PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871093

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871093

Cold Chain Logistics Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

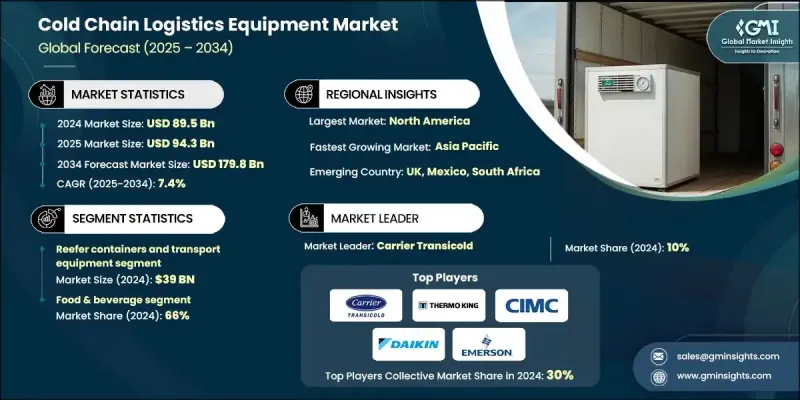

The Global Cold Chain Logistics Equipment Market was valued at USD 89.5 Billion in 2024 and is estimated to grow at a CAGR of 7.4% to reach USD 179.8 Billion by 2034.

Market growth is fueled by the increasing global demand for temperature-sensitive products such as pharmaceuticals, biologics, vaccines, fresh produce, seafood, dairy, and frozen foods. The pharmaceutical industry relies heavily on ultra-low-temperature storage and transport systems to preserve biologics and mRNA-based therapies, creating strong demand for advanced refrigerated logistics equipment. Similarly, the rising consumption of fresh and organic food products has prompted investments in refrigerated storage and transportation systems to ensure product safety and quality throughout the supply chain. With globalization extending the reach of perishable goods across continents, logistics providers are increasingly adopting temperature-controlled solutions to preserve product integrity and reduce spoilage. Growing awareness about food safety and sustainability is also accelerating the transition toward advanced cold chain systems designed to maintain consistent temperature conditions from production to final delivery.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $89.5 Billion |

| Forecast Value | $179.8 Billion |

| CAGR | 7.4% |

In 2024, the reefer containers and transport equipment segment generated USD 39 Billion. These refrigerated containers are vital for international logistics, offering efficient temperature control during multimodal transportation spanning sea, rail, and road, ensuring perishable goods maintain quality during long-distance shipment. Their adaptability and reliability make them indispensable for global cold chain operations.

The food & beverage sector held a 66% share in 2024, driven by rising consumer preference for fresh, natural, and ready-to-eat products. The need for precise temperature regulation to prevent spoilage and contamination has led producers, retailers, and distributors to invest heavily in advanced refrigeration infrastructure, including cold storage units, temperature-sensing systems, and refrigerated transport vehicles. These investments support seamless product movement from farms to retail outlets while maintaining high safety and freshness standards.

U.S. Cold Chain Logistics Equipment Market held 78.2% share and generated USD 24.9 Billion in 2024. The country's well-established infrastructure, strict regulatory environment, and strong demand for temperature-sensitive goods make it a major global hub for cold chain operations. Continuous investments in smart monitoring technologies, cold storage expansion, and efficient transportation systems are further strengthening the country's dominance. The growth is also supported by the thriving e-commerce, food delivery, and pharmaceutical industries, which rely heavily on reliable cold chain systems.

Key players in the Global Cold Chain Logistics Equipment Market include Carrier Transicold (United Technologies), Emerson Electric (Copeland), Johnson Controls, Rivacold, Danfoss, ORBCOMM, DANA Steel, Daikin Industries, Thermo King (Trane Technologies), Bureida Trading & Refrigeration, TSSC, Thermodynamics, China International Marine Containers, Zanotti Spa, Zhengzhou Kaixue Cold Chain, and Coldstores Group of Saudi Arabia (CGS). Companies in the Cold Chain Logistics Equipment Market are adopting multiple strategies to strengthen their global presence and maintain a competitive advantage. Leading manufacturers are investing in advanced refrigeration technologies, such as energy-efficient compressors, smart sensors, and real-time monitoring systems, to improve temperature control and reduce energy consumption. Strategic collaborations and partnerships with logistics providers and food producers are expanding distribution networks and optimizing supply chains. Continuous R&D efforts are focused on developing eco-friendly refrigerants and sustainable designs to meet global environmental standards.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Equipment type

- 2.2.3 Temperature range

- 2.2.4 Service type

- 2.2.5 Application

- 2.2.6 End use industry

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for temperature-sensitive products

- 3.2.1.2 Growth in e-grocery and online food delivery

- 3.2.1.3 Sustainability and green logistics

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Temperature control failures

- 3.2.2.2 High operational and energy costs

- 3.2.3 Opportunities

- 3.2.3.1 Technological innovation

- 3.2.3.2 Modular and mobile cold storage solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By equipment type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Equipment Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Reefer containers and transport equipment

- 5.2.1 Standard reefer containers (10ft, 20ft, 40ft)

- 5.2.2 Refrigerated trucks and trailers

- 5.2.3 Specialized offshore containers (DNV certified)

- 5.2.4 Mobile refrigeration units

- 5.3 Cold storage infrastructure

- 5.3.1 Modular cold rooms

- 5.3.2 Temperature-controlled warehouses

- 5.3.3 Blast freezing equipment

- 5.3.4 Walk-in coolers and freezers

- 5.4 Monitoring and control systems

- 5.4.1 IoT-enabled sensors

- 5.4.2 Data loggers and recorders

- 5.4.3 SCADA monitoring systems

- 5.4.4 Blockchain traceability platforms

- 5.5 Refrigeration equipment

- 5.5.1 Centralized refrigeration systems

- 5.5.2 Condensing units

- 5.5.3 Compressors and evaporators

- 5.5.4 Heat exchangers

Chapter 6 Market Estimates and Forecast, By Temperature Range, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Frozen storage (-25°C to -18°C)

- 6.3 Chilled storage (0°C to +8°C)

- 6.4 Cool storage (+8°C to +15°C)

- 6.5 Ambient plus (+15°C to +25°C)

- 6.6 Ultra-low temperature (-70°C to -40°C)

Chapter 7 Market Estimates and Forecast, By Service Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Storage services

- 7.3 Transportation services

- 7.4 Value-added services

- 7.4.1 Blast freezing

- 7.4.2 Labeling and packaging

- 7.4.3 Inventory management

- 7.4.4 Quality control

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Food & beverage

- 8.2.1 Fresh produce (fruits, vegetables)

- 8.2.2 Dairy products

- 8.2.3 Meat and seafood

- 8.2.4 Frozen foods

- 8.2.5 Processed foods

- 8.3 Pharmaceuticals & healthcare

- 8.3.1 Vaccines and biologics

- 8.3.2 Temperature-sensitive medicines

- 8.3.3 Blood products

- 8.3.4 Medical devices

- 8.4 Chemicals & industrial

- 8.4.1 Specialty chemicals

- 8.4.2 Industrial materials

- 8.4.3 Electronics components

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Logistics & 3PL providers

- 9.3 Food manufacturers

- 9.4 Pharmaceutical companies

- 9.5 Retail chains

- 9.6 E-commerce platforms

- 9.7 Government & healthcare institutions

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct

- 10.3 Indirect

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Bureida Trading & Refrigeration

- 12.2 Carrier Transicold (United Technologies)

- 12.3 China International Marine Containers

- 12.4 Coldstores Group of Saudi Arabia (CGS)

- 12.5 Daikin Industries

- 12.6 DANA Steel

- 12.7 Danfoss

- 12.8 Emerson Electric (Copeland)

- 12.9 Johnson Controls

- 12.10 ORBCOMM

- 12.11 Rivacold

- 12.12 Thermo King (Trane Technologies)

- 12.13 Thermodynamics

- 12.14 TSSC

- 12.15 Zanotti spa

- 12.16 Zhengzhou Kaixue Cold Chain