PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871242

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871242

Electronic Chemicals Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

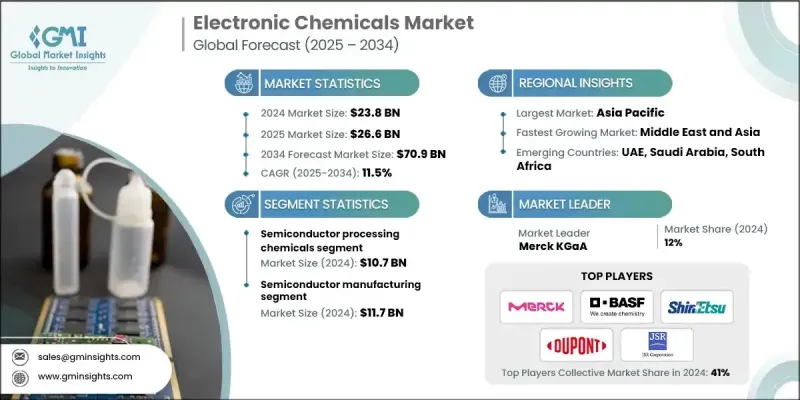

The Global Electronic Chemicals Market was valued at USD 23.8 Billion in 2024 and is estimated to grow at a CAGR of 11.5% to reach USD 70.9 Billion by 2034.

Electronic chemicals consist of highly specialized materials and compounds used in the production and assembly of semiconductors and electronic components. These include solvents, photoresists, etchants, deposition precursors, and specialty gases, all of which are integral to vital processes like lithography, cleaning, etching, and packaging. Their role is indispensable in ensuring precision, performance, and reliability within semiconductor manufacturing. The global demand for electronic chemicals is closely tied to ongoing semiconductor innovations, including miniaturized chips, 3D integration, and flexible electronics. As device geometries continue to shrink, the complexity of electronic components is increasing, creating the need for ultra-pure and high-performance chemical solutions that can maintain accuracy and yield efficiency. Furthermore, the growing focus on sustainability is pushing companies to produce PFAS-free, recyclable, and low-toxicity materials that align with global environmental mandates. The rapid advancement of electric vehicles, renewable energy technologies, and energy storage systems is also expanding the use of these chemicals beyond traditional consumer electronics, positioning the industry for long-term growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $23.8 Billion |

| Forecast Value | $70.9 Billion |

| CAGR | 11.5% |

The semiconductor processing chemicals segment generated USD 10.7 Billion in 2024. This dominance is attributed to the increasing complexity of semiconductor chip designs and the trend toward smaller, more integrated components. The demand for advanced electronic materials such as high-purity photoresists, conductive polymers, and dielectric compounds is rising as manufacturers develop new generations of IoT devices, flexible electronics, and compact sensors. These innovations are driving consistent growth within semiconductor processing chemicals, emphasizing purity, precision, and performance as critical attributes.

The semiconductor manufacturing segment reached USD 11.7 Billion in 2024. This segment continues to lead global demand due to its fundamental role in producing next-generation electronics. The expansion of chip fabrication facilities and the integration of technologies like artificial intelligence, 5G, and high-performance computing are accelerating market growth. Printed circuit board (PCB) manufacturing also remains a vital component of the market, fueled by rising demand for smart consumer devices, automotive electronics, and industrial automation systems.

U.S. Electronic Chemicals Market was valued at USD 3.9 Billion in 2024 owing to government-backed initiatives promoting semiconductor manufacturing expansion. The region benefits from a robust ecosystem of advanced research institutions, state-of-the-art fabrication facilities, and a strong focus on cleanroom innovation and material purity. The increasing production of electric vehicles and renewable energy solutions has further intensified the demand for specialty chemicals and solvents across the North American market. Canada's growing renewable energy and battery materials industries are also playing a supportive role in regional market growth, contributing to technological innovation and supply chain resilience across North America.

Major companies operating in the Global Electronic Chemicals Market include BASF SE, DuPont de Nemours Inc., Entegris Inc., Air Liquide S.A., Linde plc, Dow Inc., Merck KGaA, Covestro AG, Shin-Etsu Chemical Co. Ltd., Arkema S.A., Sumitomo Chemical Company, Wacker Chemie AG, Brewer Science Inc., JSR Corporation, Fujifilm Electronic Materials, Evonik Industries AG, Honeywell International Inc., KMG Chemicals Inc., Dongjin Semichem Co. Ltd., Technic Inc., Solvay S.A., Chemours Company, Avantor Inc., Huntsman Corporation, Cabot Microelectronics Corporation, and Tokyo Ohka Kogyo Co. Ltd. Leading companies in the Electronic Chemicals Market are pursuing innovation-driven strategies to expand their global footprint and maintain competitiveness. Many are focusing on developing ultra-high-purity, environmentally responsible chemical formulations to meet the demands of advanced semiconductor fabrication. Firms are investing heavily in R&D to support miniaturization, 3D packaging, and next-generation electronics manufacturing. Strategic collaborations and partnerships with semiconductor foundries are helping enhance supply chain stability and technology integration. Additionally, companies are expanding regional production capacities to localize supply and reduce logistical dependencies.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product type

- 2.2.2 Application

- 2.2.3 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing semiconductor fabrication demand

- 3.2.1.2 Advancements in chip miniaturization

- 3.2.1.3 Growth of display and photovoltaic manufacturing

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Technological obsolescence risk

- 3.2.2.2 High dependency on semiconductor and electronics cycles

- 3.2.3 Market opportunities

- 3.2.3.1 Development of PFAS-free and green chemical alternatives

- 3.2.3.2 Specialty chemicals for advanced packaging and 3D integration

- 3.2.3.3 Emerging applications in energy storage and batteries

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product type

- 3.9 Future market trends

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code)( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Semiconductor processing chemicals

- 5.2.1 Photoresists & photochemicals

- 5.2.2 Etchants & cleaning agents

- 5.2.3 Chemical mechanical planarization (CMP) slurries

- 5.2.4 Dopants & ion implantation materials

- 5.2.5 Deposition precursors & CVD materials

- 5.3 Electronic grade solvents & cleaning agents

- 5.3.1 Ultra-pure solvents

- 5.3.2 Flux removers & degreasers

- 5.3.3 PFAS-free cleaning solutions

- 5.4 Specialty electronic gases

- 5.4.1 Process gases & carrier gases

- 5.4.2 Dopant gases & ion sources

- 5.4.3 Etching gases & plasma chemistry

- 5.5 Electronic assembly materials

- 5.5.1 Conductive inks & pastes

- 5.5.2 Adhesives & encapsulants

- 5.5.3 Thermal interface materials

- 5.5.4 Surface treatment chemicals

- 5.6 Emerging electronic materials

- 5.6.1 Flexible electronics chemicals

- 5.6.2 2D materials & quantum dots

- 5.6.3 Biocompatible electronic materials

- 5.6.4 Sustainable electronic chemistries

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Semiconductor manufacturing

- 6.1.1 Wafer processing & fabrication

- 6.1.2 Advanced packaging & 3D integration

- 6.1.3 Memory device production

- 6.1.4 Logic device manufacturing

- 6.2 Printed circuit board (PCB) production

- 6.2.1 Substrate materials & laminates

- 6.2.2 Plating chemicals & surface treatments

- 6.2.3 Flexible & rigid-flex pcb materials

- 6.3 Electronic component assembly

- 6.3.1 Surface mount technology (SMT)

- 6.3.2 Wire bonding & interconnect materials

- 6.3.3 Component packaging & encapsulation

- 6.4 Display manufacturing

- 6.4.1 LCD production chemicals

- 6.4.2 OLED materials & processing

- 6.4.3 Flexible display technologies

- 6.5 Battery & energy storage

- 6.5.1 Lithium-ion battery chemicals

- 6.5.2 Solid-state battery materials

- 6.5.3 Alternative battery chemistries

- 6.6 Solar panel production

- 6.6.1 Photovoltaic cell processing

- 6.6.2 Encapsulants & protective coatings

- 6.6.3 Emerging solar technologies

Chapter 7 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.4.6 Rest of Asia Pacific

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.5.4 Rest of Latin America

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

- 7.6.4 Rest of Middle East and Africa

Chapter 8 Company Profiles

- 8.1 AGT Food and Ingredients Inc.

- 8.2 Aminola BV

- 8.3 Archer Daniels Midland Company (ADM)

- 8.4 Axiom Foods Inc.

- 8.5 Beneo GmbH

- 8.6 Bunge Limited

- 8.7 Burcon NutraScience Corporation

- 8.8 Cargill, Incorporated

- 8.9 Cosucra Groupe Warcoing SA

- 8.10 Eat Just, Inc.

- 8.11 Equinom Ltd.

- 8.12 ETprotein Co., Ltd.

- 8.13 FUJI Plant Protein Labs

- 8.14 Glanbia PLC

- 8.15 Laybio Natural Ingredients

- 8.16 Motif FoodWorks

- 8.17 Organicway Inc.

- 8.18 PURIS Holdings LLC

- 8.19 Roquette Freres

- 8.20 Tate & Lyle

- 8.21 Verdient Foods

- 8.22 Vestkorn Milling AS

- 8.23 VW Ingredients

- 8.24 Yantai Shuangta Food Co., Ltd