PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871320

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871320

Industrial Fans and Blowers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

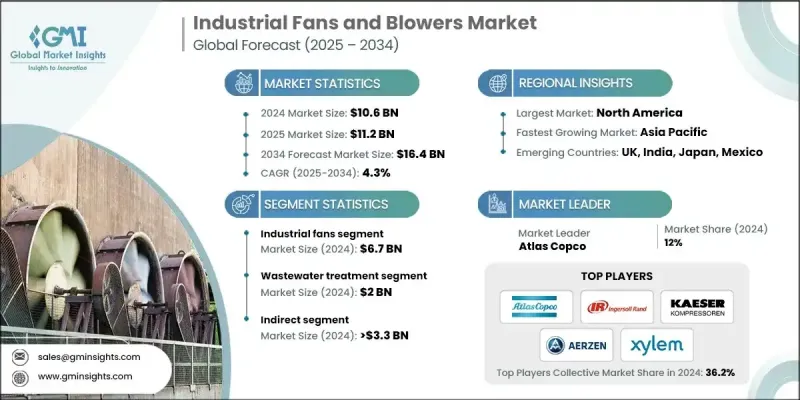

The Global Industrial Fans and Blowers Market was valued at USD 10.6 billion in 2024 and is estimated to grow at a CAGR of 4.3% to reach USD 16.4 billion by 2034.

Industrial fans and blowers are essential components across numerous sectors, ensuring proper ventilation, enhancing workplace safety, and maintaining optimal air quality. As industries increasingly recognize the importance of healthier work environments, they are investing in technologies that reduce operational costs while boosting efficiency and productivity. Manufacturers are responding with innovations in energy-efficient and high-performance systems. Leading companies such as Howden and Atlas Copco focus on delivering solutions that meet the evolving needs of critical industries, ranging from heavy manufacturing to wastewater treatment, emphasizing sustainability, safety, and operational reliability. Rising environmental awareness and stricter regulatory standards have further accelerated adoption, making fans and blowers a vital part of modern industrial operations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.6 Billion |

| Forecast Value | $16.4 Billion |

| CAGR | 4.3% |

The industrial fans category generated USD 6.7 billion in 2024. Demand is rising due to their multifunctional use in air circulation, exhaust systems, cooling, and dust control. Fans enable better temperature and humidity regulation while improving air quality, which significantly enhances safety and productivity in environments such as manufacturing facilities, chemical plants, and data centers.

The wastewater treatment segment generated USD 2 billion in 2024. Governments worldwide are increasing investments in treatment facilities to address urban population growth and stricter environmental regulations. Fans and blowers are critical in providing aeration, ventilation, and odor control, supporting efficient and compliant wastewater management.

U.S. Industrial Fans and Blowers Market held 78.7% share in 2024. The country's industrial infrastructure drives demand across key sectors, including manufacturing, chemicals, energy, and HVAC. Fans and blowers are critical for air circulation, cooling, and pollution control. Regulatory frameworks and environmental policies promote energy-efficient and innovative solutions, while ongoing urbanization and infrastructure development support continued market expansion.

Major players in the Global Industrial Fans and Blowers Market include Ingersoll Rand, Sofaco, Kaeser, Kay International, Piller, Aerzen, Busch, New York Blower, Xylem, Dicheng, Howden, Savio, Everest, Atlas Copco, and Atlantic Blower. Companies in the Industrial Fans and Blowers Market focus on innovation, efficiency, and market expansion to strengthen their presence. Investment in research and development enables the creation of energy-efficient, high-performance, and low-maintenance products. Strategic partnerships with industrial manufacturers, construction companies, and wastewater management facilities enhance distribution channels and project reach. Companies emphasize sustainability and regulatory compliance, positioning products as environmentally responsible solutions. Diversification of product portfolios to cater to multiple industries and applications strengthens market foothold. Marketing campaigns highlight operational efficiency, cost savings, and performance reliability to build customer trust.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Power source

- 2.2.4 Capacity

- 2.2.5 End use

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for industrial ventilation

- 3.2.1.2 Expanding industrial applications

- 3.2.1.3 Urbanization and infrastructure development

- 3.2.1.4 Security and safety concerns

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Maintenance and operational costs

- 3.2.2.2 Competitive pricing pressure

- 3.2.3 Opportunities

- 3.2.3.1 Energy-efficient and smart ventilation systems

- 3.2.3.2 Growth in HVAC and pollution control applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code-8414.59.30)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Gap analysis

- 3.10 Risk assessment and mitigation

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Industrial fans

- 5.2.1 Centrifugal fans

- 5.2.1.1 Forward curved

- 5.2.1.2 Backward curved

- 5.2.2 Axial fans

- 5.2.3 Mixed flow fans

- 5.2.4 Cross flow fans

- 5.2.5 Others (Plenum Fans, etc.)

- 5.2.1 Centrifugal fans

- 5.3 Industrial blower

- 5.3.1 Positive displacement blowers

- 5.3.2 Centrifugal blowers

- 5.3.3 High speed turbo blowers

- 5.3.4 Multistage centrifugal blowers

- 5.3.5 Others (regenerative blowers etc.)

Chapter 6 Market Estimates & Forecast, By Power source, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Cord

- 6.3 Cordless

Chapter 7 Market Estimates & Forecast, By Capacity, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 High

- 7.3 Medium

- 7.4 Low

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Food & beverage

- 8.3 Wastewater treatment

- 8.4 Cement plant

- 8.5 Steel plant

- 8.6 Mining

- 8.7 Power plant

- 8.8 Chemical

- 8.9 Oil and gas

- 8.10 Aerospace and defense

- 8.11 Food processing

- 8.12 Pulp and paper

- 8.13 Water treatment plant

- 8.14 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Aerzen

- 11.2 Atlantic Blower

- 11.3 Atlas Copco

- 11.4 Busch

- 11.5 Dicheng

- 11.6 Everest

- 11.7 Howden

- 11.8 Ingersoll Rand

- 11.9 Kaeser

- 11.10 Kay International

- 11.11 New York Blower

- 11.12 Piller

- 11.13 Savio

- 11.14 Sofaco

- 11.15 Xylem