PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876529

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876529

Automotive Quality Inspection AI System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

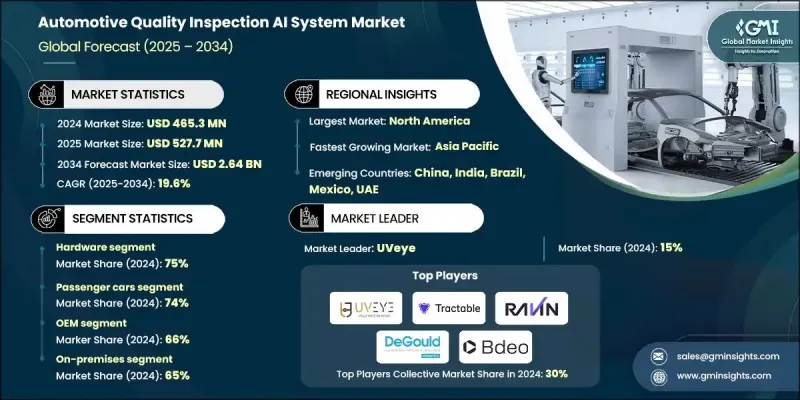

The Global Automotive Quality Inspection AI System Market was valued at USD 465.3 million in 2024 and is estimated to grow at a CAGR of 19.6% to reach USD 2.64 billion by 2034.

Automakers are increasingly adopting AI-driven inspection systems to achieve zero-defect production standards. These technologies detect defects at the earliest stages of manufacturing, ensuring product consistency and quality. The adoption of automation reduces human error, increases process reliability, and supports the production of vehicles free from rework or defects. Regulatory pressure across regions is pushing manufacturers to comply with stringent safety and quality standards, and AI systems provide real-time inspection of critical components to minimize recall risks. These solutions also enhance production efficiency, allowing manufacturers to monitor assembly lines continuously, identify flaws instantly, and make prompt, informed decisions, ensuring that high-volume manufacturing outputs remain uniform and reliable.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $465.3 Million |

| Forecast Value | $2.64 Billion |

| CAGR | 19.6% |

In 2024, the hardware segment held a 75% share, driven by demand for AI-enabled cameras, sensors, and imaging devices that enable precise defect detection and real-time process monitoring. Advanced high-resolution cameras, 3D sensors, and LiDAR systems are increasingly used in production lines, improving accuracy and monitoring capabilities. AI hardware with edge computing is becoming popular, offering enhanced data processing, lower latency, and faster decision-making independent of centralized servers.

The passenger car segment held a 74% share in 2024, reflecting strong global demand and the adoption of AI-based inspection in production lines to ensure flawless manufacturing. AI technologies help manage complex assembly processes, such as sophisticated electronics integration and advanced bodywork, detecting minor defects, reducing human error, validating quality control processes, and enhancing customer satisfaction while mitigating costly recalls.

U.S. Automotive Quality Inspection AI System Market generated USD 156.5 million in 2024. The country benefits from a mature automotive manufacturing sector with advanced robotics, integrated smart factories, and extensive AI-driven quality inspection deployments that enable real-time defect detection, predictive maintenance, and process optimization across assembly lines.

Leading companies in the Global Automotive Quality Inspection AI System Market include Monk.AI, Tractable, UVeye, Bdeo, Ravin.AI, Pave AI, Inspektlabs, Claim Genius, WeProov, and DeGould. Companies in the Global Automotive Quality Inspection AI System Market are adopting several strategies to strengthen their presence and expand market share. They are investing in R&D to develop next-generation AI algorithms and sensor technologies for higher defect detection accuracy. Strategic partnerships with OEMs, robotics integrators, and smart factory providers expand deployment opportunities. Firms are leveraging edge computing and cloud-based AI platforms to enhance real-time data processing and predictive analytics. Mergers and acquisitions are used to broaden technology portfolios and global reach. Additionally, companies emphasize customer support, training programs, and tailored solutions to build trust, ensure adoption, and create long-term strategic relationships with manufacturers, solidifying their competitive positioning.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Vehicle

- 2.2.4 Application

- 2.2.5 End Use

- 2.2.6 Deployment mode

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for zero-defect manufacturing

- 3.2.1.2 Stringent safety and regulatory standards

- 3.2.1.3 Need for real-time quality assurance

- 3.2.1.4 Cost and time optimization

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial implementation cost

- 3.2.2.2 Data quality and model training limitations

- 3.2.3 Market opportunities

- 3.2.3.1 Growing EV manufacturing base

- 3.2.3.2 Expansion in developing markets

- 3.2.3.3 Cloud-based AI inspection platforms

- 3.2.3.4 Cross-industry applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 Global

- 3.4.1.1 AI system security architecture requirements

- 3.4.1.2 Data privacy regulations compliance (GDPR, CCPA)

- 3.4.1.3 Industrial cybersecurity standards (ISO/SAE 21434)

- 3.4.1.4 Threat modeling & risk assessment

- 3.4.2 North America

- 3.4.3 Europe

- 3.4.4 Asia Pacific

- 3.4.5 Latin America

- 3.4.6 Middle East & Africa

- 3.4.1 Global

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.10.1 Total cost of ownership (TCO) calculations

- 3.10.2 Implementation cost breakdown analysis

- 3.10.3 Operational savings quantification

- 3.10.4 Quality improvement financial impact

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

- 3.14 Scalability & multi-site deployment

- 3.14.1 Global manufacturing network requirements

- 3.14.2 Centralized vs. Distributed AI model management

- 3.14.3 Cross-plant performance standardization

- 3.14.4 Regional compliance & localization needs

- 3.15 Real-time performance & latency optimization

- 3.15.1 Production line speed requirements analysis

- 3.15.2 Edge computing architecture design

- 3.15.3. Network infrastructure & 5 G integration

- 3.15.4 Hardware acceleration & GPU utilization

- 3.16 Model explainability & audit trails

- 3.16.1 Regulatory compliance documentation requirements

- 3.16.2 Ai decision transparency & interpretability

- 3.16.3 Audit trail generation & management

- 3.16.4 Quality assurance traceability systems

- 3.17 Data quality & model drift management

- 3.17.1 Training data quality assurance

- 3.17.2 Continuous model performance monitoring

- 3.17.3 Model retraining & update strategies

- 3.17.4 Data drift detection & mitigation

- 3.18 Edge-cloud hybrid architecture design

- 3.19 Vendor risk management & supply chain resilience

- 3.20 Performance benchmarking & KPI management

- 3.21 Predictive analytics & preventive actions

- 3.22 Disaster recovery & business continuity

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

- 4.7 Strategic initiatives analysis

- 4.8 Vendor selection criteria

- 4.9 Technology differentiation strategies

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 AI cameras & imaging devices

- 5.2.2 Sensors & detection units

- 5.2.3 Robotics & automation equipment

- 5.2.4 Lighting & computing systems

- 5.3 Software

- 5.3.1 Computer vision & imaging software

- 5.3.2 Machine learning / AI models

- 5.3.3 Data analytics & reporting platforms

- 5.3.4 Integration & monitoring software

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Sedan

- 6.2.2 SUV

- 6.2.3 Hatchback

- 6.3 Commercial vehicles

- 6.3.1 LCV (Light commercial vehicles)

- 6.3.2 MCV (Medium commercial vehicles)

- 6.3.3 HCV (Heavy commercial vehicles)

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Body & paint inspection

- 7.3 Engine & powertrain inspection

- 7.4 Electronics & component inspection

- 7.5 Assembly line monitoring

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Tier-1 suppliers

Chapter 9 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 On-premises

- 9.3 Cloud-based

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.3.8 Poland

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Vietnam

- 10.4.7 Thailand

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global companies

- 11.1.1 Bdeo

- 11.1.2 Cognex

- 11.1.3 DeGould

- 11.1.4 Inspektlabs

- 11.1.5 Keyence

- 11.1.6 Monk.AI

- 11.1.7 Omron

- 11.1.8 Pave AI

- 11.1.9 Ravin.AI

- 11.1.10 SICK

- 11.1.11 Tractable

- 11.1.12 UVeye

- 11.1.13 WeProov

- 11.2 Regional companies

- 11.2.1 Dataspan

- 11.2.2 Isra Vision (Atlas Copco)

- 11.2.3 Robovis

- 11.2.4 SECO

- 11.2.5 Claim Genius

- 11.3 Emerging companies

- 11.3.1 Axelera AI

- 11.3.2 Cincoze

- 11.3.3 Datagon AI

- 11.3.4 Datasensing

- 11.3.5 NXP Semiconductor (AI Solutions)

- 11.3.6 Plex by Rockwell Automation

- 11.3.7 Robovision

- 11.3.8 SinceVision