PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871149

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871149

Smart Grid Cybersecurity Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

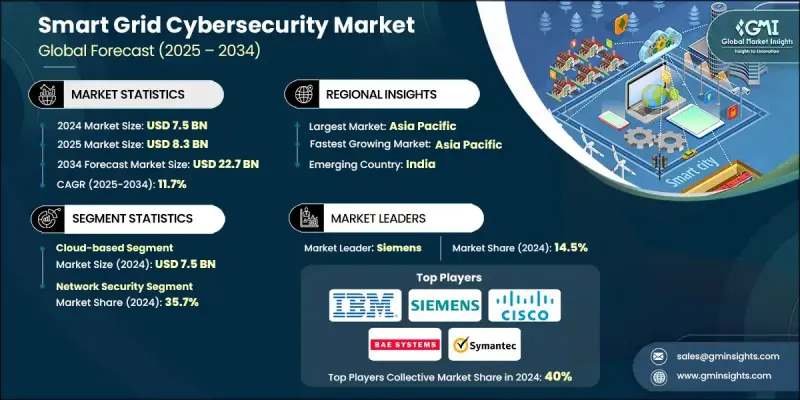

The Global Smart Grid Cybersecurity Market was valued at USD 7.5 Billion in 2024 and is estimated to grow at a CAGR of 11.7% to reach USD 22.7 Billion by 2034.

The accelerated digital transformation of power systems has broadened the attack surface, ranging from smart meters to distributed energy resources (DERs) and electric vehicle chargers, making cyber resilience a critical consideration in grid design and procurement. Grid modernization and the integration of renewable energy necessitate sophisticated digital control systems, prompting utilities to adopt secure telemetry, edge computing, and coordination platforms. As emerging markets scale and distributed assets proliferate, formal cybersecurity standards are becoming essential. The rise of DERs, solar installations, storage solutions, and EV chargers has increased vulnerability across aggregation platforms and inverter-based resources. Regulators and utilities are responding with harmonized frameworks, AI-driven anomaly detection, and automated incident response to ensure predictive analytics and real-time threat mitigation, though automation also introduces risks such as adversarial AI attacks.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.5 Billion |

| Forecast Value | $22.7 Billion |

| CAGR | 11.7% |

The cloud-based solutions segment generated USD 7.5 Billion in 2024, fueled by heightened grid digitalization and escalating cyber threats targeting operational technology. Utilities and regulators are prioritizing robust security systems to protect distributed energy assets and advanced metering infrastructures, driving demand for scalable cloud deployments.

The network security segment held a 35.7% share in 2024, reflecting the need to protect interconnected communication channels against increasingly sophisticated attacks. With the adoption of advanced metering infrastructure and DERs, utilities require strong perimeter and internal defenses to maintain operational resilience and regulatory compliance.

U.S Smart Grid Cybersecurity Market generated USD 1.8 Billion in 2024, accounting for 81.5% share. Growth is largely supported by federal initiatives focused on enhancing cyber resilience in critical infrastructure, alongside rising adoption of DERs and advanced metering systems. Utilities are investing heavily in frameworks aligned with Department of Energy and NERC standards to secure operational technology networks.

Key players driving the Global Smart Grid Cybersecurity Market include Cisco Systems, Trend Micro, Lockheed Martin, Hewlett Packard, BAE Systems, IBM, Schneider Electric, ABB, AlienVault, Fortinet, CyberArk, Itron, Check Point Software Technologies, Honeywell, Symantec, GE Vernova, Black & Veatch, Palo Alto Networks, IOActive, Entergy, Kaspersky Lab, and Siemens. Companies in the Smart Grid Cybersecurity Market strengthen their presence by developing integrated cybersecurity platforms tailored for operational technology and DER protection, investing in AI-driven threat detection and automated incident response solutions, and ensuring compliance with evolving regulatory standards. They focus on strategic partnerships with utilities and technology providers, expand cloud-based offerings for scalability, and continuously innovate with next-generation encryption, anomaly detection, and vulnerability assessment tools.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data Collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculations

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.1.1 Business trends

- 2.1.2 Solution trends

- 2.1.3 Service trends

- 2.1.4 Deployment mode trends

- 2.1.5 Subsystem trends

- 2.1.6 Security type trends

- 2.1.7 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.7 Emerging opportunities & trends

- 3.8 Investment analysis & future outlook for the smart grid cybersecurity

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiatives

- 4.4 Strategic dashboard

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Solution, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Identity and Access Management (IAM)

- 5.3 Firewalls & network security

- 5.4 Intrusion Detection/Prevention Systems (IDS/IPS)

- 5.5 Encryption solutions

- 5.6 Security Information and Event Management (SIEM)

- 5.7 Endpoint protection

- 5.8 Others

Chapter 6 Market Size and Forecast, By Service, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Consulting

- 6.3 Integration & deployment

- 6.4 Support and maintenance

Chapter 7 Market Size and Forecast, By Deployment Mode, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 On-premises

- 7.3 Cloud

Chapter 8 Market Size and Forecast, By Subsystem, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 SCADA/ICS

- 8.3 AMI (Advanced Metering Infrastructure)

- 8.4 Demand response systems

- 8.5 Home energy management

- 8.6 Others

Chapter 9 Market Size and Forecast, By Security Type, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 Endpoint security

- 9.3 Network security

- 9.4 Application security

- 9.5 Database security

Chapter 10 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.2.3 Mexico

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 France

- 10.3.3 Germany

- 10.3.4 Spain

- 10.3.5 Italy

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Australia

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 India

- 10.5 Middle East & Africa

- 10.5.1 Saudi Arabia

- 10.5.2 UAE

- 10.5.3 South Africa

- 10.6 Latin America

- 10.6.1 Brazil

- 10.6.2 Chile

Chapter 11 Company Profiles

- 11.1 ABB

- 11.2 AlertEnterprise

- 11.3 AlienVault

- 11.4 BAE Systems

- 11.5 Black & Veatch

- 11.6 Check Point Software Technologies

- 11.7 Cisco Systems

- 11.8 CyberArk

- 11.9 Entergy

- 11.10 Fortinet

- 11.11 GE Vernova

- 11.12 Honeywell

- 11.13 Hewlett Packard

- 11.14 IBM

- 11.15 IOActive

- 11.16 Itron

- 11.17 Kaspersky Lab

- 11.18 Lockheed Martin

- 11.19 McAfee

- 11.20 Palo Alto Networks

- 11.21 Schneider Electric

- 11.22 Siemens

- 11.23 Symantec

- 11.24 Trend Micro