PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876569

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876569

Hybrid Hydrogen-Electric Powertrain Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

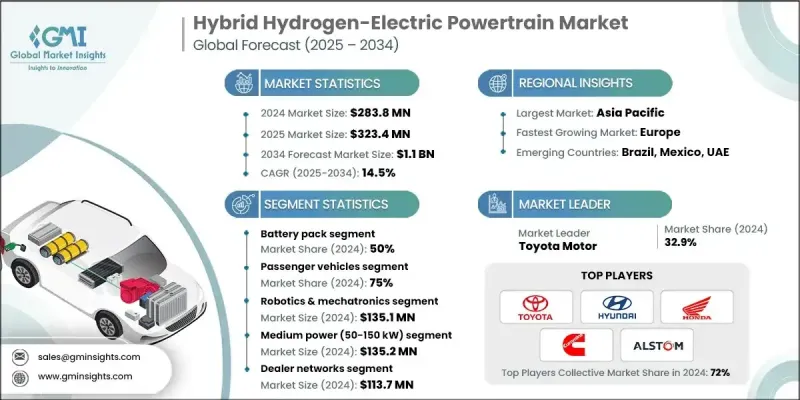

The Hybrid Hydrogen-Electric Powertrain Market was valued at USD 283.8 million in 2024 and is estimated to grow at a CAGR of 14.5% to reach USD 1.1 billion by 2034.

The market's rapid growth is propelled by the rising global focus on sustainable, energy-efficient mobility and the shift toward low-emission transportation systems. Increasing adoption of hybrid hydrogen-electric powertrains in passenger, commercial, and specialized vehicles is being influenced by stringent government policies, improved fuel economy goals, and the demand for cleaner mobility options. Ongoing progress in lightweight materials, energy storage systems, and advanced powertrain architectures is further driving technological innovation. The expanding integration of smart manufacturing and digital automation is transforming the way manufacturers design and produce these systems. Through IoT-enabled monitoring, AI-powered process management, and predictive maintenance, automotive producers are achieving greater efficiency, reduced production downtime, and improved quality standards. Advanced fuel cell technology, high-efficiency electric motors, and intelligent energy management platforms are enhancing the overall capability of hybrid hydrogen-electric systems. The adoption of digital factory ecosystems, cloud-based operations, and interoperable automation platforms is aligning the market with global decarbonization and net-zero emission initiatives.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $283.8 Million |

| Forecast Value | $1.1 Billion |

| CAGR | 14.5% |

In 2024, the battery pack segment held a 50% share and is forecast to grow at a CAGR of 14.5% between 2025 and 2034. Battery packs remain vital to hybrid hydrogen-electric powertrains, serving as the primary source for efficient energy storage and distribution. The increasing use of advanced battery technologies such as solid-state and high-density lithium-ion systems supports regenerative energy capture, extended driving range, and seamless coordination with hydrogen fuel cells and electric propulsion systems. Automakers and suppliers continue to prioritize high-performance battery packs to ensure consistent reliability, strong energy efficiency, and enhanced hybrid performance.

The passenger vehicle segment held a 75% share and is projected to grow at a CAGR of 14.4% through 2034. This segment's dominance is supported by growing production of hybrid and hydrogen-electric passenger cars, tighter emissions standards, and the expansion of smart manufacturing practices. Automotive manufacturers are investing heavily in intelligent factory solutions such as robotics, AI-based analytics, and cloud-connected monitoring systems to enhance production precision, energy efficiency, and compliance with environmental regulations.

Japan Hybrid Hydrogen-Electric Powertrain Market generated USD 69.6 million in 2024 and held a 33% share. The country's strong manufacturing base, along with extensive demand from original equipment manufacturers, Tier-1 and Tier-2 suppliers, and technology developers, supports steady market expansion. Japanese companies are implementing advanced digital solutions, including predictive analytics, IoT-based monitoring systems, and energy management platforms, across the entire powertrain value chain. The focus on modular and scalable powertrain systems enables manufacturers to meet strict environmental requirements while improving operational efficiency, reliability, and sustainability performance.

Prominent companies participating in the Global Hybrid Hydrogen-Electric Powertrain Market include Alstom SA, Ballard Power Systems, BMW Group, Cummins, Honda Motor, Hyundai Motor, Kawasaki Heavy, PowerCell Sweden AB, Symbio, and Toyota Motor. Leading manufacturers in the Global Hybrid Hydrogen-Electric Powertrain Market are strengthening their competitive positions through a combination of innovation, collaboration, and expansion. Many are investing in R&D to enhance system efficiency, hydrogen fuel cell performance, and battery integration. Strategic partnerships between automakers, component suppliers, and energy firms are accelerating technology commercialization and large-scale deployment. Companies are emphasizing digital transformation, integrating AI-based energy optimization, and adopting modular designs to improve scalability and flexibility. Furthermore, long-term investments in localized production facilities and sustainability-driven initiatives are helping leading players achieve cost advantages and align with global emission reduction goals.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Vehicle

- 2.2.4 Technology

- 2.2.5 Power Output

- 2.2.6 Hybrid Configuration

- 2.2.7 Sales Channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Government decarbonization policies & hydrogen strategies

- 3.2.1.2 Technology maturation & commercial viability demonstration

- 3.2.1.3 Heavy-duty application advantages over battery-only solutions

- 3.2.1.4 Infrastructure investment & public-private partnerships

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High system costs & component price premiums

- 3.2.2.2 Limited hydrogen refueling infrastructure

- 3.2.3 Market opportunities

- 3.2.3.1 Rail electrification gap & diesel replacement potential

- 3.2.3.2 Marine decarbonization requirements

- 3.2.3.3 Industrial & stationary power applications

- 3.2.3.4 Rail and marine decarbonization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 Global hydrogen & fuel cell policies

- 3.4.2 Emission & decarbonization regulations

- 3.4.3 Safety & vehicle standards

- 3.4.4 Infrastructure & refueling compliance

- 3.4.5 R&D & innovation incentives

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation Landscape

- 3.7.1 Fuel cell technologies

- 3.7.2 Battery & energy storage

- 3.7.3 Power electronics & control units

- 3.7.4 Electric motors & drivetrains

- 3.7.5 Digital & smart manufacturing integration

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

- 3.14 Best case scenarios

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($ Mn, Units)

- 5.1 Key trends

- 5.2 Battery pack

- 5.3 Fuel cell stack

- 5.4 Electric motor & drivetrain

- 5.5 Power electronics & control unit

- 5.6 Hydrogen storage system

- 5.7 Balance of plant (BoP)

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($ Mn, Units)

- 6.1 Key trends

- 6.2 Passenger vehicles

- 6.2.1 Hatchbacks

- 6.2.2 Sedans

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 Light commercial vehicles (LCV)

- 6.3.2 Medium commercial vehicles (MCV)

- 6.3.3 Heavy commercial vehicles (HCV)

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 ($ Mn, Units)

- 7.1 Key trends

- 7.2 Proton exchange membrane (PEM) fuel cell systems

- 7.3 Solid oxide fuel cell (SOFC) systems

- 7.4 Phosphoric acid fuel cell (PAFC) systems

- 7.5 Molten carbonate fuel cell (MCFC) systems

- 7.6 Alkaline fuel cell (AFC) systems

Chapter 8 Market Estimates & Forecast, By Power Output, 2021 - 2034 ($ Mn, Units)

- 8.1 Key trends

- 8.2 Medium power (50-150 kW)

- 8.3 High power (150-300 kW)

- 8.4 Low power (<50 kW)

- 8.5 Ultra-High power (>300 kW)

Chapter 9 Market Estimates & Forecast, By Hybrid Configuration, 2021 - 2034 ($ Mn, Units)

- 9.1 Key trends

- 9.2 Series hybrid (FC charges battery, battery drives motor)

- 9.3 Parallel hybrid (FC and battery both drive motor)

- 9.4 Series-Parallel hybrid (Combined configuration)

- 9.5 Plug-in hybrid (External charging capability)

Chapter 10 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($ Mn, Units)

- 10.1 Key trends

- 10.2 Dealer Networks

- 10.3 Fleet Sales

- 10.4 Leasing Companies

- 10.5 OEM Direct Sales

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($ Mn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Belgium

- 11.3.7 Netherlands

- 11.3.8 Sweden

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 Singapore

- 11.4.6 South Korea

- 11.4.7 Vietnam

- 11.4.8 Indonesia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 South Africa

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 Global Player

- 12.1.1 Alstom SA

- 12.1.2 Ballard Power Systems

- 12.1.3 BMW

- 12.1.4 Bosch

- 12.1.5 Cummins

- 12.1.6 Honda Motor

- 12.1.7 Hyundai Motor

- 12.1.8 Kawasaki Heavy

- 12.1.9 Symbio

- 12.1.10 Toyota Motor

- 12.2 Regional Player

- 12.2.1 Bloom Energy Corporation

- 12.2.2 BYD

- 12.2.3 Daimler AG

- 12.2.4 FuelCell Energy

- 12.2.5 Hexagon Composites ASA

- 12.2.6 Magna International

- 12.2.7 Nissan Motor

- 12.2.8 Stellantis N.V.

- 12.2.9 Volvo Group AB

- 12.2.10 Worthington Enterprises

- 12.3 Emerging Players

- 12.3.1 ITM Power PLC

- 12.3.2 Nel ASA

- 12.3.3 Plug Power

- 12.3.4 PowerCell Sweden AB

- 12.3.5 Viritech