and eco-friendly construction materials is fueling the rapid growth of this market. Biocement offers a cleaner alternative to traditional Portland cement, which is known for its high carbon emissions. Produced through microbial processes that induce calcite precipitation, biocement provides a durable, low-carbon binding solution for modern construction needs. The material's superior environmental benefits, lower energy consumption, and improved strength characteristics are driving adoption across infrastructure, residential, and commercial projects. Continuous advancements in bio-based materials and microbial technologies are making production more efficient and cost-effective, enhancing competitiveness with conventional cement. Global sustainability initiatives and regulatory mandates are also accelerating biocement's integration into large-scale projects. Growing investment in research and development is expanding its potential for soil stabilization, repair works, and precast components. The increasing awareness of environmental conservation and consumer inclination toward green building practices continue to drive the overall demand for biocement across construction sectors worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $30.2 Million |

| Forecast Value | $89 Million |

| CAGR | 10.9% |

The microbially induced carbonate precipitation (MICP) segment held 60% share in 2024. This process utilizes naturally occurring bacteria to precipitate calcium carbonate, resulting in strong and durable binding properties that are ideal for construction applications. Extensive research validating the commercial and environmental viability of MICP has reinforced its leadership in the industry. Ongoing technological advancements and the development of specialized applications for concrete reinforcement and soil stabilization are expected to sustain its dominance in the coming years.

The industrial and manufacturing facilities segment held 29.8% share, growing at a CAGR of 10.6% in 2024. The demand from these sectors is driven by the need for construction materials with exceptional durability, chemical resistance, and self-healing properties. Biocement's ability to extend service life and minimize maintenance costs makes it particularly valuable in industrial environments that experience extreme operational conditions. Its resistance to chemical degradation and capacity to maintain structural integrity even in demanding settings have positioned it as a key material in industrial construction.

North America Biocement for Construction Application Market held 43.5% share in 2024, with an anticipated CAGR of 11.1% through 2034. The region's growth is largely attributed to strong environmental awareness, government sustainability initiatives, and strict limitations on traditional cement production. The United States remains at the forefront with major investments in green building infrastructure and eco-friendly construction standards, while Canada continues to expand through policies promoting sustainable urban development. Ongoing innovation in biocement formulations, combined with increasing research activity and collaboration among manufacturers, is expected to further accelerate the region's market expansion.

Key companies operating in the Biocement for Construction Application Market include Carbicrete Inc., Biozeroc Ltd., Biomason Inc., Prometheus Materials Inc., Green Island International Ltd., and Basilisk B.V. Leading players in the Biocement for Construction Application Market are employing strategies focused on research innovation, strategic collaborations, and production scalability to enhance their market position. Many companies are investing heavily in R&D to improve microbial efficiency, optimize calcite precipitation, and develop faster, more sustainable curing processes. Partnerships between biotechnology firms, construction companies, and academic institutions are helping accelerate product development and expand application areas. Several firms are working to scale manufacturing capacity and lower production costs through automation and advanced bioengineering techniques.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology type

- 2.2.3 Application

- 2.2.4 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product category

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Technology Type, 2021-2034 (USD Million & Tons)

- 5.1 Key trends

- 5.2 Microbially induced carbonate precipitation (MICP)

- 5.2.1 Ureolytic bacteria systems

- 5.2.2 Sporosarcina pasteurii applications

- 5.2.3 Bacillus species implementations

- 5.3 Enzyme-induced carbonate precipitation (EICP)

- 5.4 Carbonic anhydrase-based systems

- 5.4.1 Co2-capturing enzyme systems

- 5.4.2 Ambient temperature carbonation

- 5.4.3 Enhanced co2 sequestration

- 5.5 Iron-respiring bacterial systems

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Million & Tons)

- 6.1 Key trends

- 6.2 Self-healing concrete

- 6.2.1 Autonomous crack repair systems

- 6.2.2 Encapsulated bacterial technologies

- 6.2.3 Long-term durability enhancement

- 6.3 Soil stabilization & ground improvement

- 6.3.1 Foundation strengthening

- 6.3.2 Liquefaction prevention

- 6.3.3 Erosion control systems

- 6.4 Infrastructure repair & rehabilitation

- 6.4.1 Crack sealing applications

- 6.4.2 Surface consolidation

- 6.4.3 Structural restoration

- 6.5 Precast building components

- 6.5.1 Architectural elements

- 6.5.2 Structural components

- 6.5.3 Decorative applications

- 6.6 Road & pavement applications

- 6.6.1 Road repair & maintenance

- 6.6.2 Dust control systems

- 6.6.3 Temporary infrastructure

Chapter 7 Market Estimates and Forecast, By End Use, 2021-2034 (USD Million & Tons)

- 7.1 Key trends

- 7.2 Residential construction

- 7.3 Institutional buildings

- 7.3.1 Office buildings

- 7.3.2 Schools

- 7.3.3 Hospitals

- 7.3.4 Retail facilities

- 7.4 Commercial structures

- 7.4.1 Roads

- 7.4.2 Bridges

- 7.4.3 Airports

- 7.4.4 Others

- 7.5 Industrial & manufacturing facilities

- 7.5.1 Warehouses

- 7.5.2 Factories

- 7.5.3 Logistic centers

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Million & Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Biomason Inc.

- 9.2 Prometheus Materials Inc.

- 9.3 Biozeroc Ltd.

- 9.4 Green Island International Ltd.

- 9.5 Basilisk B.V.

- 9.6 Carbicrete Inc.