PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871308

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871308

Postbiotic Supplements Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

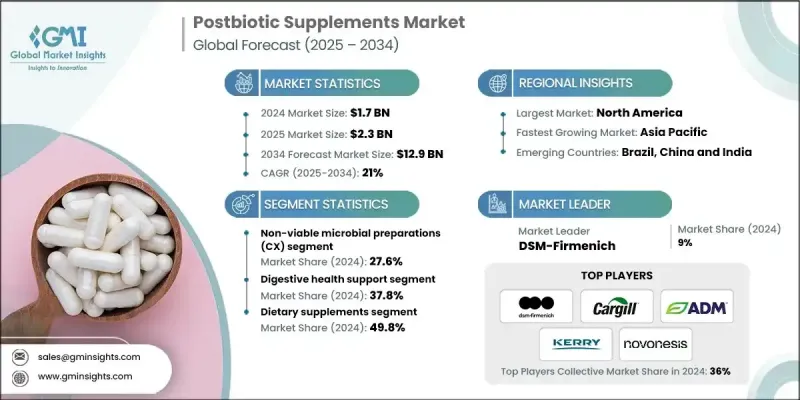

The Global Postbiotic Supplements Market was valued at USD 1.7 billion in 2024 and is estimated to grow at a CAGR of 21% to reach USD 12.9 billion by 2034.

Postbiotics, as officially defined by the International Scientific Association for Probiotics and Prebiotics (ISAPP) are preparations of non-living microorganisms and/or their components that provide health benefits to the host by preserving bioactivity despite the absence of viability. Mounting scientific evidence supports their positive effects on digestive, immune, and metabolic health across both healthy individuals and vulnerable groups. Clinical validation is gaining momentum, with studies showing improvements in stool quality, gut barrier function, and respiratory health. This growing body of proof is driving market confidence and broadening product offerings beyond traditional capsules and powders to include functional beverages, bars, and ready-to-eat products, leveraging the heat stability of postbiotics for daily nutrition integration. Their safety and stability make them especially suitable for infants, immunocompromised patients, and older adults, with clinical trials reinforcing their benefits for pediatric growth and healthy aging through metabolites like short-chain fatty acids that support gut health and inflammation control.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 Billion |

| Forecast Value | $12.9 Billion |

| CAGR | 21% |

The complex non-viable microbial preparations (CX) held a 27.6% share in 2024 and are expected to grow at a CAGR of 20.5% through 2034. These fully inactivated preparations maintain cellular structures and metabolites, enabling them to meet or even exceed the health benefits typically attributed to live probiotics. Manufacturers achieve this by employing controlled fermentation followed by validated inactivation methods, often thermal, which preserves the bioactive components used in capsule and food formulations.

The dietary supplements segment held a 49.8% share and is forecasted to grow at a CAGR of 20.8% through 2034. Postbiotic bioactive compounds are favored for their stability, safety, and adaptability, making them ideal for use in dietary supplements, functional foods, and beverages. Food producers are increasingly incorporating postbiotics to fortify snacks, drinks, and dairy alternatives, responding to consumer demand for clean-label and microbiome-supportive products. Supplements are offered in user-friendly forms like capsules, powders, and gummies, supporting immune health and metabolic function. The resilience of postbiotics under various processing conditions paves the way for innovation and wider commercial availability.

North America Postbiotic Supplements Market held a 41% share in 2024. This leadership is fueled by strong clinician acceptance, heightened consumer awareness, and extensive retail distribution across the U.S. and Canada. The U.S. market is driving growth through functional beverages and bars, supported by clear regulatory guidelines on labeling and health claims in dietary supplements. In Canada, the preference for clean-label products and growing interest in immune and digestive wellness sustain demand for stable, non-viable formats that do not require refrigeration and offer simple dosing. The ongoing premiumization within healthcare practitioner channels, combined with expanding mainstream product launches, is expected to propel market growth during the forecast period.

Key industry players in the Global Postbiotic Supplements Market include Immuse Health (Kirin Holdings/Kyowa Hakko Bio), Biofarma Group, Culturelle (i-Health, Inc.), DSM-Firmenich, Kerry Group Plc, Metagenics, Probi AB, Ritua, SCD Probiotics, Archer Daniels Midland (ADM), Cargill, Incorporated, Chr. Hansen A/S (now Novonesis), VSL Pharmaceuticals, and Labcorp. Companies in the Postbiotic Supplements Market are actively adopting strategies to strengthen their market presence and sustain growth. These include investing heavily in R&D to develop clinically validated formulations that highlight safety, efficacy, and novel health benefits. Collaborations with academic institutions and clinical research organizations help accelerate product validation and regulatory approval. Firms focus on expanding product portfolios by launching innovative formats such as beverages, bars, and ready-to-eat items that cater to evolving consumer lifestyles and preferences. Strategic partnerships with retailers and healthcare providers enhance distribution reach and consumer trust.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Application

- 2.2.4 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing consumer awareness of gut-brain axis health benefits

- 3.2.1.2 Superior stability & shelf-life advantages over probiotics

- 3.2.1.3 Regulatory clarity following ISAPP consensus definition

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited standardized analytical methods for product characterization

- 3.2.2.2 High R&D costs for strain-specific clinical validation

- 3.2.3 Market opportunities

- 3.2.3.1 Untapped pediatric & elderly population segments

- 3.2.3.2 Expansion into functional foods & beverage applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Complex non-viable microbial preparations (CX)

- 5.3 Microbial metabolic products (MM)

- 5.4 Intact non-viable microbial cells (IC)

- 5.5 Fragmented microbial cells (FC)

- 5.6 Specialized formulations

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Digestive health support

- 6.3 Immune system support

- 6.4 Metabolic health support

- 6.5 Mental health & cognitive support

- 6.6 Skin health & anti-aging

Chapter 7 Market Estimates and Forecast, By End Use, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Dietary supplements industry

- 7.3 Functional foods & beverages

- 7.4 Clinical nutrition

- 7.5 Cosmetics & personal care

- 7.6 Animal nutrition & feed

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 DSM-Firmenich

- 9.2 Cargill, Incorporated

- 9.3 Archer Daniels Midland (ADM)

- 9.4 Kerry Group Plc

- 9.5 Chr. Hansen A/S (now Novonesis)

- 9.6 Immuse Health (Kirin Holdings/Kyowa Hakko Bio)

- 9.7 SCD Probiotics

- 9.8 Biofarma Group

- 9.9 Probi AB

- 9.10 Culturelle (i-Health, Inc.)

- 9.11 VSL Pharmaceuticals

- 9.12 Ritual

- 9.13 Metagenics