PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876551

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876551

Membranes Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

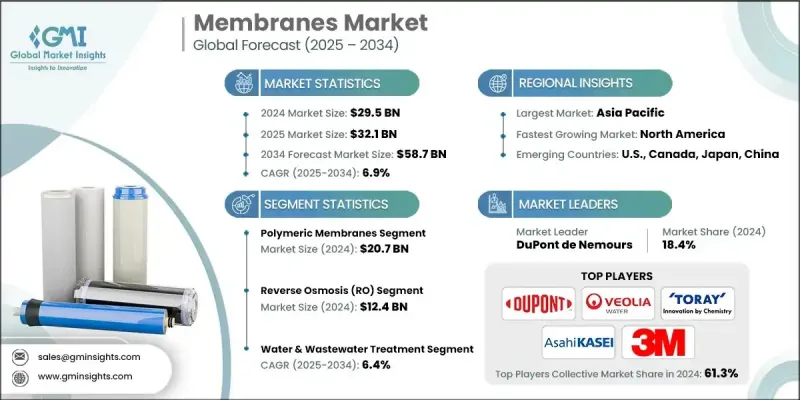

The Global Membranes Market was valued at USD 29.5 billion in 2024 and is estimated to grow at a CAGR of 6.9% to reach USD 58.7 billion by 2034.

Industries are increasingly integrating membrane technologies into wastewater treatment processes due to stricter discharge standards and new effluent targets. Regulatory guidelines encourage the use of advanced systems, such as membrane bioreactors and reverse osmosis, to achieve near-zero liquid discharge, prompting industries to adopt high-recovery membranes for cost efficiency. Rising freshwater scarcity is driving both governments and businesses to invest in water desalination and recycling technologies. Growth in seawater and brackish water reverse osmosis plants across various regions is boosting membrane adoption. Continuous improvements in thin-film composite (TFC) and PVDF membranes, including enhanced permeability, fouling resistance, and durability, are reducing operational costs and enabling their use in challenging applications. Ongoing R&D and pilot initiatives further support long-term market expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $29.5 Billion |

| Forecast Value | $58.7 Billion |

| CAGR | 6.9% |

The polymeric membranes segment generated USD 20.7 billion in 2024. These membranes dominate due to their adaptability and superior performance. PVDF, PA, and PES materials are widely used in various filtration processes for industrial and municipal applications because of their high chemical stability, permeability, and ease of scaling. Continuous innovations in antifouling coatings and surface modifications are further extending their reliability and lifespan.

The reverse osmosis (RO) segment generated USD 12.4 billion in 2024. RO systems are highly effective in removing dissolved salts and impurities, making them critical for water purification and industrial recycling. Advances in low-energy RO systems and TFC membranes have further enhanced efficiency while reducing operational costs. These improvements are strengthening RO's dominance in both developed and emerging economies.

North America Membranes Market captured 26.1% share in 2024 owing to its established industrial base and stringent water treatment regulations. Market expansion is supported by investments in municipal water reuse, desalination projects, and upgrades to industrial filtration systems across various industries. Rising environmental awareness has increased the adoption of ultrafiltration and RO systems to comply with stricter contaminant standards.

Major players in the Global Membranes Market include DuPont de Nemours, Inc., Toray Industries, Inc., Hydranautics (Nitto Group), Koch Membrane Systems, Pall Corporation (Danaher), Asahi Kasei Corporation, LG Chem Ltd., Veolia Water Technologies, Pentair plc, 3M Company, Ionomr Innovations Inc., Aquaporin A/S, Modern Water plc, Gradiant Corporation, and Membrion, Inc. Key strategies adopted by companies in the Membranes Market include investing heavily in research and development to improve membrane efficiency and lifespan, forming strategic alliances and partnerships to expand global reach, and continuously innovating product offerings to meet diverse industrial requirements. Companies are also focusing on acquisitions to consolidate market position and entering emerging markets to capture new growth opportunities.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material Type

- 2.2.3 Technology

- 2.2.4 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Stringent water quality regulations & epa compliance requirements

- 3.2.1.2 Growing water scarcity & desalination demand

- 3.2.1.3 Industrial wastewater treatment mandates

- 3.2.1.4 Technological advancements in membrane materials

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial capital investment & system costs

- 3.2.2.2 Membrane fouling & operational challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with renewable energy systems

- 3.2.3.2 Smart membrane technologies & IoT integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation Landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 Material Type

- 3.7.3 Technology

- 3.7.4 Application

- 3.8 Future market trends

- 3.9 Technology and Innovation Landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Material Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Polymeric membranes

- 5.3 Ceramic membranes

- 5.4 Composite & hybrid membranes

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Microfiltration (MF)

- 6.3 Ultrafiltration (UF)

- 6.4 Nanofiltration (NF)

- 6.5 Reverse Osmosis (RO)

- 6.6 Electrodialysis (ED)

- 6.7 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Water & wastewater treatment

- 7.2.1 Municipal drinking water treatment

- 7.2.2 Industrial wastewater processing

- 7.2.3 Membrane bioreactor (MBR) systems

- 7.2.4 Water reuse & reclamation

- 7.3 Desalination applications

- 7.3.1 Seawater reverse osmosis (SWRO)

- 7.3.2 Brackish water treatment

- 7.3.3 Energy recovery & optimization

- 7.4 Industrial processing

- 7.4.1 Food & beverage applications

- 7.4.2 Pharmaceutical & biotechnology

- 7.4.3 Chemical & petrochemical processing

- 7.4.4 Oil & gas produced water treatment

- 7.4.5 Mining & metal recovery

- 7.5 Gas separation & energy applications

- 7.5.1 Hydrogen purification & fuel cells

- 7.5.2 Natural gas processing

- 7.5.3 Air separation applications

- 7.5.4 Energy storage & battery separators

- 7.6 Medical & biotechnology applications

- 7.6.1 Hemodialysis & medical devices

- 7.6.2 Sterile filtration & bioprocessing

- 7.6.3 In-vitro diagnostics (IVD)

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 DuPont de Nemours, Inc.

- 9.2 Toray Industries, Inc.

- 9.3 Hydranautics (Nitto Group)

- 9.4 Koch Membrane Systems

- 9.5 Pall Corporation (Danaher)

- 9.6 Asahi Kasei Corporation

- 9.7 LG Chem Ltd.

- 9.8 Veolia Water Technologies

- 9.9 Pentair plc

- 9.10 3M Company

- 9.11 Ionomr Innovations Inc.

- 9.12 Aquaporin A/S

- 9.13 Modern Water plc

- 9.14 Gradiant Corporation

- 9.15 Membrion, Inc.