PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871200

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871200

U.S. Peripheral Intravenous Catheters Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

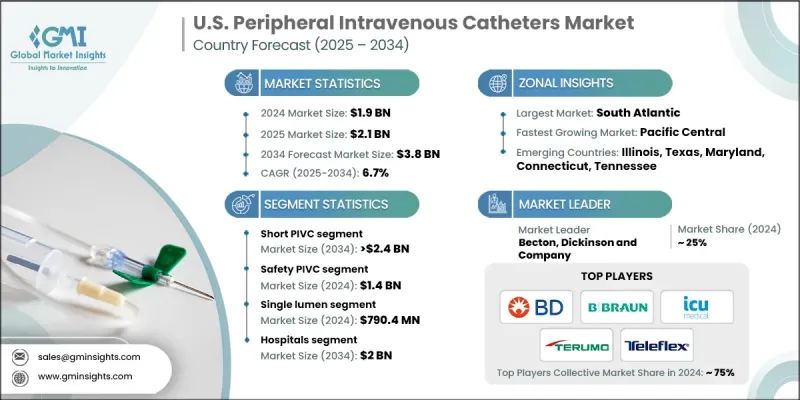

U.S. Peripheral Intravenous Catheters Market was valued at USD 1.9 Billion in 2024 and is estimated to grow at a CAGR of 6.7% to reach USD 3.8 Billion by 2034.

The market expansion is driven by the rising prevalence of chronic and lifestyle-related diseases, growing hospital admissions, increased demand for emergency and outpatient care, and the expansion of home infusion therapy services. Advancements in catheter design and safety features are also fueling growth. Peripheral intravenous catheters (PIVCs) are flexible, small tubes inserted into peripheral veins, primarily in the hand or arm, to administer medications, fluids, or nutrients directly into the bloodstream. They are widely used for short-term venous access in hospitals, emergency care, and outpatient settings, supporting therapies such as hydration, pain management, antibiotic administration, and blood sampling. The growing complexity of patient care, rising demand for minimally invasive procedures, and the need for efficient intravenous therapy are contributing to steady market growth. Additionally, hospital and outpatient infrastructure expansion, along with the increasing elderly population, is further stimulating the demand for PIVCs across the country.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.9 Billion |

| Forecast Value | $3.8 Billion |

| CAGR | 6.7% |

The short PIVC segment held a 63.9% share in 2024, due to its wide adoption in hospital and outpatient settings. Its ease of insertion, cost-effectiveness, and suitability for short- to medium-term intravenous therapy make it the preferred choice for diverse patient populations. These catheters offer reliable venous access while ensuring patient comfort, which supports their continued dominance in the market.

The safety PIVCs segment generated USD 1.4 Billion in 2024 and is expected to grow at a CAGR of 6.8% through 2034. Designed with engineered protection mechanisms, these catheters reduce needle-stick injuries among healthcare staff. With strict U.S. regulatory guidelines emphasizing workplace safety, hospitals are increasingly adopting safety PIVCs. The rising focus on occupational hazard reduction, along with the cost savings from fewer injuries, drives higher adoption of these devices in clinical settings.

South Atlantic Peripheral Intravenous Catheters Market held a 19.4% share in 2024. States within this region have a dense network of hospitals, specialty clinics, and outpatient centers, driving strong demand for PIVCs in routine IV therapy, emergency care, and surgical procedures. The presence of both urban and suburban healthcare facilities ensures consistent catheter consumption. Additionally, the region has a sizable elderly population, contributing to higher cases of chronic illnesses that require frequent intravenous therapies.

Key players operating in the U.S. Peripheral Intravenous Catheters Market include MedSource Labs, DELTA MED, Retractable Technologies, ICU Medical, Access Vascular, Lineus Medical, TERUMO, VYGON, Teleflex, Becton, Dickinson and Company, AngioDynamics, B. BRAUN, and MEDEREN. Companies in the U.S. Peripheral Intravenous Catheters Market are focusing on product innovation, safety enhancement, and strategic partnerships to strengthen their market foothold. Manufacturers are investing in R&D to design PIVCs that minimize patient discomfort, reduce infection risk, and include advanced safety features to prevent needle-stick injuries. Expansion of production facilities and regional distribution networks helps improve product availability and response times. Firms are also collaborating with hospitals, healthcare providers, and training institutions to promote catheter adoption and educate staff on safe usage. Cost optimization, regulatory compliance, and introducing specialty catheters for high-risk or chronic care patients are other strategies driving market growth.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Zonal/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Zonal trends

- 2.2.2 Product trends

- 2.2.3 Technology trends

- 2.2.4 Lumen trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of chronic diseases and cancer

- 3.2.1.2 Increasing hospital admissions and outpatient procedures

- 3.2.1.3 Preference for peripheral IVs over central lines for short-term access

- 3.2.1.4 Technological improvements in catheter materials and designs

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Risk of catheter-related bloodstream infections (CRBSIs) and complications

- 3.2.2.2 Strict regulatory requirements and lengthy approvals

- 3.2.3 Market opportunities

- 3.2.3.1 Development of antimicrobial/coated and biofilm-resistant catheters

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Reimbursement scenario

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.6.1 Current technological trends

- 3.6.2 Emerging technologies

- 3.7 Future market trends

- 3.8 Start-up scenario

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Consumer insights

- 3.12 Value chain analysis

- 3.13 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Short PIVC

- 5.3 Integrated/closed PIVC

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Safety PIVC

- 6.3 Conventional PIVC

Chapter 7 Market Estimates and Forecast, By Lumen, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Single lumen

- 7.3 Double lumen

- 7.4 Multi-lumen

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Ambulatory surgical centers

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Zone, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 East North Central

- 9.2.1 Illinois

- 9.2.2 Indiana

- 9.2.3 Michigan

- 9.2.4 Ohio

- 9.2.5 Wisconsin

- 9.3 West South Central

- 9.3.1 Arkansas

- 9.3.2 Louisiana

- 9.3.3 Oklahoma

- 9.3.4 Texas

- 9.4 South Atlantic

- 9.4.1 Delaware

- 9.4.2 Florida

- 9.4.3 Georgia

- 9.4.4 Maryland

- 9.4.5 North Carolina

- 9.4.6 South Carolina

- 9.4.7 Virginia

- 9.4.8 West Virginia

- 9.4.9 Washington, D.C.

- 9.5 Northeast

- 9.5.1 Connecticut

- 9.5.2 Maine

- 9.5.3 Massachusetts

- 9.5.4 New Hampshire

- 9.5.5 Rhode Island

- 9.5.6 Vermont

- 9.5.7 New Jersey

- 9.5.8 New York

- 9.5.9 Pennsylvania

- 9.6 East South Central

- 9.6.1 Alabama

- 9.6.2 Kentucky

- 9.6.3 Mississippi

- 9.6.4 Tennessee

- 9.7 West North Central

- 9.7.1 Iowa

- 9.7.2 Kansas

- 9.7.3 Minnesota

- 9.7.4 Missouri

- 9.7.5 Nebraska

- 9.7.6 North Dakota

- 9.7.7 South Dakota

- 9.8 Pacific Central

- 9.8.1 Alaska

- 9.8.2 California

- 9.8.3 Hawaii

- 9.8.4 Oregon

- 9.8.5 Washington

- 9.9 Mountain States

- 9.9.1 Arizona

- 9.9.2 Colorado

- 9.9.3 Utah

- 9.9.4 Nevada

- 9.9.5 New Mexico

- 9.9.6 Idaho

- 9.9.7 Montana

- 9.9.8 Wyoming

Chapter 10 Company Profiles

- 10.1 Access Vascular

- 10.2 AngioDynamics

- 10.3 B. BRAUN

- 10.4 Becton, Dickinson and Company

- 10.5 DELTA MED

- 10.6 ICU Medical

- 10.7 Lineus Medical

- 10.8 MEDEREN

- 10.9 MedSource Labs

- 10.10 Retractable Technologies

- 10.11 Teleflex

- 10.12 TERUMO

- 10.13 VYGON