PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871109

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871109

Photonic Integrated Circuits for LiDAR Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

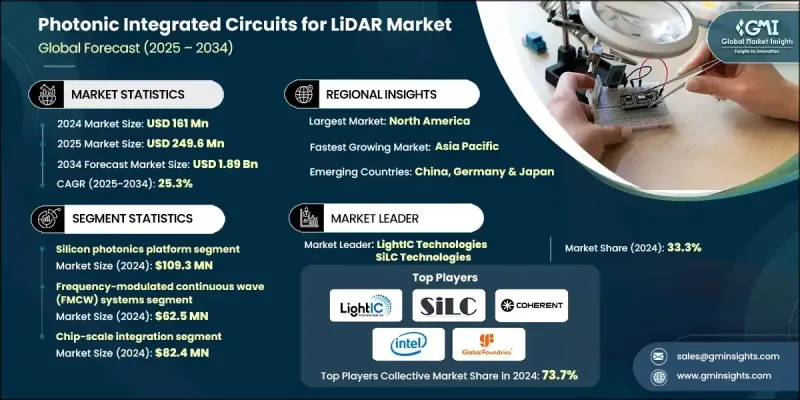

The Global Photonic Integrated Circuits for LiDAR Market was valued at USD 161 million in 2024 and is estimated to grow at a CAGR of 25.3% to reach USD 1.89 Billion by 2034.

Rising demand for autonomous mobility, the miniaturization of LiDAR components, the rollout of 5G, and significant cost reductions are fueling widespread adoption. The industry is also experiencing notable traction due to innovations in laser and optical technologies. Progress in silicon photonics is driving a shift toward faster, compact, and more efficient LiDAR systems. Integration of photonic components onto silicon chips allows for high-speed data transmission and enhanced signal processing, critical features in applications such as vehicle autonomy, smart cities, and next-gen telecommunications infrastructure. Enhanced bandwidth and cost-effectiveness are unlocking new use cases across sectors like data centers and intelligent transportation systems. These developments are transforming how photonic systems are built and applied globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $161 Million |

| Forecast Value | $1.89 Billion |

| CAGR | 25.3% |

The silicon photonics platform segment generated USD 109.3 million in 2024. Its growth is driven by an increased need for compact form factors, high-speed optical transmission, and scalable manufacturing processes. Trends in integrated optical circuits and cost-efficient production continue to influence this segment. Companies are advised to focus on refining silicon photonics for real-time data transmission and scalable solutions to meet telecom and automotive sector demands.

In 2024, the frequency-modulated continuous wave (FMCW) systems segment generated USD 62.5 million. Its growth stems from rising demand for advanced automotive sensing systems offering high resolution and long-range detection. These systems are energy-efficient and enable precise measurements, making them vital for evolving applications in autonomous driving and safety-critical use cases. Prioritizing investment in next-gen FMCW systems that offer compact design, longer range, and enhanced accuracy will help manufacturers secure a competitive edge.

United States Photonic Integrated Circuits for LiDAR Market reached USD 58.3 million in 2024. The region's stronghold is fueled by growing adoption of autonomous vehicles, advances in smart infrastructure, rising data center requirements, and support from leading semiconductor companies. The country continues to lead in innovation surrounding photonic and LiDAR technology integration. Manufacturers aiming to scale operations are recommended to accelerate research in chip-level integration, data center connectivity, and smart mobility applications to sustain their lead in the North America market.

Notable players shaping Photonic Integrated Circuits for LiDAR Market include Intel Corporation, Ayar Labs, Scintil Photonics, TSMC, VLC Photonics (Hitachi High-Tech), IBM, GlobalFoundries, AMS (Osram), Infinera Corporation, STMicroelectronics, Rockley Photonics, Cisco Systems (Acacia), X-FAB Silicon Foundries, Tower Semiconductor, SiLC Technologies, LIGENTEC, LightIC Technologies, Effect Photonics, Hamamatsu Photonics, and Coherent Corporation. Key strategies adopted by companies in the Photonic Integrated Circuits for LiDAR Market include forming strategic alliances with automotive OEMs and telecom leaders to drive adoption at scale. Many are heavily investing in R&D to accelerate the development of compact and low-cost silicon photonics platforms and next-generation FMCW-based LiDAR solutions. Scaling production capabilities while ensuring compatibility with semiconductor fabrication processes is a priority.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Technology platform trend

- 2.2.2 Lidar detection method trends

- 2.2.3 Beam steering technology trends

- 2.2.4 Wavelength trends

- 2.2.5 Integration level trends

- 2.2.6 Application trends

- 2.2.7 End Use industry trends

- 2.2.8 Regional trends

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for autonomous vehicles

- 3.2.1.2 Advancements in laser technology

- 3.2.1.3 Introduction of 5g network

- 3.2.1.4 Miniaturization of lidar systems

- 3.2.1.5 Cost reduction in lidar manufacturing

- 3.2.2 Pitfalls and challenges

- 3.2.2.1 High initial cost of lidar systems

- 3.2.2.2 Complexity in integration with existing infrastructure

- 3.2.3 Market Opportunities

- 3.2.3.1 Advancements in solid-state lidar technology

- 3.2.3.2 Integration with artificial intelligence (AI) and machine learning

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Pricing Strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Sustainability measures

- 3.13 Consumer sentiment analysis

- 3.14 Patent and IP analysis

- 3.15 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Technology Platform, 2021 - 2034 (USD Million & Thousand Units)

- 5.1 Key trends

- 5.2 Silicon photonics (si/soi) platform

- 5.3 Silicon nitride on silicon (sin-on-soi) platform

- 5.4 Indium phosphide (inp) platform

- 5.5 Lithium niobate on insulator (lnoi) platform

- 5.6 Gallium arsenide (gaas) platform

Chapter 6 Market Estimates and Forecast, By Lidar Detection Method, 2021 - 2034 (USD Million & Thousand Units)

- 6.1 Key trends

- 6.2 Frequency-modulated continuous wave (fmcw) systems

- 6.3 Time-of-flight (tof) systems

- 6.4 Integrated path differential absorption (ipda) systems

- 6.5 Hybrid tof/fmcw systems

Chapter 7 Market Estimates and Forecast, By Beam Steering Technology, 2021 - 2034 (USD Million & Thousand Units)

- 7.1 Key trends

- 7.2 Optical phased arrays (opas)

- 7.3 Focal plane arrays (fpas)

- 7.4 Mems-integrated steering

- 7.5 Electro-optic beam steering

- 7.6 Fixed beam/no steering applications

Chapter 8 Market Estimates and Forecast, By Wavelength, 2021 - 2034 (USD Million & Thousand Units)

- 8.1 Key trends

- 8.2 905nm band systems

- 8.3 1310nm band systems

- 8.4 1550nm band systems

- 8.5 Other wavelengths

Chapter 9 Market Estimates and Forecast, By Integration Level, 2021 - 2034 (USD Million & Thousand Units)

- 9.1 Key trends

- 9.2 Chip-scale integration

- 9.3 Multi-chip module integration

- 9.4 Hybrid assembly integration

Chapter 10 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million & Thousand Units)

- 10.1 Key trends

- 10.2 Adas & autonomous driving applications

- 10.3 Industrial automation & robotics applications

- 10.4 Surveillance & security applications

- 10.5 Consumer electronics integration applications

- 10.6 Environmental monitoring applications

Chapter 11 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Million & Thousand Units)

- 11.1 Key trends

- 11.2 Automotive industry

- 11.3 Aerospace & defense industry

- 11.4 Industrial manufacturing industry

- 11.5 Consumer electronics industry

- 11.6 Scientific & research institutions

Chapter 12 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million & Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 Uk

- 12.3.3 France

- 12.3.4 Spain

- 12.3.5 Italy

- 12.3.6 Netherlands

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 Middle East and Africa

- 12.6.1 Saudi Arabia

- 12.6.2 South Africa

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 Global Key Players

- 13.1.1 Coherent Corporation

- 13.1.2 Intel Corporation

- 13.1.3 GlobalFoundries

- 13.1.4 TSMC

- 13.1.5 STMicroelectronics

- 13.2 Regional Key Players

- 13.2.1 North America

- 13.2.1.1 SiLC Technologies

- 13.2.1.2 Rockley Photonics

- 13.2.1.3 Ayar Labs

- 13.2.1.4 Infinera Corporation

- 13.2.1.5 Cisco Systems (Acacia)

- 13.2.2 Europe

- 13.2.2.1 LightIC Technologies

- 13.2.2.2 LIGENTEC

- 13.2.2.3 X-FAB Silicon Foundries

- 13.2.2.4 AMS (Osram)

- 13.2.2.5 VLC Photonics (Hitachi High-Tech)

- 13.2.3 Asia-Pacific

- 13.2.3.1 Hamamatsu Photonics

- 13.2.3.2 Scintil Photonics

- 13.2.3.3 Tower Semiconductor

- 13.2.3.4 IBM

- 13.2.1 North America

- 13.3 Disruptors / Niche Players

- 13.3.1 Effect Photonics