PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871162

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871162

North America Flexible Endoscopic Surgery Robot Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

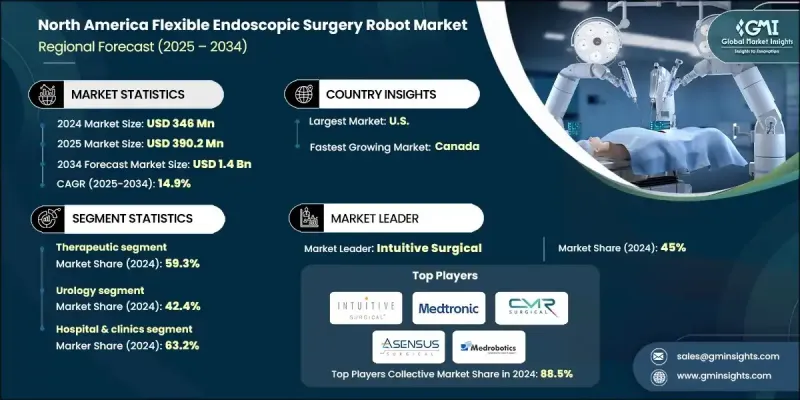

North America Flexible Endoscopic Surgery Robot Market was valued at USD 346 million in 2024 and is estimated to grow at a CAGR of 14.9% to reach USD 1.4 Billion by 2034.

The market is experiencing strong momentum due to increasing preference for minimally invasive procedures, a surge in surgical volumes, and continuous technological evolution in robotic systems. Advancements in AI-driven navigation, enhanced robotic articulation, and 3D visualization are revolutionizing the way endoscopic surgeries are performed. These innovations are improving procedural accuracy, surgeon dexterity, and overall patient safety. Artificial intelligence and machine learning are also transforming the field by allowing real-time decision-making during surgery, enabling predictive insights, and improving identification of complex tissue structures. The expanding prevalence of chronic health conditions such as colorectal and respiratory diseases across the region is further driving the demand for robotic-assisted interventions. North America's strong healthcare infrastructure, widespread adoption of medical robotics, and consistent clinical success rates are boosting market growth. With hospitals and surgical centers increasingly prioritizing efficiency, precision, and patient outcomes, the demand for flexible robotic endoscopy platforms continues to escalate, establishing the region as a global leader in this sector.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $346 Million |

| Forecast Value | $1.4 Billion |

| CAGR | 14.9% |

The therapeutic segment held a 59.3% share in 2024. Its dominance is attributed to growing utilization of robotic-assisted systems for complex therapeutic procedures that demand precision and control. These systems provide surgeons with enhanced dexterity, stable navigation, and high-definition visualization, which together allow intricate procedures to be performed with minimal invasiveness. Their use supports faster recovery, less postoperative pain, and reduced complication rates, further propelling clinical acceptance and market expansion across a wide range of treatment settings.

The urology segment held a share of 42.4% in 2024 and is forecasted to reach USD 583.6 million by 2034. The increasing incidence of urinary tract disorders, kidney diseases, and prostate-related conditions has accelerated the adoption of robotic-assisted techniques within urology. Robotic technology allows for improved surgical precision and reduced trauma in operations involving the kidneys, bladder, and prostate. The benefits of reduced blood loss, smaller incisions, and shorter recovery times continue to encourage hospitals and surgical units to expand robotic capabilities for urological care.

U.S Flexible Endoscopic Surgery Robot Market reached USD 326.4 million in 2024. Its dominance stems from high healthcare spending, widespread technological adoption, and an advanced hospital network equipped for robotic surgery integration. The country benefits from a robust ecosystem of manufacturers, research centers, and clinical innovators that accelerate product development and adoption. Rising rates of digestive and gastrointestinal disorders in the U.S. are further stimulating demand for minimally invasive robotic endoscopic procedures designed to enhance patient safety and accelerate recovery timelines.

Prominent companies operating in the North America Flexible Endoscopic Surgery Robot Market include Medtronic, Intuitive Surgical, CMR Surgical, Johnson & Johnson, Medrobotics, GI View, Endo Tools Therapeutics, and Asensus Surgical. To strengthen their North America Flexible Endoscopic Surgery Robot Market foothold, leading manufacturers in the North America flexible endoscopic surgery robot industry are focusing on innovation, strategic partnerships, and product diversification. Companies are investing heavily in R&D to develop smaller, more cost-effective robotic platforms that offer improved ergonomics and enhanced maneuverability. Collaborations with hospitals and surgical training centers are being expanded to accelerate adoption and gather real-world performance data. Firms are also integrating artificial intelligence and cloud-based analytics into robotic systems to enable smarter navigation and outcome optimization.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Country trends

- 2.2.2 Category trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing preference for minimally invasive and scar-less procedures

- 3.2.1.2 Technological advancements in robotic-assisted endoscopy

- 3.2.1.3 Rising burden of gastrointestinal and respiratory disorders

- 3.2.1.4 Integration of AI and data analytics for enhanced precision

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High acquisition and maintenance costs

- 3.2.2.2 Regulatory and reimbursement challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Emergence of single-use and modular robotic systems

- 3.2.3.2 Integration of AI-driven navigation and autonomous functions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.1.1 Integration of advanced imaging and 3D visualization systems for enhanced surgical precision

- 3.5.1.2 Miniaturization and increased flexibility of robotic arms for improved maneuverability in confined anatomical regions

- 3.5.1.3 Enhanced surgeon-console ergonomics with real-time haptic feedback and intuitive control interfaces

- 3.5.2 Emerging technologies

- 3.5.2.1 AI-assisted navigation and autonomous motion control for precision-guided surgical interventions

- 3.5.2.2 Cloud-connected robotic systems enabling remote surgery assistance and data analytics

- 3.5.2.3 Integration of augmented reality (AR) and virtual reality (VR) for surgical planning, training, and intraoperative visualization

- 3.5.1 Current technological trends

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

- 3.9.1 Integration of AI, imaging, and robotic navigation

- 3.9.2 Miniaturization and enhanced system flexibility

- 3.9.3 Integration with digital surgical ecosystems

- 3.9.4 Advancements in haptic feedback and autonomous assistance

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New service type launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Category, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Therapeutic

- 5.3 Diagnostic

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Urology

- 6.3 Respiratory applications

- 6.4 Gastrointestinal applications

- 6.5 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospital & clinics

- 7.3 Ambulatory surgical centers

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Country, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 U.S.

- 8.3 Canada

Chapter 9 Company Profiles

- 9.1 Asensus Surgical

- 9.2 CMR Surgical

- 9.3 Endo Tools Therapeutics

- 9.4 GI View

- 9.5 Intuitive Surgical

- 9.6 Johnson & Johnson

- 9.7 Medrobotics

- 9.8 Medtronic