PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871098

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871098

Recycled Concrete Aggregate Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

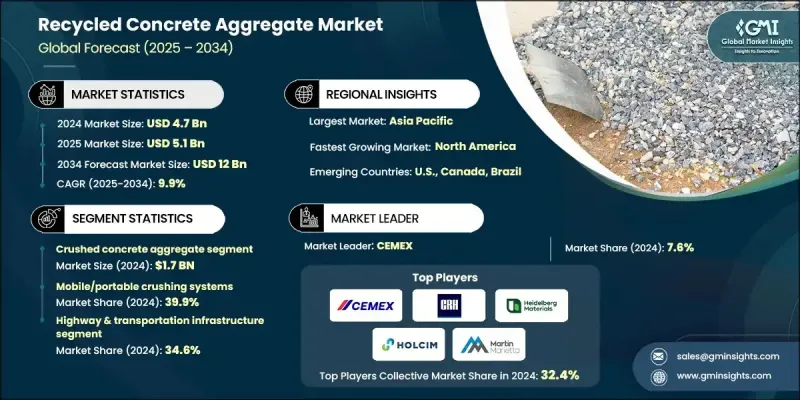

The Global Recycled Concrete Aggregate Market was valued at USD 4.7 Billion in 2024 and is estimated to grow at a CAGR of 9.9% to reach USD 12 Billion by 2034.

Recycled concrete aggregate is derived by processing demolished concrete materials into usable aggregate substitutes, reducing reliance on dwindling natural resources. As the availability of natural aggregates declines rapidly in many regions, governments and industries are strengthening resource conservation strategies. Growing concern over environmental degradation and carbon emissions in construction is accelerating the demand for sustainable alternatives like RCA. Modern infrastructure development and increased focus on eco-friendly construction methods are key contributors to this trend. Additionally, RCA provides a compelling cost advantage minimizing raw material expenses, cutting down transportation needs, and lowering environmental compliance costs. The Asia-Pacific region is currently leading the market, fueled by rapid urban development and infrastructure expansion that produces high volumes of recyclable debris. Meanwhile, Europe is seeing the fastest growth, driven by strict sustainability mandates and increased investment in cutting-edge recycling technologies. These regional dynamics reflect a global shift toward circular economy practices in construction, with recycled materials gaining stronger traction across residential, commercial, and public infrastructure sectors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.7 Billion |

| Forecast Value | $12 Billion |

| CAGR | 9.9% |

The crushed concrete aggregate segment generated USD 1.7 Billion in 2024. This material is produced in various particle sizes through primary and secondary crushing processes, serving multiple applications ranging from base layers and drainage to use in new concrete production. Facilities are optimizing output by fine-tuning gradation levels to align with specific project requirements, ensuring greater versatility and application relevance.

In 2024, the mobile and portable crushing systems segment accounted for a 39.9% share. This segment continues to dominate due to its ability to process materials directly at the demolition site. The appeal of on-site processing lies in its cost efficiency, reduced environmental footprint, and streamlined logistics, which make mobile systems the preferred solution across diverse projects. The mobility of these units also allows recycling operations to be more agile and responsive to project timelines and material needs.

North America Recycled Concrete Aggregate Market is projected to grow at a CAGR of 9.7% between 2025 and 2034. Regional growth is being driven by stronger adoption of sustainable construction practices and reinforced regulatory frameworks aimed at waste reduction. Government initiatives promoting the reuse of construction and demolition debris are pushing investment in advanced recycling infrastructure. Continued innovations in processing technology have improved the performance, quality, and reliability of RCA, enabling its use in structural applications such as road construction, precast components, and supporting frameworks.

Key players operating in the Global Recycled Concrete Aggregate Market include Tarmac Group, SHANGHAI ZENITH MINERAL CO., LTD., CEMEX, Heidelberg Materials, Sika AG, RUBBLE MASTER, CRH Plc, Martin Marietta Materials, Holcim, and CDE Group. To strengthen their position, companies in the Recycled Concrete Aggregate Market are pursuing targeted strategies focused on capacity expansion, innovation, and strategic partnerships. Many are investing in mobile crushing technologies to enhance flexibility and reduce processing costs. R&D efforts are being directed toward improving aggregate quality and performance to expand its use in high-specification construction. Collaborations with construction firms, municipalities, and waste management entities are helping streamline material supply chains and boost volume throughput.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product trends

- 2.2.2 Processing method trends

- 2.2.3 End Use trends

- 2.2.4 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Natural aggregate depletion & resource conservation mandates

- 3.2.1.2 Infrastructure modernization & sustainable construction growth

- 3.2.1.3 Cost advantages against natural extraction

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Quality variability & performance consistency challenges

- 3.2.2.2 Processing equipment investment & operational costs

- 3.2.3 Market opportunities

- 3.2.3.1 High-performance concrete applications development

- 3.2.3.2 Advanced separation technology integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Future market trends

- 3.10 Technology and Innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent Landscape

- 3.12 Trade statistics (HS code Note: the trade statistics will be provided for key countries only)

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Coarse recycled concrete aggregate

- 5.3 Fine recycled concrete aggregate

- 5.4 Crushed concrete aggregate

- 5.5 Reclaimed concrete material

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Processing Method, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Mobile/portable crushing systems

- 6.3 Stationary crushing plants

- 6.4 Jaw crushing technology

- 6.5 Advanced separation technologies

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By End Use, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Highway & transportation infrastructure

- 7.2.1 Pavement base/subbase

- 7.2.2 Bridge construction & repair applications

- 7.2.3 Airport runway & taxiway construction

- 7.2.4 Port & marine infrastructure development

- 7.2.5 Railway ballast & track bed applications

- 7.3 Ready-mix concrete production

- 7.3.1 Structural concrete

- 7.3.2 Non-structural concrete

- 7.3.3 Precast concrete element production

- 7.3.4 Architectural concrete & decorative applications

- 7.3.5 Mass concrete & foundation applications

- 7.4 Asphalt concrete production

- 7.4.1 Hot mix asphalt (HMA) production

- 7.4.2 Warm mix asphalt (WMA) applications

- 7.4.3 Cold mix asphalt & patching materials

- 7.4.4 Asphalt base course construction

- 7.4.5 Surface treatment & chip seal applications

- 7.5 Construction & demolition recycling

- 7.5.1 General fill & backfill

- 7.5.2 Site development & grading

- 7.5.3 Utility trench backfill & underground construction

- 7.5.4 Landscaping & site preparation

- 7.5.5 Temporary road construction

- 7.6 Precast concrete manufacturing

- 7.6.1 Precast building elements (Panels, beams, columns)

- 7.6.2 Infrastructure precast (Culverts, pipes, barriers)

- 7.6.3 Architectural precast & facade elements

- 7.6.4 Prestressed concrete applications

- 7.7 Concrete block & masonry

- 7.7.1 Concrete masonry units (CMU) production

- 7.7.2 Paving stones & interlocking pavers

- 7.7.3 Retaining wall blocks

- 7.7.4 Architectural masonry & decorative blocks

- 7.8 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 CDE Group

- 9.2 CEMEX

- 9.3 CRH Plc

- 9.4 Heidelberg Materials

- 9.5 Holcim

- 9.6 Martin Marietta Materials

- 9.7 RUBBLE MASTER

- 9.8 Shanghai Zenith Mineral Co.,Ltd.

- 9.9 Sika AG

- 9.10 Tarmac Group