PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876553

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876553

Heterogeneous Catalysts for Green Chemistry Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

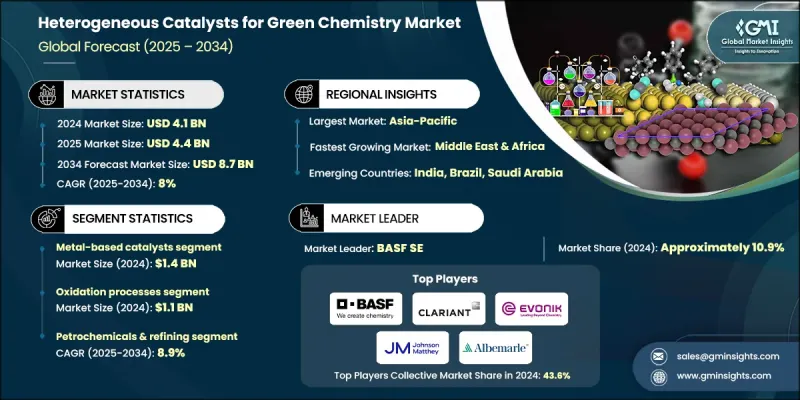

The Global Heterogeneous Catalysts for Green Chemistry Market was valued at USD 4.1 billion in 2024 and is estimated to grow at a CAGR of 8% to reach USD 8.7 billion by 2034.

The growth is being driven by technological breakthroughs, regulatory pressures, and the rising focus on sustainable chemical processes. Advancements in computational modeling, high-throughput screening, and digital twin simulations are significantly shortening research cycles and enabling faster identification of high-performance catalysts. Meanwhile, regulations targeting sulfur and CO2 emissions in major regions like the European Union and China are encouraging refineries and chemical plants to invest in next-generation catalysts, even during periods of economic uncertainty. The industry is increasingly data-driven, combining in-situ spectroscopy with cloud analytics to accelerate concept-to-commercialization timelines. These trends are attracting new entrants with digital-first approaches, while established players are continuously upgrading processes to comply with evolving environmental standards.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.1 Billion |

| Forecast Value | $8.7 Billion |

| CAGR | 8% |

The oxidation processes segment was valued at USD 1.1 billion in 2024 and is expected to grow at a CAGR of 7% from 2025 to 2034. Low-temperature electrified platforms are enabling decarbonization, with oxidation and hydrogenation reactions increasingly sharing water-electrolysis infrastructure, shifting operating costs from gas to renewable power. This is driving demand for cross-compatible heterogeneous catalysts that perform effectively under both chemical and electrochemical conditions.

The petrochemicals and refining segment was valued at USD 1.3 billion in 2024, accounting for a 31.3% share, and is projected to grow at a CAGR of 8.9% during 2025-2034. Refining continues to consume the majority of heterogeneous catalyst volumes, with operations now processing alternative feedstocks and optimizing product yields to meet stringent sulfur regulations. Advanced catalyst formulations are helping refineries transform traditional operations into value-generating processes.

North America Heterogeneous Catalysts for Green Chemistry Market generated USD 1.2 billion in 2024 and is expected to reach USD 2.6 billion by 2034. Supportive policies, including incentives under the Inflation Reduction Act, are driving investments in renewable-fuel and CO2-to-chemical projects. These programs create a steady demand for durable catalysts like Ag, CuZn, and NiFe produced by industry leaders such as Albemarle, Johnson Matthey, and emerging innovators. Multi-year service contracts bundling catalysts, digital twin technologies, and metal buy-back programs are increasingly adopted to secure supply chains and stabilize pricing.

Key players operating in the Global Heterogeneous Catalysts for Green Chemistry Market include Evonik Industries AG, Johnson Matthey plc, Clariant AG, BASF SE, and Albemarle Corporation. Companies in the Heterogeneous Catalysts for Green Chemistry Market are employing several strategies to strengthen their position and expand their presence. They are investing in advanced research and development to create catalysts with higher efficiency, selectivity, and cross-compatibility for both chemical and electrochemical processes. Strategic collaborations with industrial end-users and research institutions help accelerate product adoption and validation. Firms are also enhancing digital capabilities through simulation, AI, and cloud-based analytics to optimize catalyst performance and lifecycle management.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Process

- 2.2.4 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Type, 2025 - 2034 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Metal-based catalysts

- 5.2.1 Noble metal catalysts (Pt, Pd, Rh, Au)

- 5.2.2 Base metal catalysts (Ni, Cu, Co, Fe)

- 5.2.3 Bimetallic and alloy systems

- 5.3 Metal oxide catalysts

- 5.3.1 Single metal oxides

- 5.3.2 Mixed metal oxides and perovskites

- 5.4 Zeolite-based catalysts

- 5.4.1 Synthetic zeolites

- 5.4.2 Hierarchical and modified zeolites

- 5.5 Metal-organic frameworks (MOFs)

- 5.5.1 Zr-MOFs and UiO series

- 5.5.2 Cu-MOFs and HKUST-1 derivatives

- 5.6 Carbon-based catalysts

- 5.6.1 Activated carbon and biochar

- 5.6.2 Carbon nanotubes and graphene

Chapter 6 Market Estimates and Forecast, By Process, 2025 - 2034 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Oxidation processes

- 6.3 Hydrogenation and reduction

- 6.4 Acid-base catalyzed reactions

- 6.5 C-C bond formation reactions

- 6.6 Photocatalytic and electrocatalytic processes

Chapter 7 Market Estimates and Forecast, By End Use, 2025 - 2034 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Petrochemicals & refining

- 7.2.1 Hydroprocessing applications

- 7.2.2 Fluid catalytic cracking

- 7.2.3 Reforming and isomerization

- 7.3 Fine chemicals & pharmaceuticals

- 7.3.1 API synthesis

- 7.3.2 Specialty chemical production

- 7.3.3 Chiral and enantioselective synthesis

- 7.4 Environmental applications

- 7.4.1 Air pollution control

- 7.4.2 Water treatment technologies

- 7.4.3 CO2 conversion and utilization

- 7.5 Polymer & plastics production

- 7.5.1 Polyolefin catalysis

- 7.5.2 Sustainable polymer synthesis

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Region, 2025 - 2034 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East & Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 BASF SE

- 9.2 Clariant AG

- 9.3 Evonik Industries AG

- 9.4 Johnson Matthey plc

- 9.5 Albemarle Corporation

- 9.6 W. R. Grace & Co.

- 9.7 Haldor Topsøe A/S

- 9.8 Honeywell UOP

- 9.9 Axens S.A.

- 9.10 Umicore

- 9.11 Zeolyst International

- 9.12 JGC Catalysts and Chemicals Ltd.

- 9.13 CRI Catalyst Company

- 9.14 SOLVAY S.A.

- 9.15 Sud-Chemie India Pvt Ltd