PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871213

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871213

Smart Traffic Signal Communication Module Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

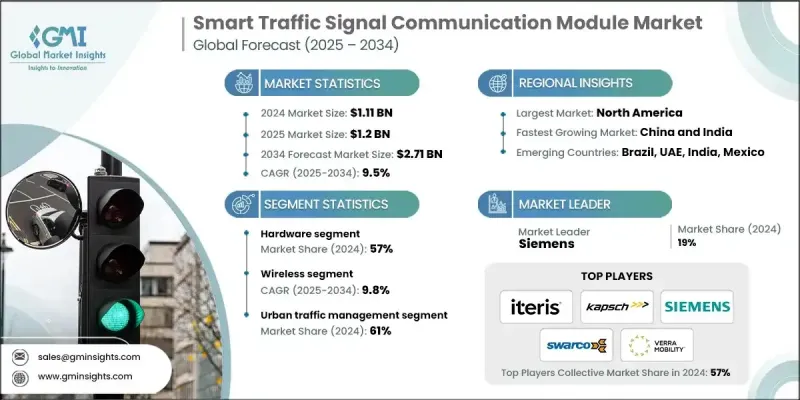

The Global Smart Traffic Signal Communication Module Market was valued at USD 1.11 Billion in 2024 and is estimated to grow at a CAGR of 9.5% to reach USD 2.71 Billion by 2034.

The market is witnessing strong expansion due to the widespread adoption of intelligent transportation systems and smart city initiatives. Governments worldwide are prioritizing the development of connected infrastructure to minimize traffic congestion, enhance road safety, and optimize traffic signal timing in real time. These advancements are transforming traditional traffic systems into highly responsive, data-driven networks. Rapid urbanization and the need for efficient mobility solutions are also driving investments in communication modules that connect signals, sensors, and control systems across road networks. The increasing integration of artificial intelligence, machine learning, and edge computing into traffic management systems enables predictive control and adaptive responses to traffic conditions, significantly improving operational efficiency. Meanwhile, the rise of IoT-enabled smart mobility ecosystems and cloud-based traffic control solutions is accelerating the shift toward centralized, data-centric transportation networks capable of supporting the growing complexity of urban mobility.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.11 Billion |

| Forecast Value | $2.71 Billion |

| CAGR | 9.5% |

The smart traffic signal communication module industry is rapidly transitioning from fixed-timing systems to adaptive, AI-powered architectures that utilize real-time data analytics. These intelligent systems can automatically adjust signal patterns based on live traffic conditions, reducing congestion and improving intersection efficiency. The deployment of edge computing allows local data processing for instant adjustments, enhancing responsiveness while minimizing dependence on cloud infrastructure. Furthermore, integrating IoT platforms and cloud-based management tools supports unified control across large urban networks, helping city planners monitor, analyze, and optimize signal operations more efficiently.

The hardware segment held 57% share in 2024. Hardware components such as sensors, processors, roadside units, and transceivers form the backbone of communication modules that transmit and process traffic data in real time. The segment's growth is strongly supported by major infrastructure modernization programs worldwide, which include significant funding for the installation of physical modules along urban corridors and key transportation routes. The ongoing global push to modernize road networks and establish smart intersections continues to create substantial demand for reliable and scalable hardware solutions.

The urban traffic management segment held a 61% share in 2024, making it the dominant application segment. Rapid urbanization, coupled with increasing congestion in metropolitan areas, is fueling the adoption of adaptive traffic control and intersection coordination systems. These solutions are central to modern smart city projects, helping to synchronize traffic flow and enhance safety. The growing implementation of vehicle-to-everything (V2X) communication technologies is expected to accelerate this trend further, as connected-vehicle infrastructure becomes an integral part of next-generation transportation ecosystems.

United States Smart Traffic Signal Communication Module Market generated USD 397.1 million in 2024. The country remains one of the most mature markets for connected traffic systems, supported by large-scale public funding and infrastructure renewal programs. Federal investments in intelligent transportation and connected corridor projects are driving large-scale deployment of advanced traffic management modules, establishing the U.S. as a global leader in smart mobility innovation and infrastructure modernization.

Prominent companies active in the Smart Traffic Signal Communication Module Market include Thales, Bosch, Cubic, Econolite, Q-Free, Siemens, Iteris, SWARCO, Verra Mobility, and Kapsch TrafficCom. To strengthen their Smart Traffic Signal Communication Module Market, companies in the smart traffic signal communication module industry are adopting a blend of strategic initiatives focused on innovation, collaboration, and global expansion. Many are investing heavily in R&D to enhance communication reliability, latency reduction, and AI-based traffic management features. Strategic alliances and partnerships with municipal governments and technology providers are helping accelerate the deployment of connected infrastructure. Manufacturers are also expanding their production capabilities and diversifying product portfolios to support varying regional requirements.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Technology

- 2.2.4 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising deployment of connected vehicle and V2X infrastructure

- 3.2.1.2 Increasing government focus on smart city and ITS deployments

- 3.2.1.3 Growing urban congestion and safety initiatives

- 3.2.1.4 Integration of 5G, AI, and edge computing technologies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High installation and integration costs

- 3.2.2.2 Lack of interoperability and standardization in communication protocols

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of cooperative ITS and connected corridor projects

- 3.2.3.2 Integration with cloud and edge analytics platforms

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL Analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Sustainability & environmental aspects

- 3.9.1 Carbon Footprint Assessment

- 3.9.2 Circular Economy Integration

- 3.9.3 E-Waste Management Requirements

- 3.9.4 Green Manufacturing Initiatives

- 3.10 Use cases and applications

- 3.11 Best-case scenario

- 3.12 Funding and incentive analysis

- 3.12.1 Government grants and subsidies

- 3.12.2 Private sector investment trends

- 3.12.3 Public-private partnership initiatives impacting the market

- 3.13 Market resilience and risk factors

- 3.13.1 Supply chain resilience for hardware modules

- 3.13.2 Regulatory and compliance risk assessment

- 3.13.3 Cybersecurity risks in communication networks

- 3.14 Benchmarking and performance metrics

- 3.14.1 Intersection efficiency improvements

- 3.14.2 Travel time reduction and emission impact

- 3.14.3 ROI from adaptive traffic module deployments

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 RSUs (Roadside Units)

- 5.2.2 Sensors

- 5.2.3 GPS units

- 5.2.4 Transceivers

- 5.2.5 Antennas

- 5.3 Software

- 5.3.1 ATMS (Advanced Traffic Management Systems)

- 5.3.2 Cloud-based analytics

- 5.3.3 Signal control optimization platforms

- 5.3.4 Interoperability/communication protocol software

- 5.4 Services

- 5.4.1 Professional Services

- 5.4.2 Managed Services

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Wireless

- 6.2.1 DSRC / ITS-G5 (5.9 GHz)

- 6.2.2 Cellular (5G / LTE)

- 6.2.3 Wi-Fi (IEEE 802.11)

- 6.2.4 Spread spectrum radio

- 6.3 Wired

- 6.3.1 Fiber optics

- 6.3.2 Twisted-pair

- 6.3.3 Coaxial cables

- 6.4 V2X-Specific communication systems

- 6.4.1 Vehicle-to-Vehicle (V2V)

- 6.4.2 Vehicle-to-Infrastructure (V2I)

- 6.4.3 Infrastructure-to-Infrastructure (I2I)

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Urban Traffic Management

- 7.3 Interurban / Highway Management

- 7.4 Connected Vehicles & Safety

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 US

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Nordics

- 8.3.7 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Global Players

- 9.1.1 Advantech

- 9.1.2 Alstom

- 9.1.3 Bosch

- 9.1.4 Cisco Systems

- 9.1.5 Cubic

- 9.1.6 Denso

- 9.1.7 Hitachi

- 9.1.8 Huawei Technologies

- 9.1.9 IBM

- 9.1.10 Indra Sistemas

- 9.1.11 Kapsch TrafficCom

9.1.12. L3 Harris Technologies

- 9.1.13 Mundys

- 9.1.14 NEC

- 9.1.15 PTV

- 9.1.16 Q-Free

- 9.1.17 Siemens

- 9.1.18 ST Engineering

- 9.1.19 Teledyne FLIR Systems

- 9.1.20 Thales

- 9.2 Regional Players

- 9.2.1 Aireon

- 9.2.2 Econolite

- 9.2.3 EFKON

- 9.2.4 GeoToll

- 9.2.5 Iteris

- 9.2.6 SWARCO

- 9.2.7 TransCore

- 9.2.8 Verra Mobility

- 9.3 Emerging Players / Disruptors

- 9.3.1 Connected Signals

- 9.3.2 Mobileye