PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871274

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871274

Virtual Extensible LAN (VXLAN) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

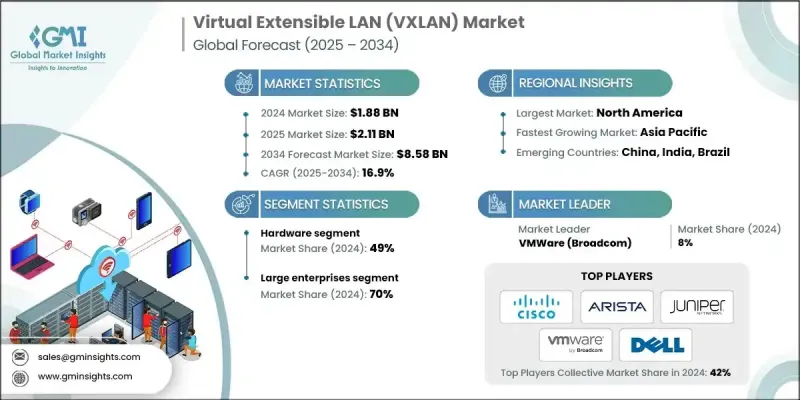

The Global Virtual Extensible LAN (VXLAN) Market was valued at USD 1.88 billion in 2024 and is estimated to grow at a CAGR of 16.9% to reach USD 8.58 billion by 2034.

VXLAN technology is transforming enterprise and data center networking by enabling scalable, flexible, and efficient network virtualization across Layer 2 and Layer 3 boundaries. It enhances agility by extending Layer 2 services over Layer 3 networks, ensuring better workload mobility and multi-tenancy in cloud environments. As enterprises continue migrating workloads to cloud platforms, the demand for virtualized overlay networks offering greater scalability, security, and flexibility is accelerating. Network infrastructure providers are developing robust VXLAN ecosystems integrated with SDN controllers, automation tools, and orchestration frameworks to optimize deployment efficiency. The rise of hyperscale data centers and cloud computing fuels the use of VXLAN protocols to support dynamic, programmable networks that manage heavy east-west traffic and facilitate virtual machine mobility. VXLAN overlays enable seamless interconnection between distributed facilities, providing elastic scalability and workload migration, core requirements for resilient enterprise and cloud-native architecture.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.88 Billion |

| Forecast Value | $8.58 Billion |

| CAGR | 16.9% |

The hardware segment held a 49% share in 2024, driven by the rising need for physical network components such as switches, routers, and gateways compatible with VXLAN encapsulation and overlay technologies. Demand for VXLAN-enabled switches, routers, and network interface cards continues to grow as enterprises and large-scale data centers prioritize high-performance hardware capable of managing internal traffic and hybrid cloud environments. The segment's growth is being supported by innovations in high-speed switching and stronger integration with SDN-based network management systems.

The large enterprises segment held a 70% share in 2024, owing to the widespread deployment of cloud computing, SDN, and network virtualization technologies. These organizations use VXLAN overlays to connect on-premises and multi-cloud infrastructures, ensuring uniform security policies, streamlined workload migration, and centralized network management across global data centers. The adoption of AI-powered automation within VXLAN frameworks is further helping enterprises improve operational efficiency and optimize management of large-scale distributed systems.

U.S. Virtual Extensible LAN (VXLAN) Market accounted for a 90.5% share, generating USD 632.3 million in 2024. This dominance stems from early adoption of SDN, cloud-first strategies, and large-scale deployments by hyperscale data centers and enterprises. The U.S. benefits from an advanced IT ecosystem, high cloud penetration, and the integration of VXLAN with SDN, NFV, and multi-cloud orchestration platforms that enable secure, scalable, and automated network virtualization.

Major players in the Global Virtual Extensible LAN (VXLAN) Market include Cisco Systems, Juniper Networks, Arista Networks, VMware (Broadcom), Hewlett Packard Enterprise (HPE) / Aruba Networks, Huawei Technologies Co., Cumulus Networks (NVIDIA Corporation), Dell Technologies, and Extreme Networks. Key strategies adopted by leading companies in the Virtual Extensible LAN (VXLAN) Market include expanding software-defined networking portfolios, investing in high-speed, VXLAN-compatible hardware, and forming partnerships with cloud service providers to enhance interoperability. Firms are also leveraging AI and automation for dynamic network orchestration, optimizing latency, and improving scalability. Continuous R&D efforts, open networking initiatives, and acquisitions of software-driven network solution providers are enabling companies to enhance product portfolios, increase market penetration, and meet evolving enterprise connectivity demands.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021-2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Enterprise size

- 2.2.4 Application

- 2.2.5 End Use

- 2.2.6 Deployment model

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid cloud and data center expansion

- 3.2.1.2 Rising adoption of software-defined networking (SDN)

- 3.2.1.3 Growing need for network segmentation and security

- 3.2.1.4 Increased virtual machine mobility

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Complex deployment and configuration

- 3.2.2.2 Interoperability challenges across vendors

- 3.2.3 Market opportunities

- 3.2.3.1 Edge and 5g network virtualization

- 3.2.3.2 AI-driven network automation

- 3.2.3.3 Cloud-native and container networking

- 3.2.3.4 Expansion in emerging data center markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 Global

- 3.4.1.1 IETF standards development & RFC evolution

- 3.4.1.2 IEEE networking standards & interoperability

- 3.4.1.3 NIST cybersecurity framework & guidelines

- 3.4.1.4 Open source licensing & intellectual property

- 3.4.2 North America

- 3.4.3 Europe

- 3.4.4 Asia Pacific

- 3.4.5 Latin America

- 3.4.6 Middle East & Africa

- 3.4.1 Global

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.1.1 Next-generation VXLAN enhancements & standards evolution

- 3.7.1.2 Integration with intent-based networking (IBN)

- 3.7.1.3 AI/ML-driven network automation & optimization

- 3.7.1.4 Edge computing & 5G network slicing integration

- 3.7.2 Emerging technologies

- 3.7.2.1 Container networking & kubernetes integration

- 3.7.2.2 Security enhancement & zero trust architecture

- 3.7.2.3 Performance optimization & hardware acceleration

- 3.7.2.4 Multi-cloud & hybrid cloud networking evolution

- 3.7.3 Technology adoption barriers & mitigation strategies

- 3.7.1 Current technological trends

- 3.8 Price trends

- 3.8.1 Hardware pricing trends & cost optimization

- 3.8.2 Software licensing model evolution (perpetual vs subscription)

- 3.8.3 Professional services pricing & market rates

- 3.8.4 Cloud-based & saas pricing models

- 3.8.5 Total cost of ownership (TCO) analysis

- 3.8.6 Price-performance benchmarking across vendors

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Investment & funding analysis

- 3.13.1 Venture Capital & Private Equity Investment Trends

- 3.13.2 Government Funding & Infrastructure Investment Programs

- 3.13.3 R&D Investment Priorities & Technology Development

- 3.14 Market maturity assessment

- 3.15 Customer needs vs vendor capability gap analysis

- 3.15.1 Enterprise requirements assessment & unmet needs

- 3.15.2 Service provider demands vs current offerings

- 3.15.3 SME market accessibility & simplification gaps

- 3.15.4 Performance & scalability expectation misalignment

- 3.16 Vendor gap reduction strategies & roadmaps

- 3.16.1 Product development & feature enhancement plans

- 3.16.2 Partnership & ecosystem expansion initiatives

- 3.16.3 Training & certification program investments

- 3.16.4 Open source contribution & community building

- 3.17 Market case studies & implementation analysis

- 3.17.1 Large enterprise VXLAN deployment case studies

- 3.17.2 Cloud service provider implementation examples

- 3.17.3 Government & defense deployment success stories

- 3.17.4 SME adoption patterns & lessons learned

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

- 4.7 Product portfolio analysis & differentiation strategies

- 4.8 Vendor selection criteria & customer decision factors

- 4.9 Channel partner & distribution network analysis

- 4.10 Customer satisfaction & brand perception analysis

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Switches

- 5.2.2 Routers

- 5.2.3 Gateways

- 5.2.4 Others

- 5.3 Software

- 5.3.1 VXLAN enabled network operating system

- 5.3.2 Network virtualization software

- 5.3.3 Network management and orchestration software

- 5.3.4 Others

- 5.4 Services

- 5.4.1 Professional services

- 5.4.1.1 Consulting

- 5.4.1.2 Deployment & integration

- 5.4.1.3 Support & maintenance

- 5.4.2 Managed services

- 5.4.1 Professional services

Chapter 6 Market Estimates & Forecast, By Enterprise Size, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Large enterprises

- 6.3 SME

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Multi-tenancy

- 7.3 Workload mobility

- 7.4 Software-defined networking (SDN) overlays

- 7.5 Network function virtualization (NFV)

- 7.6 Disaster recovery

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Manufacturing

- 8.3 Healthcare

- 8.4 BFSI

- 8.5 Retail

- 8.6 Media & entertainment

- 8.7 Government

- 8.8 IT & telecommunications

- 8.9 Others

Chapter 9 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 On-premises

- 9.3 Cloud-based

- 9.4 Hybrid

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.3.8 Poland

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Vietnam

- 10.4.7 Thailand

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global companies

- 11.1.1 Arista Networks

- 11.1.2 Cisco Systems

- 11.1.3 Cumulus Networks (NVIDIA Corporation)

- 11.1.4 Hewlett Packard Enterprise (HPE)

- 11.1.5 Huawei Technologies

- 11.1.6 Juniper Networks

- 11.1.7 VMware (Broadcom)

- 11.2 Hardware Infrastructure Leaders

- 11.2.1 Dell Technologies

- 11.2.2 Foxconn Technology Group

- 11.2.3 Inspur Group

- 11.2.4 Lenovo Group

- 11.2.5 Quanta Computer

- 11.2.6 Supermicro Computer

- 11.3 Emerging & Disruptive Players

- 11.3.1 Forward Networks

- 11.3.2 Fungible Inc. (Microsoft)

- 11.3.3 Kaloom Inc.

- 11.3.4 Netris AI

- 11.3.5 Pensando Systems (AMD)

- 11.3.6 Veriflow Systems

- 11.4 Regional & Niche Players

- 11.4.1 Allied Telesis

- 11.4.2 D-Link Corporation

- 11.4.3 Extreme Networks

- 11.4.4 Netgear

- 11.4.5 TP-Link Technologies

- 11.4.6 Ubiquiti