PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871245

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871245

Vehicle-as-a-Platform Hardware Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

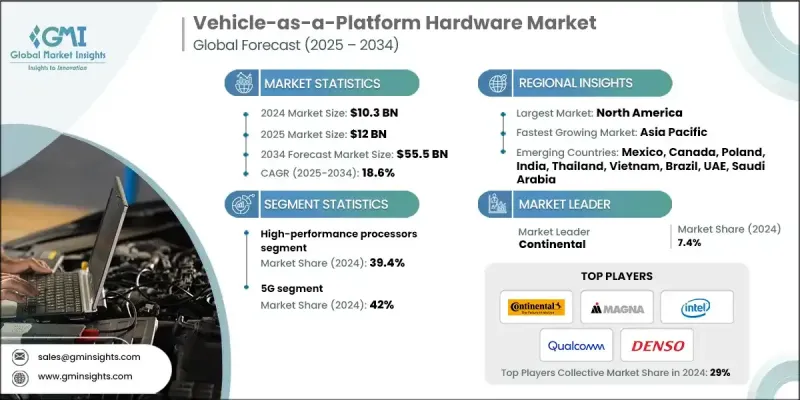

The Global Vehicle-as-a-Platform Hardware Market was valued at USD 10.3 Billion in 2024 and is estimated to grow at a CAGR of 18.6% to reach USD 55.5 Billion by 2034.

The automotive sector is undergoing a major technological transformation as vehicles evolve into intelligent platforms designed to meet changing user expectations. Vehicle-as-a-platform hardware plays a central role in enhancing driver and passenger experiences by enabling advanced systems such as infotainment, vehicle connectivity, and driver assistance technologies. As road safety becomes an urgent priority, the integration of advanced driver assistance systems (ADAS) featuring radar, lidar, ultrasonic sensors, and cameras ensures accurate monitoring of lanes, traffic signals, and surrounding objects. The increasing consumer interest in connected and intelligent features is driving OEMs and aftermarket suppliers to deliver integrated solutions that improve comfort, safety, and convenience. The expanding autonomous vehicle landscape is creating new opportunities for investment, while growing demand for connected cars continues to propel market momentum. To achieve seamless communication between vehicles, infrastructure, and cloud platforms, manufacturers are focusing on developing high-performance hardware systems capable of supporting ultra-fast data processing, secure connectivity, and efficient edge computing functions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.3 Billion |

| Forecast Value | $55.5 Billion |

| CAGR | 18.6% |

The high-performance processors segment held 39.4% share in 2024, driven by their ability to handle artificial intelligence workloads and ensure secure, centralized processing across vehicle systems. These processors manage massive data flows generated by cameras, sensors, and LiDAR technologies, allowing vehicles to make real-time driving decisions with high precision. Their capacity to execute complex algorithms instantly makes them essential for autonomous driving functions and advanced vehicle operations, especially as industry transitions toward higher levels of automation.

The 5G hardware segment held a 42% share in 2024, owing to rapid integration across both commercial and passenger vehicles. Automakers are embedding low-latency 5G components into vehicle compute architectures, enabling real-time communication, over-the-air system updates, and cloud-assisted intelligence. This shift allows connected and self-driving vehicles to perform advanced sensor fusion and decision-making with minimal network delays. Vehicles are increasingly being designed with in-built Wi-Fi mesh hardware that links multiple modules, sensors, and control units for seamless operation.

U.S. Vehicle-as-a-Platform Hardware Market USD 2.91 Billion in 2024. The country remains a hub for automotive hardware innovation, supported by advanced research infrastructure and strong collaborations between technology firms and original equipment manufacturers. Continuous advancements in artificial intelligence, high-performance computing, and sensor technologies have positioned the U.S. as a global leader in smart vehicle development. The domestic market benefits from the integration of domain controllers, zonal architecture, and chiplet-based systems-on-chip (SoCs) that enable real-time data processing and fully autonomous capabilities.

Prominent companies shaping the Global Vehicle-as-a-Platform Hardware Market include Bosch, Denso, Texas Instruments, NVIDIA, Continental, Intel, Renesas Electronics, Qualcomm Technologies, and Magna International. Leading companies in the Vehicle-as-a-Platform Hardware Market are actively pursuing innovation-driven growth strategies to strengthen their competitive edge. Firms are channeling significant investments into research and development to create scalable, energy-efficient hardware systems capable of supporting AI-based autonomous driving and advanced connectivity. Strategic collaborations and long-term partnerships with automakers, semiconductor producers, and software developers are helping them accelerate new product launches and achieve faster commercialization. Many players are expanding their production capabilities and global presence through mergers, acquisitions, and regional expansion.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Connectivity

- 2.2.4 Interface

- 2.2.5 End use

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Profit margin

- 3.2.2 Cost structure

- 3.2.3 Value addition at each stage

- 3.2.4 Factor affecting the value chain

- 3.2.5 Disruptions

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Growing adoption of Advanced Driver Assistance Systems (ADAS)

- 3.3.1.2 Favorable Government Policies for Autonomous Vehicles

- 3.3.1.3 Increasing Consumer Interest in Advanced Infotainment Systems

- 3.3.1.4 Connected Vehicle Ecosystem

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Cybersecurity and Data Privacy Concerns

- 3.3.2.2 High Cost of Advanced Hardware Components

- 3.3.3 Market opportunities

- 3.3.3.1 Growth of Electric Vehicles (EVs)

- 3.3.3.2 Expansion of Mobility-as-a-Service (MaaS)

- 3.3.3.3 Advancements in AI and Edge Computing

- 3.3.3.4 Emergence of 5G and V2X Communication

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.5.4 Latin America

- 3.5.5 Middle East & Africa

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Technology and innovation landscape

- 3.8.1 Current technology

- 3.8.2 Emerging technology

- 3.9 Price trends

- 3.9.1 By region

- 3.9.2 By product

- 3.10 Production statistics

- 3.10.1 Production hubs

- 3.10.2 Consumption hubs

- 3.10.3 Export and import

- 3.11 Cost breakdown analysis

- 3.12 Patent analysis

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.13.5 Carbon footprint considerations

- 3.14 Market entry & expansion strategies

- 3.14.1 New market penetration models

- 3.14.2 Regional expansion roadmaps

- 3.15 Investment landscape & market opportunities

- 3.15.1 Investment ecosystem overview & market dynamics

- 3.15.2 Venture capital & private equity activity analysis

- 3.15.3 Strategic investment opportunities & priorities

- 3.15.4 Market entry strategies & timing analysis

- 3.15.5 Partnership & collaboration opportunity mapping

- 3.16 Strategic implementation & execution roadmap

- 3.16.1 Strategic market entry & positioning strategies

- 3.16.2 Technology investment priorities & allocation

- 3.16.3 Partnership & ecosystem development strategies

- 3.16.4 Risk mitigation & contingency planning framework

- 3.16.5 Implementation timeline & milestone planning

- 3.17 Digital transformation & innovation ecosystem

- 3.17.1 Digital transformation strategy & roadmap

- 3.17.2 Innovation management & development processes

- 3.17.3 Technology scouting & emerging trend analysis

- 3.17.4 Startup ecosystem & partnership opportunities

- 3.17.5 Open innovation & collaboration platforms

- 3.18 Customer experience & market adoption

- 3.18.1 Customer journey mapping & experience design

- 3.18.2 Market adoption patterns & behavior analysis

- 3.18.3 Customer segmentation & targeting strategies

- 3.18.4 Value proposition development & communication

- 3.18.5 Customer decision-making process analysis

- 3.19 Risk management & business continuity

- 3.19.1 Comprehensive Risk Assessment & Identification

- 3.19.2 Risk Categorization & Prioritization Framework

- 3.19.3 Risk Mitigation Strategies & Implementation

- 3.19.4 Business Continuity Planning & Preparedness

- 3.19.5 Supply Chain Risk Management & Resilience

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 High performance processors

- 5.3 GPU

- 5.4 Edge computing modules

- 5.5 Sensors

- 5.5.1 Cameras

- 5.5.2 LiDAR

- 5.5.3 RADAR

- 5.5.4 Telematics devices

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Connectivity, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 5G

- 6.3 Wi-Fi

- 6.4 V2X

- 6.5 Satellite communication systems

Chapter 7 Market Estimates & Forecast, By Interface, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Electronic Control Units (ECU)

- 7.3 Ports

Chapter 8 Market Estimates & Forecast, By End use, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Passenger vehicle

- 8.2.1 Sedan

- 8.2.2 Hatchback

- 8.2.3 SUV

- 8.3 Commercial vehicle

- 8.3.1 LCV

- 8.3.2 MCV

- 8.3.3 HCV

- 8.4 Electric vehicle

- 8.4.1 BEV

- 8.4.2 PHEV

- 8.4.3 FCEV

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Russia

- 9.3.8 Poland

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Vietnam

- 9.4.7 Thailand

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global companies

- 10.1.1 NVIDIA

- 10.1.2 Qualcomm Technologies

- 10.1.3 Intel

- 10.1.4 Mobileye (Intel Company)

- 10.1.5 Bosch

- 10.1.6 Infineon Technologies

- 10.1.7 STMicroelectronics

- 10.1.8 Texas Instruments

- 10.2 Regional companies

- 10.2.1 Continental

- 10.2.2 Denso

- 10.2.3 Aptiv

- 10.2.4 Visteon

- 10.2.5 Magna International

- 10.2.6 ZF Friedrichshafen

- 10.2.7 Valeo

- 10.2.8 Hyundai Mobis

- 10.2.9 Panasonic Automotive Systems

- 10.3 Emerging companies

- 10.3.1 Horizon Robotics

- 10.3.2 Black Sesame Technologies

- 10.3.3 Hailo Technologies

- 10.3.4 Ambarella

- 10.3.5 Renesas Electronics

- 10.3.6 NXP Semiconductors

- 10.3.7 Xilinx (AMD Company)

- 10.3.8 Arm