PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876568

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876568

Silicon Carbide (SiC) for Wireless EV Charging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

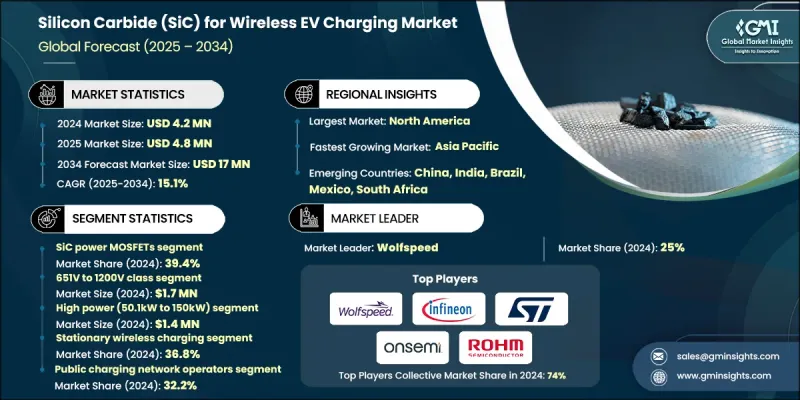

The Global Silicon Carbide (SiC) for Wireless EV Charging Market was valued at USD 4.2 million in 2024 and is estimated to grow at a CAGR of 15.1% to reach USD 17 million by 2034.

The surge in electric vehicle adoption worldwide is driving demand for SiC in wireless EV charging systems, as consumers and commercial fleets increasingly prefer faster, more efficient, and convenient charging solutions. SiC components provide higher power conversion efficiency and lower energy losses than conventional silicon devices, making them highly suitable for high-frequency wireless charging applications. Their ability to function at elevated voltages and temperatures also allows for compact and lightweight charger designs, positioning SiC as a critical enabler of next-generation EV charging infrastructure. Advancements in SiC semiconductor materials and manufacturing such as higher wafer quality, improved production yield, and refined device architecture have enhanced efficiency, thermal stability, and reliability. Innovations in SiC MOSFETs and diodes further reduce energy losses and support smaller, integrated charging solutions with higher power density and switching frequency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.2 Million |

| Forecast Value | $17 Million |

| CAGR | 15.1% |

The SiC power MOSFETs segment held a 39.4% share in 2024, driven by their superior efficiency, lower switching losses, and higher power density. These features enable faster, more compact, and thermally efficient wireless EV chargers. Manufacturers are focusing on improving device reliability, gate oxide stability, and packaging to meet high-frequency operational demands.

The 651V to 1200V class segment generated USD 1.7 million in 2024, owing to its suitability for mid- to high-power wireless EV charging. These components offer exceptional efficiency and thermal performance, and producers are investing in device robustness, gate reliability, and automotive-grade packaging integration, while collaborating with EV OEMs on inverter design and thermal modeling to enhance product positioning.

North America Silicon Carbide (SiC) for Wireless EV Charging Market held a 34.5% share in 2024, driven by rising EV adoption, supportive government initiatives, and investments in advanced charging infrastructure. Environmental awareness and clean energy incentives are increasing demand for high-efficiency SiC technology. Manufacturers have opportunities to expand wireless EV charging networks in both urban and suburban areas, with strategic partnerships with utilities and investments in scalable SiC infrastructure helping to capture growing residential, commercial, and public transit charging demand.

Leading players in the Global Silicon Carbide (SiC) for Wireless EV Charging Market include Infineon Technologies, Mitsubishi Electric, Microchip Technology, STMicroelectronics, GeneSiC Semiconductor (Qorvo), onsemi (ON Semiconductor), UnitedSiC (Qorvo), Fuji Electric, Toshiba, ROHM Semiconductor, WiTricity Corporation, HEVO Inc., Littelfuse (IXYS), General Electric (GE), Electreon Wireless Ltd., Plugless Power Inc. (Evatran), Qualcomm Technologies (Halo), InductEV Inc., ABB Ltd., Robert Bosch GmbH, Toyota Motor Corporation, Siemens AG, and Continental AG. Companies in the Silicon Carbide (SiC) for Wireless EV Charging Market are strengthening their presence through strategies such as continuous product innovation, focusing on high-efficiency, thermally robust SiC MOSFETs and diodes. Many are forming strategic partnerships with EV OEMs and utility providers to integrate SiC solutions into wireless charging networks. Investments in scalable manufacturing processes, wafer quality improvements, and packaging optimization enhance reliability and reduce energy losses. Firms also focus on expanding regional presence, participating in collaborative research, and demonstrating high-performance applications to gain a competitive edge. Marketing efforts highlight the energy efficiency and compact design advantages of SiC-based solutions to attract both residential and commercial clients, solidifying their foothold in the growing EV ecosystem.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Voltage trends

- 2.2.4 Power level trends

- 2.2.5 Application trends

- 2.2.6 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing adoption of electric vehicles (EVs)

- 3.2.1.2 Advancements in SiC semiconductor technology

- 3.2.1.3 Rising government support for sustainable mobility

- 3.2.1.4 Increasing focus on fast and efficient wireless charging

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of SiC materials and manufacturing

- 3.2.2.2 Complex fabrication and design requirements

- 3.2.3 Market opportunities

- 3.2.3.1 Rising global EV adoption and government incentives will drive strong demand for high-efficiency SiC-based wireless charging solutions worldwide.

- 3.2.3.2 Technological advancements in SiC semiconductors will enable faster, compact, and energy-efficient wireless chargers, expanding market opportunities across residential and commercial sectors.

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.4.1 North America

- 3.5 Technology landscape

- 3.5.1 Current trends

- 3.5.2 Emerging technologies

- 3.6 Pipeline analysis

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By SiC Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 SiC power MOSFETs

- 5.3 SiC schottky barrier diodes

- 5.4 SiC power modules

- 5.5 SiC discrete components

Chapter 6 Market Estimates and Forecast, By Voltage Rating, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Up to 650V class

- 6.3 651V to 1200V class

- 6.4 1201V to 1700V class

- 6.5 Above 1700V class

Chapter 7 Market Estimates and Forecast, By Power Level, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Low power (Up to 11kW)

- 7.3 Medium power (11.1kW to 50kW)

- 7.4 High power (50.1kW to 150kW)

- 7.5 Ultra-high power (Above 150kW)

Chapter 8 Market Estimates and Forecast, By Application Type, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Stationary wireless charging

- 8.3 Dynamic wireless charging

- 8.4 Quasi-dynamic wireless charging

- 8.5 Others

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Residential users

- 9.3 Commercial fleet operators

- 9.4 Public transit authorities

- 9.5 Public charging network operators

- 9.6 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Wolfspeed

- 11.2 Infineon Technologies

- 11.3 STMicroelectronics

- 11.4 onsemi (ON Semiconductor)

- 11.5 ROHM Semiconductor

- 11.6 Mitsubishi Electric

- 11.7 Fuji Electric

- 11.8 GeneSiC Semiconductor (Qorvo)

- 11.9 UnitedSiC (Qorvo)

- 11.10 Microchip Technology

- 11.11 Toshiba

- 11.12 General Electric (GE)

- 11.13 Littelfuse (IXYS)

- 11.14 WiTricity Corporation

- 11.15 InductEV Inc.

- 11.16 Plugless Power Inc. (Evatran)

- 11.17 HEVO Inc.

- 11.18 Electreon Wireless Ltd.

- 11.19 Qualcomm Technologies (Halo)

- 11.20 Robert Bosch GmbH

- 11.21 Continental AG

- 11.22 Toyota Motor Corporation

- 11.23 ABB Ltd.

- 11.24 Siemens AG

- 11.25 ENRX (Norway)