PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871137

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871137

5G Telematics Control Unit Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

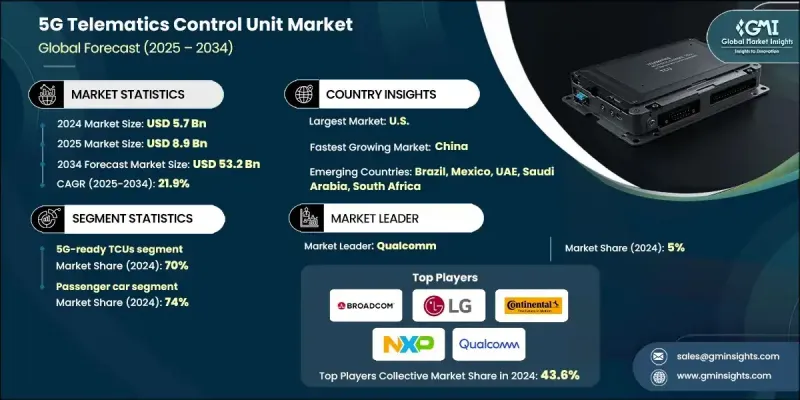

The Global 5G Telematics Control Unit Market was valued at USD 5.7 Billion in 2024 and is estimated to grow at a CAGR of 21.9% to reach USD 53.2 Billion by 2034.

Automakers are increasingly integrating 5G TCUs directly into vehicles during production to meet rising demands for high-speed connectivity, real-time data processing, and seamless system integration. As the auto industry transitions toward connected and autonomous mobility, built-in telematics units are becoming more favorable than retrofit solutions due to their superior performance and reliability. These units play a pivotal role in enabling modern features such as in-car infotainment, cloud communication, smart navigation, remote diagnostics, and predictive maintenance, all requiring fast data transmission with minimal latency. With EV adoption accelerating, 5G-enabled TCUs are essential for enhancing energy efficiency and elevating the overall driving experience. Edge computing combined with 5G connectivity allows real-time data analysis, empowering faster decision-making for safety-critical vehicle operations. The synergy of AI, telematics, and multi-sensor data processing has also fueled the adoption of 5G TCUs, driving the need for advanced semiconductors across the automotive ecosystem.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.7 Billion |

| Forecast Value | $53.2 Billion |

| CAGR | 21.9% |

The passenger vehicles segment held a 74% share and is expected to grow at a CAGR of 22% between 2025 and 2034. The growing preference for connected cars is motivating vehicle manufacturers to embed TCUs that support real-time communication with external infrastructure, cloud platforms, and other vehicles. These units control everything from navigation to entertainment, and they enhance safety and functionality by managing live data streams. Rising consumer demand for intelligent mobility experiences continues to pressure OEMs to integrate high-performance 5G TCUs into their vehicles to ensure seamless connectivity.

The automakers are actively planning to install 5G-compatible TCUs into new car models to enable ultra-low latency and fast data transmission, which helps run advanced infotainment and AI-based functions smoothly. These units support real-time diagnostics and predictive maintenance, creating a smarter vehicle ecosystem. OEMs aim to gain a competitive edge by embracing 5G TCUs early, strengthening their position in the future of connected transportation. The development of autonomous and semi-autonomous driving capabilities also drives higher investments in 5G-based telematics systems. These units allow vehicles to rapidly process sensor input, communicate with other systems (V2X), and make real-time decisions, key elements for safe automated driving.

China 5G Telematics Control Unit Market held a 40% share and generated USD 1 Billion in 2024. The country is witnessing a rapid surge in connected car deployment, largely driven by consumer demand for smart in-vehicle systems like live navigation, diagnostics, and infotainment. As more vehicles integrate connected features, OEMs are stepping up the adoption of advanced TCUs to manage data-intensive applications efficiently. Government backing through safety mandates and intelligent transport policies is accelerating growth, with frameworks supporting emergency response, geolocation, and compliance pushing TCU deployment forward. Strategic programs promoting smart infrastructure and automotive digitization have further positioned China at the forefront of vehicle connectivity innovation.

Key players shaping the 5G Telematics Control Unit Market include Renesas Electronics, Infineon Technologies, NXP, STMicroelectronics, Texas Instruments, Analog Devices, and Toshiba Electronic Devices. To solidify their foothold in the 5G Telematics Control Unit Market, industry leaders are focusing on enhancing chipset integration, expanding automotive-grade semiconductor portfolios, and building collaborative partnerships with OEMs and Tier 1 suppliers. Companies are prioritizing low-power design, faster data throughput, and reliability to meet strict automotive standards. Strategic investments in R&D are fueling innovation in edge computing, AI acceleration, and secure over-the-air updates. By aligning with evolving V2X standards and autonomous driving demands, these firms are future-proofing their solutions while capitalizing on the shift toward software-defined and connected vehicles.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Vehicle

- 2.2.4 Propulsion

- 2.2.5 Technology

- 2.2.6 Installation

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook

- 2.6 Strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Government mandates for connected vehicle safety systems

- 3.2.1.2 5G network infrastructure deployment acceleration

- 3.2.1.3 Autonomous vehicle development & testing requirements

- 3.2.1.4 Fleet management efficiency & cost optimization demands

- 3.2.1.5 Consumer demand for advanced infotainment & connectivity

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High implementation costs & RoI uncertainty

- 3.2.2.2 Spectrum allocation & interference challenges

- 3.2.2.3 Cybersecurity vulnerabilities & privacy concerns

- 3.2.2.4 Standardization fragmentation across regions

- 3.2.2.5 Legacy system integration complexities

- 3.2.3 Market opportunities

- 3.2.3.1 Edge computing integration for ultra-low latency applications

- 3.2.3.2 Cross-border V2X communication standardization

- 3.2.3.3 Aftermarket retrofit solutions for existing vehicle fleets

- 3.2.3.4 Public-private partnerships for smart city infrastructure

- 3.2.3.5 Emerging market penetration in developing economies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Major market trends and disruptions

- 3.5 Future market trends

- 3.6 Regulatory landscape

- 3.6.1 North America

- 3.6.2 Europe

- 3.6.3 Asia Pacific

- 3.6.4 Latin America

- 3.6.5 MEA

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.1.1 5G NR technology standards & specifications

- 3.9.1.2 C-V2X communication protocols

- 3.9.1.3 Edge computing integration

- 3.9.1.4 AI & Machine Learning Applications

- 3.9.2 Emerging technologies

- 3.9.2.1 6G research & development initiatives

- 3.9.2.2 Quantum communication technologies

- 3.9.2.3 Advanced antenna technologies

- 3.9.2.4 Digital twin integration for vehicle systems

- 3.9.1 Current technological trends

- 3.10 Patent analysis

- 3.11 Price analysis

- 3.11.1 OEM pricing strategies

- 3.11.2 Aftermarket pricing models

- 3.11.3 Subscription-based service pricing

- 3.11.4 Volume-based pricing tiers

- 3.12 Cost breakdown analysis

- 3.12.1 Hardware component costs

- 3.12.2 Software & licensing costs

- 3.12.3 Integration & installation costs

- 3.12.4 Maintenance & support costs

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.13.5 Carbon footprint considerations

- 3.14 Investment Landscape Analysis

- 3.14.1 Semiconductor R&D Investment

- 3.14.2 Automotive Audio Technology Funding

- 3.14.3 Venture Capital in Audio Innovation

- 3.14.4 Corporate Investment Patterns

- 3.14.5 Government Research Funding

- 3.14.6 M&A Activity in Audio Semiconductors

- 3.15 Customer behavior & market adoption analysis

- 3.15.1 Customer segmentation & profiling

- 3.15.2 Adoption patterns & decision-making factors

- 3.15.3 Purchase behavior analysis

- 3.15.4 Technology preference trends

- 3.15.5 Regional customer behavior variations

- 3.15.6 Customer satisfaction & loyalty analysis

- 3.15.7 Barriers to adoption & market resistance

- 3.15.8 Customer education & awareness levels

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 5G-Ready TCUs

- 5.3 Native 5G TCUs

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Gasoline

- 6.3 Diesel

- 6.4 All-electric

- 6.5 HEV

- 6.6 PHEV

- 6.7 FCEV

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Sub-6 GHz 5G TCUs

- 7.3 Wave 5G TCUs

Chapter 8 Market Estimates & Forecast, By Installation, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 OEMs

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Passenger car

- 9.2.1 Hatchback

- 9.2.2 Sedan

- 9.2.3 SUV

- 9.3 Commercial Vehicle

- 9.3.1 Light duty

- 9.3.2 Medium duty

- 9.3.3 Heavy-duty

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Samsung Electronics

- 11.1.2 Harman International (Samsung)

- 11.1.3 LG Electronics

- 11.1.4 Qualcomm Technologies

- 11.1.5 Continental AG

- 11.1.6 Robert Bosch GmbH

- 11.1.7 Valeo

- 11.1.8 Visteon Corporation

- 11.1.9 Marelli Holdings

- 11.1.10 Huawei Technologies

- 11.2 Regional Champions

- 11.2.1 NXP Semiconductors

- 11.2.2 Denso Corporation

- 11.2.3 Infineon Technologies

- 11.2.4 Quectel Wireless Solutions

- 11.2.5 Sierra Wireless

- 11.2.6 Ficosa International

- 11.2.7 Cavli Wireless

- 11.2.8 Rolling Wireless

- 11.2.9 Anritsu Corporation

- 11.2.10 Panasonic Industrial

- 11.3 Emerging Players

- 11.3.1 aicas GmbH

- 11.3.2 CalAmp Corp

- 11.3.3 Zonar Systems

- 11.3.4 Xirgo Technologies

- 11.3.5 Telit Communications

- 11.3.6 Peiker Acustic GmbH

- 11.3.7 Novero GmbH (Laird)

- 11.3.8 Rohde & Schwarz

- 11.3.9 Jimi IoT Co., Ltd

Xiamen Yaxon Network