PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871284

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871284

Roller Bearings Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

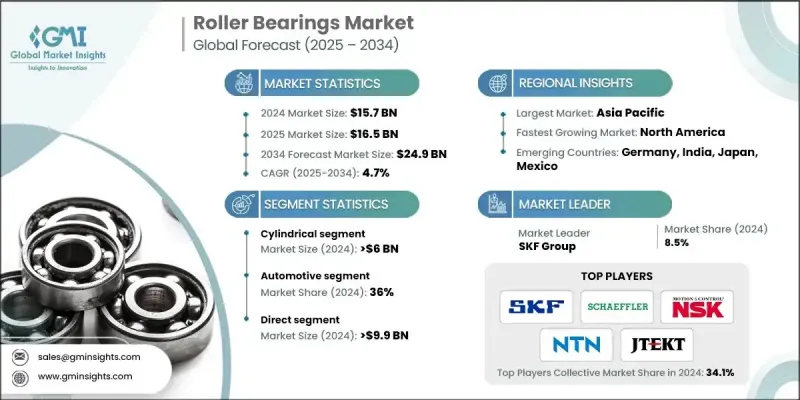

The Global Roller Bearings Market was valued at USD 15.7 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 24.9 billion by 2034.

Roller bearings serve as essential components across industries such as construction, mining, and manufacturing, where reliability and durability are key to efficient operations. The growing adoption of automation and advanced machinery across industrial sectors has driven the need for high-performance bearings capable of handling heavy loads, high pressure, and extreme temperature variations. Governments promoting industrial automation and energy-efficient systems are further fueling market growth. With increased focus on research and development, roller bearings are evolving to deliver improved performance, precision, and longevity in demanding industrial environments. Global initiatives supporting renewable energy and smart manufacturing also continue to influence the market's evolution, encouraging innovations that enhance efficiency and operational stability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.7 Billion |

| Forecast Value | $24.9 Billion |

| CAGR | 4.7% |

The cylindrical roller bearing segment reached USD 6 billion in 2024, driven by demand for bearings that support heavy radial loads and perform efficiently at high speeds. These bearings are widely adopted in industrial motors, manufacturing, and automotive systems. Industrial motors alone account for more than half of total energy consumption in manufacturing, and cylindrical bearings play a crucial role in improving their operational efficiency, thereby driving strong demand across industries seeking energy savings and reduced maintenance costs.

The direct sales segment reached USD 9.9 billion in 2024, dominating the roller bearings market due to its effectiveness in maintaining direct partnerships with OEMs. Direct distribution enables manufacturers to deliver customized solutions while ensuring seamless communication and technical collaboration. This approach is particularly beneficial in high-value sectors such as automotive, aerospace, and heavy equipment manufacturing, where precision, quality assurance, and performance reliability are key decision factors for OEMs.

U.S. Roller Bearings Market held 77.1% share in 2024. The country's advanced manufacturing ecosystem, strong automotive base, and expanding aerospace and heavy machinery sectors are major contributors to this growth. Continuous technological development and the presence of key industry players have reinforced the U.S. as a dominant force in the region, supporting both domestic and global demand for industrial-grade roller bearings.

Major players in the Global Roller Bearings Market include NBI Bearings Europe, HKT Bearings, C&U Group, Minebea, NTN, NSK, SKF, Schaeffler Group, The Timken Company, RBC Bearings, Brammer, Daido Metal, Harbin Bearing Manufacturing, JTEKT, and Rexnord. Companies in the Roller Bearings Market are focused on technological innovation, product diversification, and strategic partnerships to strengthen their global presence. Heavy investment in R&D enables them to develop advanced, high-durability bearings that perform efficiently under extreme conditions. Many players are adopting automation and smart manufacturing processes to improve precision and reduce production costs. Collaborations with OEMs across industrial, automotive, and aerospace sectors ensure long-term contracts and product customization opportunities. Expanding regional manufacturing bases and supply chains allows for faster delivery and cost efficiency.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Material

- 2.2.4 Application

- 2.2.5 End use Industry

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Industrial expansion and automation

- 3.2.1.2 Automotive industry growth

- 3.2.1.3 Technological advancements and product innovation

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High production costs

- 3.2.2.2 Emergence of alternative technologies

- 3.2.3 Opportunities

- 3.2.3.1 Energy-efficient and smart roller bearing systems

- 3.2.3.2 Growth in industrial automation and smart manufacturing

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code-8482)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Gap analysis

- 3.10 Risk assessment and mitigation

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Cylindrical

- 5.3 Tapered

- 5.4 Spherical

- 5.5 Others

- 5.5.1 Needle

- 5.5.2 Thrust

- 5.5.3 Split

Chapter 6 Market Estimates & Forecast, By Material, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Steel

- 6.3 Ceramic

- 6.4 Polymer

- 6.5 Hybrid

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Gearboxes

- 7.3 Electric Motors

- 7.4 Pumps & Compressors

- 7.5 Wind Turbines

- 7.6 Conveyors

- 7.7 Machine Tools

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Agriculture

- 8.4 Electrical

- 8.5 Mining & Construction

- 8.6 Railway & Aerospace

- 8.7 Automotive aftermarket

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Brammer

- 11.2 C&U Group

- 11.3 Daido Metal

- 11.4 Harbin Bearing Manufacturing

- 11.5 HKT Bearings

- 11.6 JTEKT

- 11.7 Minebea

- 11.8 NBI Bearings Europe

- 11.9 NSK

- 11.10 NTN

- 11.11 RBC Bearings

- 11.12 Rexnord

- 11.13 Schaeffler Group

- 11.14 SKF

- 11.15 The Timken Company