PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871285

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871285

Food Enzymes Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

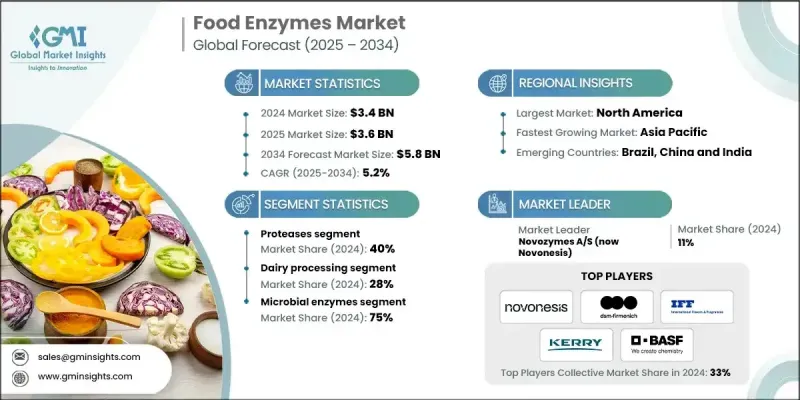

The Global Food Enzymes Market was valued at USD 3.4 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 5.8 billion by 2034.

The market is steadily advancing, driven by the rising demand for enzyme-based solutions in the food processing industry. Enzymes enhance production efficiency, reduce operational costs, and improve product quality across multiple food categories. The growth is further supported by the expanding scale of industrial food manufacturing worldwide, where demand for processing aids naturally rises with higher food output. Additionally, the growing preference for processed and convenience foods in emerging regions creates fresh avenues for enzyme applications. Research and development investments in enzyme technologies are at an all-time high, with leading companies allocating substantial resources to innovation. Continuous R&D ensures the introduction of advanced solutions, sustaining long-term market growth and demonstrating resilience even through economic fluctuations, highlighting the essential role of enzymes in modern food production systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.4 Billion |

| Forecast Value | $5.8 Billion |

| CAGR | 5.2% |

The proteases segment held a 40% share in 2024 and is expected to grow at a CAGR of 4.9% by 2034. Their dominance stems from their versatile applications in enhancing texture, digestibility, and overall product quality in meat, dairy, baking, and brewing processes. Proteases continue to be vital as demand for protein-rich and functional foods expands.

The dairy processing segment held a 28% share in 2024 and is projected to grow at a CAGR of 4.9% from 2025 to 2034. Enzymes play a critical role in dairy production, including cheese-making and lactose-modified milk products, catering to the increasing consumer demand for diverse nutritional options. Advanced enzyme systems now improve flavor, texture, and shelf life, with proteases and lipases being central to producing high-quality, functional dairy products.

North America Food Enzymes Market held a 25% share in 2024. The region's growth is fueled by advanced food processing infrastructure, stringent regulatory frameworks, and consumer awareness about enzyme benefits. The presence of key enzyme manufacturers, coupled with ongoing innovation and R&D-driven product development, further strengthens North America's leadership position.

Leading players in the Global Food Enzymes Market include Novonesis (formerly Novozymes A/S), DSM-Firmenich, BASF SE, Kerry Group plc, International Flavors & Fragrances Inc. (IFF), Chr. Hansen Holding A/S, Advanced Enzyme Technologies Ltd, Amano Enzyme Inc, Biocatalysts Ltd, Kemin Industries Inc, Associated British Foods plc, Enzyme Development Corporation, Maps Enzymes Ltd, Creative Enzymes, Prozomix Ltd, Nagase ChemteX Corporation, Enzyme Solutions Inc, and Biocon Ltd. Companies in the Food Enzymes Market adopt a variety of strategies to strengthen market presence and expand their footprint. They invest heavily in research and development to create novel enzymes with enhanced functionality, improved stability, and broader application across food categories. Strategic mergers, acquisitions, and partnerships enable expansion of product portfolios and regional penetration. Firms also focus on process optimization, cost efficiency, and technology integration to provide tailored solutions for industrial food processors. Marketing initiatives, collaboration with food manufacturers, and knowledge-sharing programs help build brand recognition and trust.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Application

- 2.2.4 Source

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for clean label products

- 3.2.1.2 Increasing food processing efficiency requirements

- 3.2.1.3 Rising health & wellness consciousness

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Regulatory compliance complexity

- 3.2.2.2 High R&D investment requirements

- 3.2.3 Market opportunities

- 3.2.3.1 Emerging applications in plant-based foods

- 3.2.3.2 Biotechnology innovation pipeline

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Proteases

- 5.2.1 Rennet & chymosin

- 5.2.2 Pepsin & trypsin

- 5.2.3 Papain & bromelain

- 5.2.4 Microbial proteases

- 5.3 Carbohydrases

- 5.3.1 Alpha-amylase

- 5.3.2 Glucoamylase & pullulanase

- 5.3.3 Cellulase & hemicellulase

- 5.3.4 Pectinase & xylanase

- 5.4 Lipases

- 5.4.1 Animal lipases

- 5.4.2 Microbial lipases

- 5.4.3 Plant-derived lipases

- 5.5 Phytases

- 5.5.1 Microbial Phytases

- 5.5.2 Genetically modified phytases

- 5.6 Catalases

- 5.6.1 Bovine liver catalase

- 5.6.2 Microbial catalases

- 5.7 Polymerases & Nucleases

- 5.7.1 DNA polymerases

- 5.7.2 RNA processing enzymes

- 5.8 Other

- 5.8.1 Transglutaminases

- 5.8.2 Glucose oxidase

- 5.8.3 Invertase & lactase

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Dairy processing

- 6.2.1 Cheese production & coagulation

- 6.2.2 Milk processing & modification

- 6.2.3 Whey processing & protein recovery

- 6.2.4 Lactose-free product development

- 6.3 Bakery & confectionery

- 6.3.1 Dough conditioning & strengthening

- 6.3.2 Anti-staling & shelf-life extension

- 6.3.3 Texture & volume improvement

- 6.3.4 Acrylamide reduction

- 6.4 Animal feed

- 6.4.1 Phytase applications

- 6.4.2 Carbohydrase applications

- 6.4.3 Protease applications

- 6.4.4 Multi-enzyme complexes

- 6.5 Beverages

- 6.5.1 Juice clarification & processing

- 6.5.2 Brewing & fermentation

- 6.5.3 Wine production & quality enhancement

- 6.5.4 Sports & functional beverages

- 6.6 Processed foods

- 6.6.1 Protein modification & texturization

- 6.6.2 Fat replacement & reduction

- 6.6.3 Flavor enhancement

- 6.6.4 Nutritional fortification

- 6.7 Starch & sweetener production

- 6.7.1 Glucose syrup production

- 6.7.2 High fructose corn syrup (HFCS)

- 6.7.3 Maltodextrin & modified starches

- 6.7.4 Specialty sweeteners

Chapter 7 Market Estimates and Forecast, By Source, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Microbial enzymes

- 7.2.1 Bacterial sources

- 7.2.2 Fungal sources

- 7.2.3 Yeast sources

- 7.3 Genetically modified enzymes

- 7.3.1 Recombinant chymosin

- 7.3.2 Gm microbial enzymes

- 7.3.3 Engineered enzyme variants

- 7.4 Plant-derived enzymes

- 7.4.1 Papain from papaya

- 7.4.2 Bromelain from pineapple

- 7.4.3 Ficin from fig

- 7.5 Animal-derived enzymes

- 7.5.1 Pancreatin

- 7.5.2 Pepsin

- 7.5.3 Animal Rennet

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Novozymes A/S (now Novonesis)

- 9.2 DSM-firmenich

- 9.3 International Flavors & Fragrances Inc. (IFF)

- 9.4 Kerry Group plc

- 9.5 BASF SE

- 9.6 Chr. Hansen Holding A/S

- 9.7 Associated British Foods plc

- 9.8 Advanced Enzyme Technologies Ltd

- 9.9 Kemin Industries Inc

- 9.10 Amano Enzyme Inc

- 9.11 Biocatalysts Ltd

- 9.12 Enzyme Development Corporation

- 9.13 Maps Enzymes Ltd

- 9.14 Creative Enzymes

- 9.15 Prozomix Ltd

- 9.16 Nagase ChemteX Corporation

- 9.17 Enzyme Solutions Inc

- 9.18 Biocon Ltd