PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871124

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871124

In-Vehicle Payment System Hardware Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

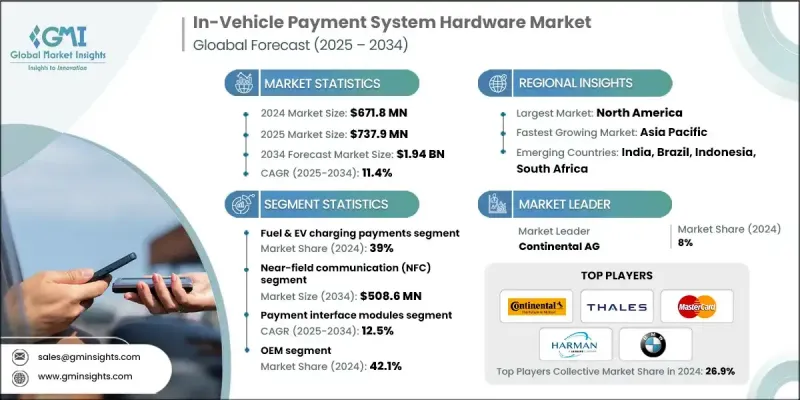

The Global In-Vehicle Payment System Hardware Market was valued at USD 671.8 million in 2024 and is estimated to grow at a CAGR of 11.4% to reach USD 1.94 Billion by 2034.

The expansion of connected and autonomous vehicles worldwide is accelerating the adoption of integrated in-vehicle payment technologies. Advanced hardware components such as secure chips, biometric sensors, and NFC modules enable real-time and seamless transactions directly from vehicles. This evolution is reshaping the mobility landscape by streamlining automated payments for services such as fueling, parking, and tolls within mobility-as-a-service ecosystems. The widespread shift in consumer preferences toward digital and contactless transactions, particularly following the pandemic, has further increased demand for secure, frictionless, and fast payment experiences. Automakers are responding by increasing their investment in embedded vehicle payment systems using technologies like Bluetooth, NFC, and RFID. These systems integrate with infotainment platforms and digital wallets, allowing secure synchronization with external payment networks. Meanwhile, cities and transport authorities are modernizing tolling, parking, and charging infrastructure using V2X and DSRC technologies that depend on in-vehicle payment hardware to enable interoperability and cross-border functionality. Partnerships between automakers, fintech firms, and payment providers are expanding opportunities for monetization through in-car commerce, subscriptions, and connected digital services.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $671.8 Million |

| Forecast Value | $1.94 Billion |

| CAGR | 11.4% |

The payment interface module segment is expected to grow at a CAGR of 12.5% from 2025 to 2034. These modules, embedded into infotainment systems, enable cashless and contactless transactions for parking, fuel, and tolls, offering convenience and high security through tokenized payment methods. OEMs and top-tier suppliers are heavily investing in automotive-grade interface modules designed for reliability, scalability, and compliance with global safety standards. These integrated modules help standardize payment experiences across various vehicle models and enhance user confidence in secure, on-the-go transactions.

The fuel and EV charging payment segment held a 39% share in 2024. Growing adoption of electric vehicles and rising demand for efficient refueling and recharging solutions are fostering the use of in-vehicle payment systems. These systems enable drivers to complete transactions for fuel or EV charging directly from their infotainment systems, reducing reliance on physical cards or cash. The inclusion of contactless payment support and compatibility with diverse payment platforms adds flexibility and simplifies user interaction, enhancing convenience for consumers.

United States In-Vehicle Payment System Hardware Market held 86.4% share in 2024. The strong preference among U.S. drivers for secure, contactless, and instant payments integrated directly into vehicle systems continues to drive market growth. OEMs are prioritizing the implementation of advanced security features, including biometric verification, embedded wallets, and PCI-compliant tokenization to protect consumer data and ensure payment safety. The focus on privacy standards and compliance requirements, combined with collaboration between vehicle manufacturers and financial networks, is strengthening the country's leadership in this space.

Major companies operating in the Global In-Vehicle Payment System Hardware Market include BMW, Continental, Daimler, Thales Group, Mastercard Incorporated, Harman International, Hyundai Motor Company, and Honda Motor. Key players in the in-vehicle payment system hardware market are pursuing strategic initiatives to reinforce their competitive standing and expand their technological capabilities. Companies are focusing on developing integrated payment modules equipped with advanced authentication, encryption, and connectivity features to ensure seamless and secure transactions. Strategic collaborations between automakers, fintech providers, and payment technology companies are fostering innovation and expanding ecosystem compatibility. Heavy investment in R&D is driving the creation of standardized, interoperable hardware solutions that align with global security and data protection standards.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Component

- 2.2.2 Payment Application

- 2.2.3 Technology

- 2.2.4 End use

- 2.2.5 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Value Chain Analysis & Industry Structure

- 3.1.1.1 Raw Materials & Wafer Fabrication

- 3.1.1.2 BMS IC Design & Development

- 3.1.1.3 Semiconductor Manufacturing & Testing

- 3.1.1.4 BMS Module Assembly & Integration

- 3.1.1.5 Battery Pack Integration & Validation

- 3.1.1.6 OEM Vehicle Integration & Deployment

- 3.1.1.7 Aftermarket & Service Ecosystem

- 3.1.1.8 End-of-Life Recycling & Sustainability

- 3.1.1 Value Chain Analysis & Industry Structure

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component manufacturers

- 3.2.3 System integrators

- 3.2.4 OEM

- 3.2.5 End use

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Surge in Connected and Smart Vehicles

- 3.3.1.2 Rising Consumer Preference for Contactless Payments

- 3.3.1.3 Growth of EVs and Charging Infrastructure

- 3.3.1.4 OEM-Fintech Collaborations

- 3.3.1.5 Smart City and Intelligent Transportation Development

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High Hardware and Integration Costs

- 3.3.2.2 Cybersecurity and Data Privacy Concerns

- 3.3.3 Market opportunities

- 3.3.3.1 Integration with Mobility-as-a-Service (MaaS)

- 3.3.3.2 Expansion of EV Charging and Green Mobility

- 3.3.3.3 Partnerships Between OEMs and Digital Wallet Providers

- 3.3.3.4 Emergence of Biometric Authentication in Vehicles

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.5.4 Latin America

- 3.5.5 Middle east and Africa

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Technology and Innovation landscape

- 3.8.1 Current technology

- 3.8.2 Emerging technology

- 3.9 Patent analysis

- 3.10 Price Trends Analysis

- 3.10.1 By component

- 3.10.2 By region

- 3.11 Cost breakdown analysis

- 3.12 Production statistics

- 3.12.1 Production hubs

- 3.12.2 Consumption hubs

- 3.12.3 Export and import

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.13.5 Carbon footprint considerations

- 3.14 Market maturity & adoption analysis

- 3.14.1 Technology readiness level assessment

- 3.14.2 Regional adoption maturity comparison

- 3.14.3 Application domain maturity analysis

- 3.14.4 Manufacturing readiness & scale assessment

- 3.14.5 Commercial deployment timeline

- 3.15 Future trends

- 3.16 Major market trends and disruptions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key news and initiatives

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Payment Interface Modules

- 5.3 Biometric Authentication Devices

- 5.4 Display & Infotainment Units

- 5.5 Connectivity Components

- 5.6 Sensors & Controllers

- 5.7 Embedded Security Hardware

Chapter 6 Market Estimates & Forecast, By Payment Application, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Fuel & EV Charging Payments

- 6.3 Toll Collection

- 6.4 Parking Fees

- 6.5 Drive-through & Retail Payments

- 6.6 Subscription & In-Car Services

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Near-Field Communication (NFC)

- 7.3 Radio Frequency Identification (RFID)

- 7.4 Dedicated Short-Range Communication (DSRC)

- 7.5 Cellular (4G/5G)

- 7.6 Wi-Fi/Bluetooth Low Energy

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Fleet Operators

- 8.4 Mobility Service Providers

- 8.5 Toll & Parking Operators

- 8.6 Fuel & EV Infrastructure Providers

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Netherlands

- 9.3.8 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 BMW AG

- 10.1.2 Continental AG

- 10.1.3 Daimler AG (Mercedes-Benz Group)

- 10.1.4 Denso Corporation

- 10.1.5 Harman International

- 10.1.6 Honda Motor Co., Ltd.

- 10.1.7 Hyundai Motor Company

- 10.1.8 Mastercard Incorporated

- 10.1.9 NXP Semiconductors

- 10.1.10 Qualcomm Technologies Inc.

- 10.1.11 Robert Bosch GmbH

- 10.1.12 Thales Group

- 10.2 Regional Players

- 10.2.1 Aisin Corporation

- 10.2.2 Aptiv PLC

- 10.2.3 Garmin Ltd.

- 10.2.4 Hyundai Mobis

- 10.2.5 LG Electronics

- 10.2.6 Magna International Inc.

- 10.2.7 Valeo SA

- 10.2.8 ZF Friedrichshafen AG

- 10.3 Emerging Players and Disruptors

- 10.3.1 Car IQ Inc.

- 10.3.2 Cerence Inc.

- 10.3.3 IDEMIA

- 10.3.4 Ingenico (Worldline)

- 10.3.5 PayByCar Inc.

- 10.3.6 Rambus Inc.

- 10.3.7 Secure-IC

- 10.3.8 Utimaco GmbH

- 10.3.9 Verifone Systems Inc.

- 10.3.10 Xevo Inc. (Lear Corporation)