PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871189

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871189

North America Fire Sprinkler Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

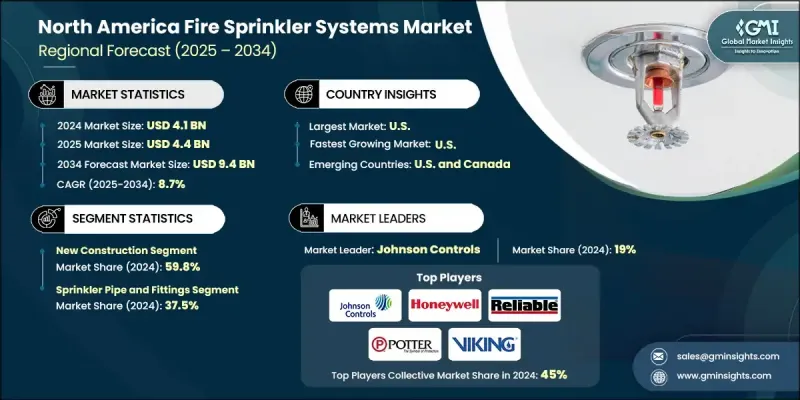

North America Fire Sprinkler Systems Market was valued at USD 4.1 Billion in 2024 and is estimated to grow at a CAGR of 8.7% to reach USD 9.4 Billion by 2034.

The regional market is witnessing robust momentum due to increasingly stringent fire safety codes, particularly across large residential complexes, commercial establishments, and industrial developments. These safety regulations, coupled with strong investments in new building construction, continue to shape the market outlook. Rapid urbanization, population growth, and an uptick in infrastructure projects have significantly boosted demand for fire protection systems across various segments. The emergence of smart fire safety systems, integrating IoT devices and AI-driven detection tools, is transforming how buildings manage emergencies. Smart sensors enable real-time monitoring of flow, pressure, and temperature, helping stakeholders respond quickly and conduct predictive maintenance. These advancements align with the growing preference for automated, intelligent infrastructure. As North America's building landscape evolves, the deployment of advanced sprinkler systems is becoming essential not only for compliance but also for enhancing operational safety and risk management across both new and existing structures.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.1 Billion |

| Forecast Value | $9.4 Billion |

| CAGR | 8.7% |

In 2024, the new construction segment held a 59.8% share and is forecasted to grow at a CAGR of 8.5% through 2034. The rising need to comply with updated fire safety laws and insurance mandates is driving the integration of fire sprinklers into residential, commercial, and industrial building plans. With urban development accelerating across the region, fire protection is now embedded in early design and planning phases to ensure structural safety and regulatory compliance from the outset. Demand continues to surge as cities expand and focus increases on preserving life and property in newly built environments.

The sprinkler pipe and fittings segment held a 37.5% share and is expected to grow at a CAGR of 7.5% between 2025 and 2034. The segment is driven by foundational infrastructure requirements in newly built and existing properties. As architectural designs become more complex, the need for corrosion-resistant, lightweight, and high-performance piping materials is increasing. Additionally, the popularity of prefabricated assemblies, particularly in modular construction, supports faster, more efficient installations in residential and light commercial projects, further driving market growth.

U.S. Fire Sprinkler Systems Market held 85.3% share in 2024 and generated USD 3.5 Billion. This growth is being propelled by a combination of rigorous safety standards, expanding construction activity, and the deployment of advanced, connected fire sprinkler systems. High-rise buildings, industrial corridors, and retrofit upgrades in older facilities continue to contribute to elevated demand. Enhanced digital monitoring, automation, and efficient water management features are helping the U.S. remain at the forefront of fire protection innovation across both urban and suburban developments.

Key players shaping the North America Fire Sprinkler Systems Market include CeaseFire, AGF Manufacturing Inc., Honeywell, Encore Fire Protection, Fireline Corporation, Eaton, Johnson Controls, Minimax, Kauffman CO., REHAU, Potter Electric Signal Company, LLC, Thermon, Victaulic, Viking Group, Senju Sprinkler, NAFFCO, Reliable, National Fire Equipment Ltd., Troy Life & Fire Safety, Ltd., and UNITED Fire Systems. Leading companies in the North America Fire Sprinkler Systems Market are focusing on advanced product development, integrating AI-driven monitoring and smart IoT capabilities into their systems to provide real-time analytics and faster emergency response. Many are strengthening their partnerships with construction firms, insurers, and building management solution providers to ensure early integration of fire protection systems during the design stage. Firms are also investing in modular and prefabricated technologies to streamline installation and lower project timelines. Mergers and acquisitions help them expand geographical presence and technical expertise.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Construction type trends

- 2.4 Component trends

- 2.5 System type trends

- 2.6 Application trends

- 2.7 Response time trends

- 2.8 Material trends

- 2.9 Country trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Key factors affecting the value chain

- 3.1.3 Disruptions

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of fire sprinkler systems

- 3.8 Emerging opportunities & trends

- 3.8.1 Digital transformation with IoT technologies

- 3.8.2 Emerging market penetration

- 3.9 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share, by country, 2024

- 4.2.1 U.S.

- 4.2.2 Canada

- 4.3 Strategic initiatives

- 4.3.1 Key partnerships & collaborations

- 4.3.2 Major M&A activities

- 4.3.3 Product innovations & launches

- 4.3.4 Market expansion strategies

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Construction Type, 2021 - 2034, (USD Million)

- 5.1 Key trends

- 5.2 New construction

- 5.3 Retrofit

Chapter 6 Market Size and Forecast, By Component, 2021 - 2034, (USD Million)

- 6.1 Key trends

- 6.2 Sprinkler pipe and pipe fittings

- 6.3 Sprinkler heads

- 6.4 Valves

- 6.5 Compressors

- 6.6 Pumps and pump controllers

- 6.7 Others

Chapter 7 Market Size and Forecast, By System Type, 2021 - 2034, (USD Million)

- 7.1 Key trends

- 7.2 Wet-pipe sprinkler system

- 7.3 Dry-pipe sprinkler system

- 7.4 Pre-action sprinkler system

- 7.5 Deluge sprinkler system

- 7.6 Others

Chapter 8 Market Size and Forecast, By Application, 2021 - 2034, (USD Million)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.4 Industrial

Chapter 9 Market Size and Forecast, By Response Time, 2021 - 2034, (USD Million)

- 9.1 Key trends

- 9.2 Standard

- 9.3 Quick

Chapter 10 Market Size and Forecast, By Material, 2021 - 2034, (USD Million)

- 10.1 Key trends

- 10.2 Metallic

- 10.2.1 Black steel

- 10.2.2 Mild steel

- 10.2.3 Galvanized steel

- 10.2.4 Stainless steel

- 10.2.5 Others

- 10.3 Non-metallic

- 10.3.1 CPVC (Chlorinated polyvinyl chloride)

- 10.3.2 PEX (Cross-linked polyethylene)

- 10.3.3 HDPE (High-density polyethylene)

- 10.3.4 PP-R (Polypropylene random copolymer)

Chapter 11 Market Size and Forecast, By Country, 2021 - 2034, (Million Units, USD Million)

- 11.1 Key trends

- 11.2 U.S.

- 11.3 Canada

Chapter 12 Company Profiles

- 12.1 AGF Manufacturing Inc.

- 12.2 CeaseFire

- 12.3 Eaton

- 12.4 Encore Fire Protection

- 12.5 Fireline Corporation

- 12.6 Honeywell

- 12.7 Johnson Controls

- 12.8 Kauffman CO.

- 12.9 Minimax

- 12.10 NAFFCO

- 12.11 National Fire Equipment Ltd.

- 12.12 Potter Electric Signal Company, LLC

- 12.13 REHAU

- 12.14 Reliable

- 12.15 Senju Sprinkler

- 12.16 Thermon

- 12.17 Troy Life & Fire Safety, Ltd.

- 12.18 UNITED Fire Systems

- 12.19 Victaulic

- 12.20 Viking Group