PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871166

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871166

Agricultural Machinery Maintenance Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

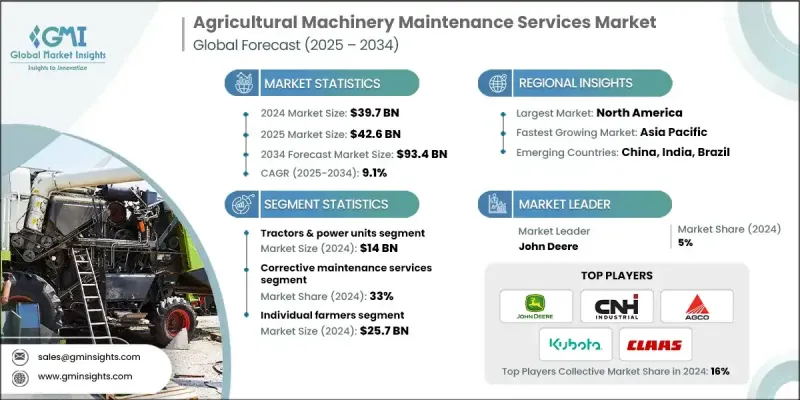

The Global Agricultural Machinery Maintenance Services Market was valued at USD 39.7 Billion in 2024 and is estimated to grow at a CAGR of 9.1% to reach USD 93.4 Billion by 2034.

The industry is expanding rapidly as mechanization becomes increasingly essential in labor-intensive agricultural activities. Farmers are heavily relying on machinery to boost productivity, making regular maintenance a critical part of modern farming operations. The sector is shifting toward predictive and preventive maintenance models, with smart sensors, digital monitoring, and remote-control systems helping farmers identify potential equipment issues before failures occur. This proactive approach minimizes costly downtime during peak farming periods and enhances overall operational efficiency. The growing use of farm machinery in developing regions has opened new opportunities for maintenance service providers. As farmers replace manual labor with tractors, harvesters, and irrigation systems, digital platforms facilitate repair scheduling, spare part procurement, and remote technical support. However, challenges persist in rural areas, where smallholders often lack resources for advanced maintenance tools, and finding skilled technicians can be difficult.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $39.7 Billion |

| Forecast Value | $93.4 billion |

| CAGR | 9.1% |

The tractors and power units segment generated USD 14 Billion in 2024. These machines remain central to agricultural operations, and the adoption of precision agriculture technology has further increased their complexity and importance.

The corrective maintenance services segment held a 33% share in 2024, holding the largest share due to the critical need for repair services during equipment failures. Despite the shift toward preventive solutions, corrective maintenance remains essential, especially during peak agricultural seasons.

North America Agricultural Machinery Maintenance Services Market held 77% share and generated USD 12.1 Billion in 2024. North America's dominance is driven by advanced mechanization, robust service infrastructure, and widespread adoption of precision agriculture. The region's agricultural machinery maintenance market benefits from continuous equipment upgrades and strong trade relations between the United States and Canada.

Key players in the Global Agricultural Machinery Maintenance Services Market include CLAAS Group, John Deere, CNH Industrial N.V., SDF Group, Kubota Corporation, Mahindra & Mahindra, Autonomous Tractor Corporation, Yanmar Holdings, JCB, Precision Planting, FarmWise, Escorts Kubota Limited, Stara, and Iron Ox. Firms are emphasizing preventive and predictive maintenance solutions by integrating IoT, sensors, and remote monitoring to reduce equipment downtime. Expanding service networks in rural and emerging markets helps capture new customer bases and improve accessibility. Companies are investing in training programs to upskill technicians, ensuring high-quality maintenance support. Strategic partnerships with machinery manufacturers and distributors enable bundled service offerings that strengthen customer loyalty. Digital platforms for scheduling repairs, ordering spare parts, and remote diagnostics improve operational efficiency and customer experience.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Equipment type

- 2.2.3 Ownership

- 2.2.4 Operational size

- 2.2.5 Application

- 2.2.6 Service type

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Personalization and curation appeal

- 3.2.1.2 Growth of e-commerce and direct-to-consumer models

- 3.2.1.3 Recurring revenue model for businesses

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High customer churn rates

- 3.2.2.2 Logistics and fulfilment complexity

- 3.2.3 Opportunities

- 3.2.3.1 Sustainability-focused packaging and products

- 3.2.3.2 Expansion into niche segments

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Regulatory landscape

- 3.6.1 Standards and compliance requirements

- 3.6.2 Regional regulatory frameworks

- 3.6.3 Certification standards

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Equipment Type, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Tractors & power units

- 5.3 Harvester

- 5.4 Tillage & soil preparation equipment

- 5.5 Planting & seeding equipment

- 5.6 Irrigation systems

- 5.7 Spraying & application equipment

Chapter 6 Market Estimates and Forecast, By Ownership, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Individual farmers

- 6.3 Corporate farms

Chapter 7 Market Estimates and Forecast, By Operational Size, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 Small-scale operations

- 7.3 Medium-sized farms

- 7.4 Large sized farms

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion)

- 8.1 Key trends

- 8.2 Crops

- 8.3 Livestock

Chapter 9 Market Estimates and Forecast, By Service Type, 2021 - 2034 (USD Billion)

- 9.1 Key trends

- 9.2 Preventive maintenance services

- 9.3 Corrective maintenance services

- 9.4 Predictive maintenance services

- 9.5 Condition-based maintenance services

- 9.6 Emergency maintenance services

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 John Deere

- 11.2 CNH Industrial N.V.

- 11.3 AGCO Corporation

- 11.4 Kubota Corporation

- 11.5 CLAAS Group

- 11.6 Mahindra & Mahindra

- 11.7 Escorts Kubota Limited

- 11.8 SDF Group

- 11.9 JCB

- 11.10 Yanmar Holdings

- 11.11 Stara

- 11.12 Autonomous Tractor Corporation

- 11.13 FarmWise

- 11.14 Iron Ox

- 11.15 Precision Planting