PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876540

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876540

Machine Tool Spindle Units Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

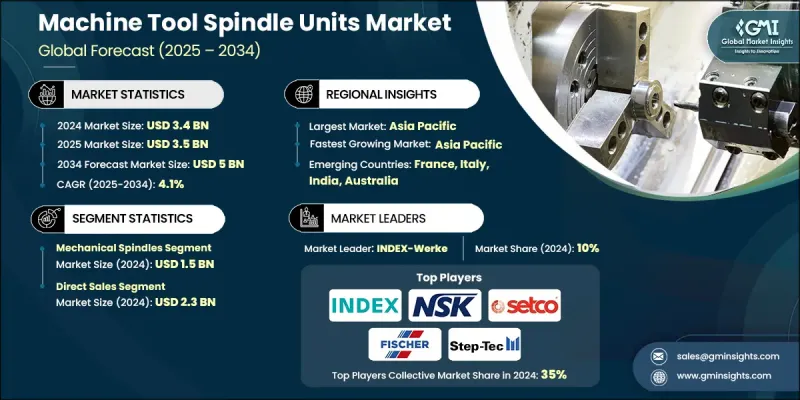

The Global Machine Tool Spindle Units Market was valued at USD 3.4 billion in 2024 and is estimated to grow at a CAGR of 4.1% to reach USD 5 billion by 2034.

The growth is fueled by rising demand for high-precision machining across industries, including aerospace, automotive, electronics, and medical devices. Manufacturers are increasingly investing in advanced spindle technologies to achieve higher speeds, lower vibration, and consistent torque, enabling the production of parts with tight tolerances, intricate geometries, and superior surface finishes. High demand is particularly observed in applications requiring extreme precision, such as advanced drivetrain components, turbine blades, and microelectronics. Smaller and lighter materials further emphasize the need for precise machining. High-performance spindles also facilitate multi-axis CNC machining and additive-subtractive hybrid manufacturing, where spindles post-process 3D-printed components. Growing global quality standards and regulatory requirements continue to drive the adoption of precision spindles worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.4 Billion |

| Forecast Value | $5 Billion |

| CAGR | 4.1% |

The mechanical spindles segment generated USD 1.5 billion in 2024. Their popularity is attributed to their simplicity, durability, and high uptime. Without an integrated motor, mechanical spindles rely on external drives, which makes them cost-effective and easier to maintain, particularly for small and mid-sized manufacturers. Their robust design is ideal for heavy-duty applications requiring consistent torque and rigidity.

The direct sales distribution segment generated USD 2.3 billion in 2024. Selling directly allows spindle manufacturers to build strong relationships with end-users, understand their specific machining requirements, and provide tailored solutions. Direct engagement also ensures access to technical support, customization, and enhanced feedback loops, improving overall customer experience.

U.S. Machine Tool Spindle Units Market held 78.2% share, generating USD 210 million in 2024. Market growth is driven by revitalized domestic manufacturing and federal initiatives promoting semiconductors, electric vehicles, and defense manufacturing. These investments are increasing the demand for advanced spindles, particularly multi-axis and AI-integrated models compatible with CNC machinery. U.S. manufacturers are also adopting hybrid additive-subtractive machining systems that rely heavily on high-performance spindles to enhance productivity and maintain precision in complex operations.

Key players in the Global Machine Tool Spindle Units Market include EMCO Group, Takisawa Machine Tools, Buffoli Industries Group, Step-Tec, GMN Paul Muller Industrie, Setco Spindle, FISCHER Spindle Technology, NSK Nakanishi, IBAG Spindle Technology, Westwind Air Bearings, INDEX-Werke, Professional Instruments, Kessler Spindle Systems, Colombo Filippetti, and Changzhou Hanqi Spindle. Companies in the Global Machine Tool Spindle Units Market are implementing multiple strategies to strengthen their position. They are investing heavily in research and development to improve spindle speed, precision, vibration control, and durability. Strategic collaborations and partnerships expand their distribution reach and enable entry into new industrial applications. Firms are focusing on developing customizable solutions to meet the unique requirements of aerospace, automotive, and electronics manufacturers. Mergers and acquisitions are leveraged to consolidate market share and acquire advanced technologies.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product/technology type

- 2.2.3 Technology performance

- 2.2.4 Application

- 2.2.5 End use industry

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for high-precision machining

- 3.2.1.2 Technological advancements in spindle design

- 3.2.1.3 Demand for energy-efficient and compact solutions

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High R&D and production costs

- 3.2.2.2 Fluctuating raw material costs

- 3.2.3 Opportunities

- 3.2.3.1 Smart manufacturing & industry 4.0

- 3.2.3.2 Customization & modular spindle systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product/technology type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product/Technology Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Mechanical spindles

- 5.3 Electric/motorized spindles

- 5.4 Air-driven spindles

- 5.5 Specialized/hybrid spindles

Chapter 6 Market Estimates and Forecast, By Technology Performance, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Standard Speed Spindles (0-8,000 RPM)

- 6.3 High-Speed Spindles (8,000-25,000 RPM)

- 6.4 Ultra-High Speed Spindles (25,000-60,000+ RPM)

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Machining centers (vertical/horizontal)

- 7.3 Turning machines/lathes

- 7.4 Grinding machines

- 7.5 Milling machines

- 7.6 Gear cutting/finishing machines

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Automotive industry

- 8.3 Aerospace

- 8.4 Medical technology

- 8.5 Energy sector

- 8.6 Defense industry

- 8.7 General manufacturing

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Buffoli Industries Group

- 11.2 Changzhou Hanqi Spindle

- 11.3 Colombo Filippetti

- 11.4 EMCO Group

- 11.5 FISCHER Spindle Technology

- 11.6 GMN Paul Muller Industrie

- 11.7 IBAG Spindle Technology

- 11.8 INDEX-Werke

- 11.9 Kessler Spindle Systems

- 11.10 NSK Nakanishi

- 11.11 Professional Instruments Company

- 11.12 Setco Spindle

- 11.13 Step-Tec

- 11.14 Takisawa Machine Tools

- 11.15 Westwind Air Bearings