PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871205

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871205

Aerogel Composites for Aerospace Insulation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

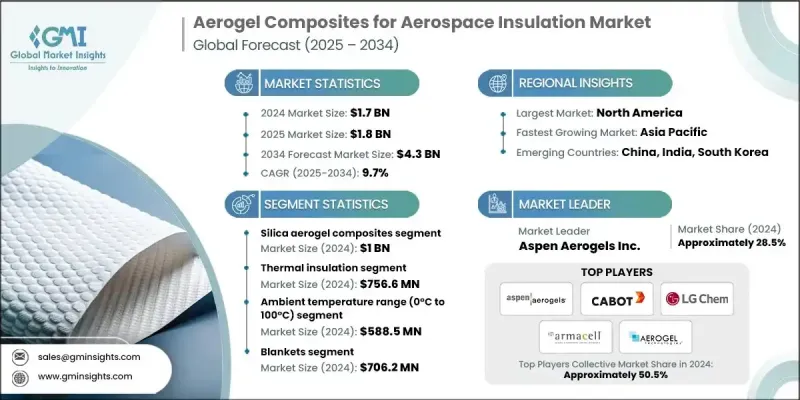

The Global Aerogel Composites for Aerospace Insulation Market was valued at USD 1.7 Billion in 2024 and is estimated to grow at a CAGR of 9.7% to reach USD 4.3 Billion by 2034.

Market growth is driven by the aerospace industry's growing focus on lightweight, high-performance thermal protection systems for both commercial and defense aircraft. Aerogel composites offer exceptional thermal insulation while minimizing weight, helping aircraft meet fuel efficiency targets without compromising structural integrity. Their superior thermal conductivity, combined with the ability to endure extreme temperatures ranging from cryogenic conditions to above 1,200°C, makes them ideal for next-generation aircraft and spacecraft applications. Advances in silica and polymer-based aerogel composites have enhanced mechanical durability and processing efficiency, enabling broader implementation in aerospace thermal management. Innovations in fiber-reinforced and polyimide aerogels are improving mechanical strength by hundreds of times over conventional aerogels while retaining thermal performance. Increasing emphasis on sustainable aviation, electric aircraft, and battery thermal management is further propelling adoption, as manufacturers seek materials that combine lightweight properties with high-performance insulation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 billion |

| Forecast Value | $4.3 billion |

| CAGR | 9.7% |

The silica aerogel composites segment generated USD 1 Billion in 2024 and is projected to grow at a CAGR of 9.9% from 2025 to 2034, accounting for 60.2% of the market. Silica-based composites lead the segment due to their ultra-low thermal conductivity, structural stability, and excellent fire resistance, making them suitable for aircraft engine compartments, spacecraft thermal systems, and cryogenic fuel storage. Their proven performance in extreme temperature conditions and compliance with stringent aerospace fire standards have positioned them as the material of choice for critical thermal insulation applications across commercial, military, and space sectors.

The thermal insulation segment was valued at USD 756.6 million in 2024 and is expected to grow at a CAGR of 10% through 2034, capturing a 45% market share. This segment dominates due to the essential role of temperature control in aircraft engines, spacecraft systems, and cryogenic fuel containment. Aerogel composites excel in maintaining thermal performance across extreme environments, from -200°C to over 500°C. The demand is particularly high for space applications, where thermal protection systems must withstand the harsh temperature fluctuations of outer space while safeguarding equipment and crew compartments.

North America Aerogel Composites for Aerospace Insulation Market accounted for a 42% share in 2024. The region's leadership stems from the presence of major aerospace manufacturers, advanced research institutions, and substantial government investment in defense and aerospace programs. The U.S. benefits from a strong aerospace ecosystem, with companies actively integrating aerogel composites into aircraft and spacecraft designs. Government-funded space exploration initiatives and defense programs are also accelerating technological development and the application of aerogel-based thermal solutions in North America.

Leading players in the Global Aerogel Composites for Aerospace Insulation Market include FLEXcon, LG Chem, Armacell International, Blueshift Materials, Aspen Aerogels, Inc., Active Aerogels, Aerogel Technologies LLC, EAS Fiberglass Co., Ltd., Jucos Refractory, WH Thermal Energy Technology, Green Earth Aerogel Technologies, Svenska Aerogel Holding AB, Guangdong Alison Technology, and Wedge India. Companies in the Aerogel Composites for Aerospace Insulation Market are employing several strategic approaches to strengthen their presence and market position. They are investing heavily in R&D to enhance the material strength, thermal efficiency, and manufacturability of aerogel composites. Strategic partnerships with aerospace OEMs and defense contractors help secure long-term contracts and expand adoption in commercial, military, and space applications. Firms are also focusing on diversifying their product portfolio with polymer- and fiber-reinforced composites to meet evolving performance requirements.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Product type

- 2.2.2 Application

- 2.2.3 Temperature range

- 2.2.4 Form

- 2.2.5 Manufacturing process

- 2.2.6 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Supply chain complexity

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Silica aerogel composites

- 5.3 Carbon aerogel composites

- 5.4 Hybrid aerogel composites

- 5.5 Polymer aerogel composites

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Thermal insulation

- 6.3 Acoustic insulation

- 6.4 Fire protection

- 6.5 Vibration damping

Chapter 7 Market Estimates and Forecast, By Temperature Range, 2021 - 2034 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Cryogenic (-200°C to -100°C)

- 7.3 Low temperature (-100°C to 0°C)

- 7.4 Ambient (0°C to 100°C)

- 7.5 High temperature (100°C to 500°C)

- 7.6 Extreme temperature (>500°C)

Chapter 8 Market Estimates and Forecast, By Form, 2021 - 2034 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 Blankets

- 8.3 Panels

- 8.4 Coatings

- 8.5 Custom shapes

Chapter 9 Market Estimates and Forecast, By Manufacturing Process, 2021 - 2034 (USD Billion, Kilo Tons)

- 9.1 Key trends

- 9.2 Supercritical drying

- 9.3 Ambient pressure drying

- 9.4 Freeze drying

- 9.5 Sol-gel processing

Chapter 10 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion, Kilo Tons)

- 10.1 Key trends

- 10.2 Commercial aircraft

- 10.3 Military aircraft

- 10.4 Spacecraft

- 10.5 Electric aircraft

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion, Kilo Tons)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Rest of Europe

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Rest of Asia Pacific

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Rest of Latin America

- 11.6 Middle East & Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

- 11.6.4 Rest of Middle East & Africa

Chapter 12 Company Profiles

- 12.1 Aspen Aerogels, Inc.

- 12.2 Cabot Corporation

- 12.3 LG Chem

- 12.4 Armacell International

- 12.5 Aerogel Technologies LLC

- 12.6 Blueshift Materials

- 12.7 Svenska Aerogel Holding AB

- 12.8 Active Aerogels

- 12.9 Green Earth Aerogel Technologies

- 12.10 FLEXcon

- 12.11 EAS Fiberglass Co., Ltd.

- 12.12 Guangdong Alison Technology

- 12.13 Jucos Refractory

- 12.14 WH Thermal Energy Technology

- 12.15 Wedge India