PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871164

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871164

Automotive Cybersecurity Hardware Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

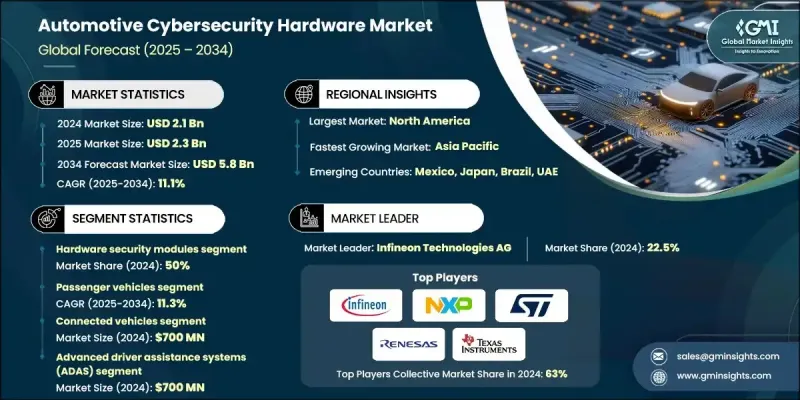

The Global Automotive Cybersecurity Hardware Market was valued at USD 2.1 Billion in 2024 and is estimated to grow at a CAGR of 11.1% to reach USD 5.8 Billion by 2034.

As vehicles evolve into highly connected, software-defined platforms, the threat landscape has expanded significantly. Increasing integration of ECUs, sensors, digital cockpits, and telematics systems has created greater vulnerabilities to cyber threats. In response, demand is surging for hardware-based cybersecurity systems that can secure critical vehicle functions and maintain operational integrity. OEMs and Tier-1 suppliers are embedding secure elements to prevent data breaches, unauthorized access, and functional disruptions. The market is accelerating due to trends like centralized vehicle architectures, OTA software updates, and tighter regulations around automotive cybersecurity compliance. As connectivity becomes a cornerstone of modern mobility, cybersecurity hardware is playing a pivotal role in ensuring safe and trusted driving experiences.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.1 Billion |

| Forecast Value | $5.8 Billion |

| CAGR | 11.1% |

In 2024, the hardware security modules segment held a 50% share and is projected to grow at a CAGR of 10.8% from 2025 to 2034. These modules act as foundational security components, delivering key management, cryptographic processing, and tamper resistance within core vehicle systems. Their deployment in ECUs, domain controllers, and connected platforms supports secure communication, authenticated software functions, and real-time cyber defense capabilities. Automakers increasingly rely on HSMs to meet regulatory mandates and mitigate rising cybersecurity risks in vehicle networks.

The passenger vehicles segment held an 82% share in 2024 and is expected to grow at a 11.3% CAGR through 2034. Growth in this segment is fueled by widespread integration of digital systems in everyday vehicles, including electric and hybrid models. Secure microcontrollers, HSMs, and trusted hardware elements are now standard components in infotainment systems, ADAS, V2X connectivity, and OTA update frameworks. These solutions ensure secure data exchange, system integrity, and alignment with international standards like ISO/SAE 21434 and UNECE WP.29, making them essential for next-gen automotive platforms.

US Automotive Cybersecurity Hardware Market held an 81.1% share and generated USD 610 million in 2024. With its advanced automotive ecosystem, high EV adoption rate, and evolving regulations, the US represents a strong demand center for cybersecurity hardware. Automakers are deploying cryptographic modules and advanced ECUs to address threats in connected and autonomous vehicles. The country's regulatory momentum and robust manufacturing base continue to support the rollout of embedded hardware protections across commercial and passenger fleets.

Key companies active in the Automotive Cybersecurity Hardware Market include C2A Security, Infineon Technologies AG, STMicroelectronics N.V., Renesas Electronics, Microchip Technology, Analog Devices, NXP Semiconductors N.V., Texas Instruments, GuardKnox, and Escrypt. Leading players in the Global Automotive Cybersecurity Hardware Market are heavily investing in secure hardware IP, chip-level cryptography, and scalable platform architectures to strengthen their competitive edge. Companies are prioritizing integration-ready modules such as HSMs and TPMs that are compatible with centralized vehicle architectures and domain controllers. Collaborations with OEMs and Tier-1 suppliers help ensure early design-phase inclusion and long-term supply agreements.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Hardware

- 2.2.3 Vehicle connectivity level

- 2.2.4 Vehicle

- 2.2.5 Application

- 2.2.6 Sales Channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing vehicle connectivity

- 3.2.1.2 Electrification and autonomous vehicle adoption

- 3.2.1.3 Stringent regulatory frameworks

- 3.2.1.4 Increasing use of secure hardware modules

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High implementation and integration costs

- 3.2.2.2 Complex system integration

- 3.2.3 Market opportunities

- 3.2.3.1 Adoption of AI-driven security solutions

- 3.2.3.2 Expansion of secure OTA update ecosystems

- 3.2.3.3 Increasing regulatory compliance requirements

- 3.2.3.4 Integration of cloud-connected security solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 ISO 21434 cybersecurity engineering standard

- 3.4.2 UN-R155 & UN-R156 regulatory requirements

- 3.4.3 SAE J3061 cybersecurity guidebook

- 3.4.4 NIST cybersecurity framework adaptation

- 3.4.5 Regional compliance & certification requirements

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation Landscape

- 3.7.1 Cryptographic performance & throughput analysis

- 3.7.2 Security processing latency & real-time capability

- 3.7.3 Threat detection accuracy & false positive rates

- 3.7.4 Power consumption & efficiency metrics

- 3.7.5 Tamper resistance & physical security assessment

- 3.7.6 Integration of complexity & development time

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Risk assessment framework

- 3.14 Best case scenarios

- 3.15 Privacy & Data Protection Framework Analysis

- 3.16 Market maturity & adoption analysis

- 3.16.1 Automotive data privacy requirements

- 3.16.2 GDPR & regional privacy regulation compliance

- 3.16.3 Data anonymization & pseudonymization techniques

- 3.16.4 Consent management & user control

- 3.16.5 Cross-border data transfer security

- 3.17 Threat landscape & attack vector analysis

- 3.17.1 Vehicle attack surface mapping

- 3.17.2 Common attack vectors & methodologies

- 3.17.3 Emerging threat trends & predictions

- 3.17.4 Industry incident analysis & lessons learned

- 3.17.5 Threat intelligence & information sharing

- 3.18 Privacy & data protection framework analysis

- 3.18.1 Automotive data privacy requirements

- 3.18.2 GDPR & regional privacy regulation compliance

- 3.18.3 Data anonymization & pseudonymization techniques

- 3.18.4 Consent management & user control

- 3.18.5 Cross-border data transfer security

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Hardware, 2021 - 2034 ($ Bn, Units)

- 5.1 Key trends

- 5.2 Hardware security module (HSM)

- 5.3 Network security controllers

- 5.4 Firewalls and intrusion detection units

- 5.5 Secure microcontrollers

- 5.6 Encryption/decryption chips

Chapter 6 Market Estimates & Forecast, By Vehicle Connectivity Level, 2021 - 2034 ($ Bn, Units)

- 6.1 Key trends

- 6.2 Connected vehicles

- 6.3 Semi-autonomous

- 6.4 Fully autonomous vehicles

- 6.5 Non-connected vehicles

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Passenger Vehicles

- 7.2.1 SUV

- 7.2.2 Sedan

- 7.2.3 Hatchback

- 7.3 Commercial Vehicles

- 7.3.1 Light commercial vehicles (LCV)

- 7.3.2 Medium commercial vehicles (MCV)

- 7.3.3 Heavy commercial vehicles (HCV)

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Advanced driver assistance systems (ADAS)

- 8.3 Infotainment & telematics

- 8.4 Powertrain & chassis

- 8.5 Body electronics & comfort systems

- 8.6 Communication systems (V2X, OTA updates)

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 Key trends

- 10.3 North America

- 10.3.1 US

- 10.3.2 Canada

- 10.4 Europe

- 10.4.1 UK

- 10.4.2 Germany

- 10.4.3 France

- 10.4.4 Italy

- 10.4.5 Spain

- 10.4.6 Belgium

- 10.4.7 Netherlands

- 10.4.8 Sweden

- 10.5 Asia Pacific

- 10.5.1 China

- 10.5.2 China

- 10.5.3 India

- 10.5.4 Japan

- 10.5.5 Australia

- 10.5.6 Singapore

- 10.5.7 South Korea

- 10.5.8 Vietnam

- 10.5.9 Indonesia

- 10.6 Latin America

- 10.6.1 Brazil

- 10.6.2 Mexico

- 10.6.3 Argentina

- 10.7 MEA

- 10.7.1 UAE

- 10.7.2 South Africa

- 10.7.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Global players

- 11.1.1 Analog Devices

- 11.1.2 Blackberry

- 11.1.3 Infineon Technologies AG

- 11.1.4 Maxim Integrated Products

- 11.1.5 Microchip Technology

- 11.1.6 NXP Semiconductors

- 11.1.7 Qualcomm Technologies

- 11.1.8 Renesas Electronics Corporation

- 11.1.9 STMicroelectronics N.V.

- 11.1.10 Texas Instruments Incorporated

- 11.2 Regional players

- 11.2.1 Aptiv PLC

- 11.2.2 BMW

- 11.2.3 Continental AG

- 11.2.4 Denso

- 11.2.5 Harman International

- 11.2.6 Mercedes-Benz

- 11.2.7 Robert Bosch

- 11.2.8 Tesla

- 11.3 Emerging players

- 11.3.1 Argus Cyber Security

11.3.2. C2 A Security

- 11.3.3 Escrypt

- 11.3.4 GuardKnox

- 11.3.5 Karamba Security

- 11.3.6 Upstream