PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871178

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871178

Wearable Blood Pressure Monitor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

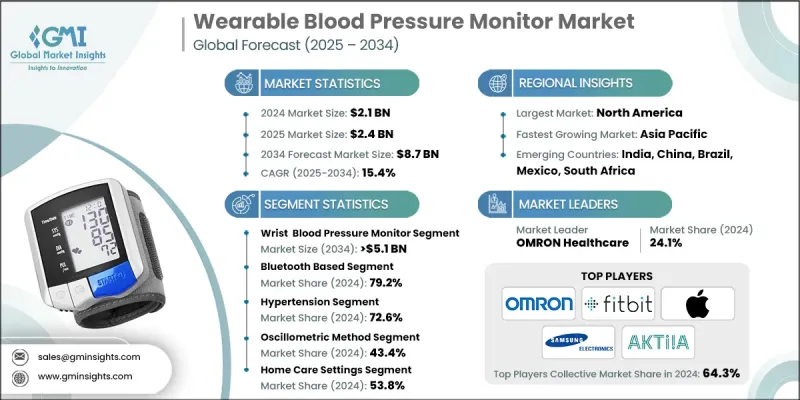

The Global Wearable Blood Pressure Monitor Market was valued at USD 2.1 Billion in 2024 and is estimated to grow at a CAGR of 15.4% to reach USD 8.7 Billion by 2034.

Market growth is fueled by the increasing prevalence of hypertension and the rising demand for continuous, non-invasive health monitoring solutions. Wearable blood pressure devices are transforming the way consumers, healthcare providers, and payers manage cardiovascular health by offering real-time insights, supporting preventive care, and aiding clinical decision-making. These devices include wrist-worn, cuffless, and smartwatch-integrated monitors equipped with AI-driven analytics and wireless connectivity, allowing users to track blood pressure conveniently and accurately. Technological innovations such as smartphone integration, AI-based data analysis, and Bluetooth-enabled connectivity enhance usability, accuracy, and patient engagement. Compact and user-friendly, these monitors provide continuous cardiovascular monitoring, early detection of anomalies, and convenient management of blood pressure, empowering individuals to take a proactive role in their health.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.1 Billion |

| Forecast Value | $8.7 Billion |

| CAGR | 15.4% |

The wrist blood pressure monitors segment held a 58.1% share in 2024. Their popularity stems from portability, user-friendly design, and real-time tracking capabilities, which appeal to both tech-savvy consumers and elderly users. These devices are ideal for ongoing home and point-of-care monitoring, eliminating the need for professional supervision. Recent technological advances, including miniaturized sensors, mobile app integration, and Bluetooth connectivity, allow for real-time data tracking, personalized insights, and long-term trend analysis, further driving adoption.

The Bluetooth-based segment held 79.2% share in 2024 and is estimated to reach USD 7.2 Billion through 2034. The widespread use of Bluetooth technology enables seamless communication with smartphones, tablets, and other connected devices, allowing instant transmission of blood pressure readings to mobile apps or healthcare providers. This convenience, combined with the growing use of health and fitness applications, encourages regular monitoring, active disease management, and patient engagement in preventive care routines.

North America Wearable Blood Pressure Monitor Market held a 35.5% share in 2024. The region's leadership is attributed to advanced healthcare infrastructure, high adoption of digital health solutions, and a rising incidence of cardiovascular disorders. Widespread awareness of preventive healthcare, supportive reimbursement policies, and regulatory encouragement for remote patient monitoring further drive growth. High penetration of wearable devices and smartphones facilitates seamless health data tracking, making continuous blood pressure monitoring accessible and appealing to consumers.

Key players operating in the Wearable Blood Pressure Monitor Market include Samsung, Fitbit (Google), HUAWEI, iHealth Labs, CardiacSense, Caretaker Medical, Biobeat Medical, OMRON Healthcare, Tenovi, Withings, SunTech Medical, Corsano Health, CardieX, Aktiia, and Apple. Companies in the wearable blood pressure monitor market are strengthening their foothold through innovation, strategic partnerships, and market expansion initiatives. They are investing heavily in research and development to enhance device accuracy, design, and integration with mobile health platforms. Collaborations with healthcare providers and technology firms enable the creation of AI-driven monitoring solutions and improve interoperability with health apps. Firms are expanding their global presence by entering new regions, establishing distribution channels, and leveraging telehealth integration.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Connecting technology trends

- 2.2.4 Indication trends

- 2.2.5 Measurement type trends

- 2.2.6 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of hypertension & CVD

- 3.2.1.2 Shift to home care & remote patient monitoring (RPM)

- 3.2.1.3 Growing adoption of medical wearables

- 3.2.1.4 Advances in cuffless sensor tech (PPG/PTT/AI algorithms)

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Clinical accuracy & validation concerns

- 3.2.2.2 Regulatory hurdles & variable approval pathways

- 3.2.3 Market opportunities

- 3.2.3.1 Innovation in sensor technology

- 3.2.3.2 Expansion in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 LAMEA

- 3.5 Pricing analysis, 2024

- 3.6 Technology landscape

- 3.6.1 Current technological trends

- 3.6.1.1 Growth of portable and home-based wearable blood pressure monitors

- 3.6.1.2 Digital health platforms enabling remote monitoring

- 3.6.1.3 Patient-friendly, non-invasive monitoring systems

- 3.6.2 Emerging technologies

- 3.6.2.1 AI-Powered predictive analytics

- 3.6.2.2 Wearable connected devices

- 3.6.2.3 Smart devices with adaptive monitoring modes

- 3.6.1 Current technological trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Future market trends

- 3.10.1 Convergence of AI, digital health, and connected devices

- 3.10.2 Expansion of home-based and remote monitoring solutions

- 3.10.3 Adoption of cuffless and non-invasive technologies

- 3.10.4 Integration with wellness and preventive health programs

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LAMEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New service type launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Wrist blood pressure monitor

- 5.3 Finger blood pressure monitor

- 5.4 Upper arm blood pressure monitor

Chapter 6 Market Estimates and Forecast, By Connecting Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Bluetooth based

- 6.3 WiFi based

Chapter 7 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hypertension

- 7.3 Irregular heartbeat

- 7.4 Hypotension

Chapter 8 Market Estimates and Forecast, By Measurement Type, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Oscillometric method

- 8.3 Arterial tonometry

- 8.4 Pulse transit time (PPT)

- 8.5 Photoplethysmography (PPG)

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Home care settings

- 9.3 Hospital & clinics

- 9.4 Ambulatory surgical centers

- 9.5 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Aktiia

- 11.2 Apple

- 11.3 Biobeat Medical

- 11.4 CardiacSense

- 11.5 CardieX

- 11.6 Caretaker Medical

- 11.7 Corsano Health

- 11.8 Fitbit (Google)

- 11.9 HUAWEI

- 11.10 iHealth Labs

- 11.11 Microlife

- 11.12 OMRON Healthcare

- 11.13 Samsung

- 11.14 Sotera Wireless

- 11.15 SunTech Medical

- 11.16 Tenovi

- 11.17 Withings