PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876570

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876570

In-Wheel Motor Control Semiconductors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

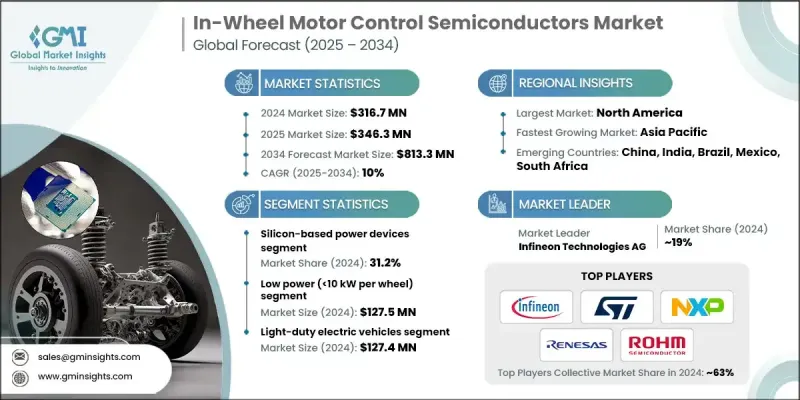

The Global In-Wheel Motor Control Semiconductors Market was valued at USD 316.7 million in 2024 and is estimated to grow at a CAGR of 10% to reach USD 813.3 million by 2034.

The growing transition toward electric mobility and the demand for efficient, lightweight, and compact drivetrain systems are key drivers behind this market's expansion. These semiconductors are essential components in controlling and optimizing power distribution within electric vehicles, ensuring better torque control, higher energy efficiency, and enhanced vehicle performance. The rising focus on sustainable transportation and energy-efficient vehicles, coupled with rapid innovation in power electronics, continues to accelerate market adoption. Increasing integration of wide-bandgap semiconductor materials such as silicon carbide (SiC) and gallium nitride (GaN) is further transforming the performance of in-wheel motor systems by reducing energy loss and improving heat management. The strong push from the electric vehicle industry, evolving consumer expectations for high-performance vehicles, and the ongoing advancements in motor control technology are shaping the global outlook for the in-wheel motor control semiconductors market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $316.7 Million |

| Forecast Value | $813.3 Million |

| CAGR | 10% |

The silicon-based power devices segment held a 31.2% share in 2024. These devices remain the most widely adopted due to their cost-effectiveness, proven dependability, and established production infrastructure. Silicon-based semiconductors are preferred by automakers for their stable performance, ease of integration, and broad market availability, making them a reliable option compared with more expensive emerging materials like SiC and GaN.

The low-power (10 kW per wheel) segment generated USD 127.5 million in 2024. This category dominates because of its suitability for smaller electric mobility applications. Low-power in-wheel motor control systems are ideal for compact and light-duty vehicles, offering efficient energy delivery, reduced heat generation, and affordable design. Their adaptability for urban mobility, including shared EVs and small electric models, continues to promote widespread deployment.

North America In-Wheel Motor Control Semiconductors Market held 28.5% share in 2024. The region benefits from strong automotive manufacturing capabilities, research innovation, and increasing investments in electric mobility and autonomous vehicle technologies. The demand for advanced semiconductor solutions in electric vehicle propulsion systems across both light-duty and heavy-duty categories continues to support regional market growth.

Europe In-Wheel Motor Control Semiconductors Market generated USD 67.9 million in 2024. The region's leadership in electric vehicle adoption, coupled with stringent emission standards and high automotive engineering expertise, is driving demand for compact and efficient motor control solutions. Continuous investment from leading European automakers in next-generation electric drivetrain systems is propelling further expansion of the market.

Key participants operating in the Global In-Wheel Motor Control Semiconductors Market include Infineon Technologies AG, NXP Semiconductors N.V., STMicroelectronics N.V., Texas Instruments Incorporated, ON Semiconductor Corporation, Renesas Electronics Corporation, ROHM Semiconductor Co., Ltd., Mitsubishi Electric Corporation, Wolfspeed, Inc., Analog Devices, Inc., Allegro MicroSystems, Inc., Melexis NV, Maxim Integrated Inc., Toshiba Corporation, Fuji Electric Co., Ltd., Continental AG, Robert Bosch GmbH, Valeo SA, Magna International Inc., and BorgWarner Inc. Leading companies in the In-Wheel Motor Control Semiconductors Market are focusing on innovation, strategic alliances, and technological expansion to strengthen their market position. Many are investing heavily in research and development to advance semiconductor efficiency, thermal management, and power density.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Semiconductor Technology Type Trends

- 2.2.3 Vehicle Application Trends

- 2.2.4 Power Rating Trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising Adoption of Electric Vehicles Demanding Efficient and Compact Motor Control Solutions.

- 3.2.1.2 Advancements in Wide-Bandgap Semiconductor Materials such as Gan and SiC Enhancing System Performance.

- 3.2.1.3 Growing Focus on Vehicle Electrification and Energy Efficiency.

- 3.2.1.4 Increasing Demand for Improved Torque Control and Driving Dynamics.

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High Production Costs Associated with Advanced Semiconductor Materials.

- 3.2.2.2 Complex Design and Integration Challenges in In-wheel Motor Systems.

- 3.2.3 Market opportunities

- 3.2.3.1 Rising Demand for Next-generation Electric and Autonomous Vehicles.

- 3.2.3.2 Integration of AI and IoT Technologies for Smart Motor Control Systems.

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.4.1 North America

- 3.5 Technology landscape

- 3.5.1 Current trends

- 3.5.2 Emerging technologies

- 3.6 Pipeline analysis

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.2.5 Latin America

- 4.2.6 Middle East and Africa

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Semiconductor Technology Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Silicon Carbide (SiC) Power Devices

- 5.3 Silicon-Based Power Devices

- 5.4 Gate Driver ICs

- 5.5 Motor Control Microcontrollers

- 5.6 Power Management ICs

- 5.7 Sensors & Actuators

Chapter 6 Market Estimates and Forecast, By Power Rating, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Low Power (<10 kW per wheel)

- 6.3 Medium Power (10-50 kW per wheel)

- 6.4 High Power (>50 kW per wheel)

Chapter 7 Market Estimates and Forecast, By Vehicle Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Light-Duty Electric Vehicles

- 7.3 Medium-Duty Electric Vehicles

- 7.4 Heavy-Duty Electric Vehicles

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Infineon Technologies AG

- 9.2 NXP Semiconductors N.V.

- 9.3 STMicroelectronics N.V.

- 9.4 Texas Instruments Incorporated

- 9.5 ON Semiconductor Corporation

- 9.6 Renesas Electronics Corporation

- 9.7 ROHM Semiconductor Co., Ltd.

- 9.8 Mitsubishi Electric Corporation

- 9.9 Wolfspeed, Inc.

- 9.10 Analog Devices, Inc.

- 9.11 Allegro MicroSystems, Inc.

- 9.12 Melexis NV

- 9.13 Maxim Integrated Inc.

- 9.14 Toshiba Corporation

- 9.15 Fuji Electric Co., Ltd.

- 9.16 Continental AG

- 9.17 Robert Bosch GmbH

- 9.18 Valeo SA

- 9.19 Magna International Inc.

- 9.20 BorgWarner Inc.