PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876575

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876575

In-Car Wellness Monitoring System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

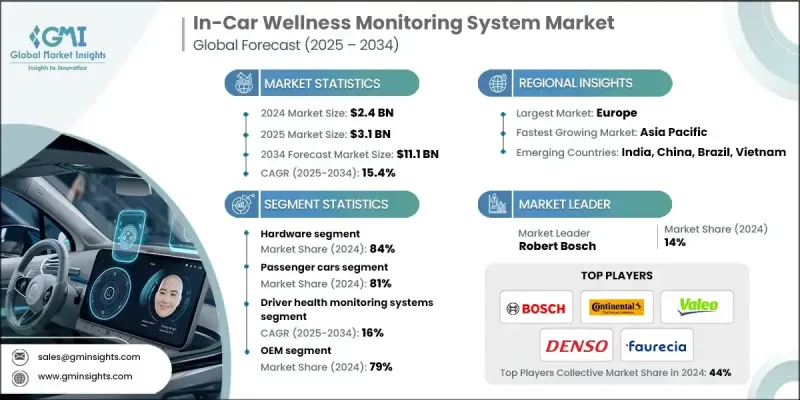

The Global In-Car Wellness Monitoring System Market was valued at USD 2.4 billion in 2024 and is estimated to grow at a CAGR of 15.4% to reach USD 11.1 billion by 2034.

The market is rapidly expanding as vehicles increasingly incorporate sensors, cameras, and AI technologies to track vital health metrics, including heart rate, fatigue, and stress levels. Consumer awareness around in-vehicle safety, combined with the adoption of advanced connected and luxury vehicle features, is fueling this growth. AI-driven monitoring solutions now offer more than safety functions, leveraging sophisticated computer vision algorithms to achieve detection accuracy exceeding 95%. By integrating multiple sensors, these systems assess physiological signals, environmental conditions, and behavioral patterns, creating comprehensive wellness ecosystems that monitor occupant health, comfort, and alertness. Infrared cameras, biometric sensors, and multi-sensor setups are used to track vital signs, posture, and stress in real time. These technologies are increasingly embedded in smart cockpit architectures, enabling proactive driver assistance, adaptive climate control, and personalized comfort settings.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.4 Billion |

| Forecast Value | $11.1 Billion |

| CAGR | 15.4% |

The ecosystem is further strengthened as in-car systems connect with wearable devices and mobile health platforms, enabling continuous health monitoring and cloud-based analytics. With the rise of automated vehicles, wellness monitoring plays a critical role in maintaining both safety and emotional stability, especially during situations where the vehicle assumes partial control.

The hardware segment held an 84% share in 2024 and is expected to grow at a CAGR of 15.6% from 2025 to 2034. High-resolution cameras, infrared sensors, and cabin monitoring optics dominate the hardware segment, while radar-based sensors allow contactless monitoring of heart rate, breathing patterns, and micro-movements without wearables. Bosch, among others, provides radar solutions enhanced by AI for in-cabin health monitoring.

The driver health monitoring systems segment held a 39.2% share in 2024, highlighting its crucial role in safety, regulatory compliance, and OEM adoption. These systems detect fatigue, track attention, and identify medical emergencies such as heart attacks or strokes. Advanced driver monitoring solutions integrate physiological sensing, enabling real-time health assessments through heart rate, stress, and vital sign measurements.

Germany In-Car Wellness Monitoring System Market is projected to grow at a CAGR of 14.3% from 2025 to 2034. The country's leadership stems from its strong automotive manufacturing sector and commitment to driver safety. Leading automakers like Audi and BMW are incorporating AI-driven wellness monitors, including biometric sensors, driver attention tracking, and emotion recognition, to enhance occupant well-being. These technologies align with the increasing adoption of electrified, connected, and semi-autonomous vehicles, catering to the demand for personalized, health-focused driving experiences.

Key companies operating in the Global In-Car Wellness Monitoring System Market include Continental, Faurecia, Robert Bosch, Aptiv, Denso, Valeo, Seeing Machines, Smart Eye, Tata Elxsi, and Gentex. Companies in the In-Car Wellness Monitoring System Market are deploying several strategies to strengthen their presence and market position. Providers are investing heavily in AI, computer vision, and multi-sensor technologies to enhance detection accuracy and reliability. Strategic partnerships with automotive OEMs enable seamless integration of wellness solutions into new vehicle models. Firms are also focusing on software-hardware ecosystems that connect vehicles with cloud analytics and mobile health platforms to offer continuous health monitoring.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Vehicle

- 2.2.4 System

- 2.2.5 Sales Channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 Rising focus on driver safety and health

- 3.2.1.3 Integration of AI, IoT, and advanced sensors

- 3.2.1.4 Government safety regulations and mandates

- 3.2.1.5 Increasing adoption in luxury and premium vehicles

- 3.2.1.6 Technological convergence with wearables and mobile devices

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High system cost and integration complexity

- 3.2.2.2 Data privacy and security concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into commercial and fleet vehicles

- 3.2.3.2 Growth in autonomous and semi-autonomous vehicles

- 3.2.3.3 Integration with wearable devices and mobile health platforms

- 3.2.3.4 Development of AI-driven predictive health analytics

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.7.3 Technology maturity & adoption lifecycle analysis

- 3.7.3.1 Technology readiness level (TRL) assessment

- 3.7.3.2 Adoption curve by market segment

- 3.7.3.3 Innovation diffusion patterns

- 3.7.3.4 Market penetration forecasting

- 3.8 Pricing analysis & cost structure dynamics

- 3.8.1 Historical price trend analysis (2021-2024)

- 3.8.2 Cost breakdown by component

- 3.8.3 Manufacturing cost structure analysis

- 3.8.4 R&d investment impact on pricing

- 3.8.5 Volume-based pricing strategies

- 3.9 Cost-benefit & ROI analysis

- 3.9.1 Total cost of ownership (TCO) models

- 3.9.2 Return on investment (ROI) calculations

- 3.9.3 Payback period analysis

- 3.9.4 Economic impact assessment

- 3.10 Patent analysis

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly Initiatives

- 3.12 Carbon footprint considerations

- 3.13 Trade analysis

- 3.13.1 Tariff & trade policy impact

- 3.13.2 Supply chain localization trends

- 3.13.3 Regional manufacturing hubs

- 3.14 User experience and human factors

- 3.14.1 Driver acceptance and adoption rates

- 3.14.2 Usability testing and user interface design

- 3.14.3 Privacy perception and consumer concerns

- 3.14.4 Alert fatigue management

- 3.14.5 Behavioral psychology in system design

- 3.15 Cybersecurity and data privacy framework

- 3.16 Insurance and fleet management integration

- 3.17 OEM vs. aftermarket ecosystem dynamics

- 3.18 Health data interoperability standards

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 (USD Mn, Units)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Sensors

- 5.2.2 Cameras

- 5.2.3 Steering wheel and seat sensors

- 5.2.4 Control units and processors

- 5.3 Software

- 5.3.1 AI-based health analytics

- 5.3.2 Driver monitoring algorithms

- 5.3.3 Data integration and alert systems

- 5.4 Services

- 5.4.1 Cloud connectivity and data management

- 5.4.2 Emergency assistance and telehealth integration

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 (USD Mn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Hatchbacks

- 6.2.2 Sedans

- 6.2.3 SUVs

- 6.3 Commercial vehicles

- 6.3.1 Light commercial vehicles

- 6.3.2 Medium commercial vehicles

- 6.3.3 Heavy commercial vehicles

- 6.4 Electric vehicles

Chapter 7 Market Estimates & Forecast, By System, 2021 - 2034 (USD Mn, Units)

- 7.1 Key trends

- 7.2 Driver health monitoring systems

- 7.3 Passenger wellness monitoring systems

- 7.4 In-cabin environment and comfort monitoring systems

- 7.5 Integrated vehicle wellness systems

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 (USD Mn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.3.8 Portugal

- 9.3.9 Croatia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Singapore

- 9.4.7 Thailand

- 9.4.8 Indonesia

- 9.4.9 Vietnam

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

- 9.6.4 Turkey

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Aptiv

- 10.1.2 Continental

- 10.1.3 Denso

- 10.1.4 HARMAN International

- 10.1.5 Magna International

- 10.1.6 NXP Semiconductors

- 10.1.7 Robert Bosch

- 10.1.8 Valeo

- 10.2 Regional Players

- 10.2.1 Antolin

- 10.2.2 Faurecia

- 10.2.3 Gentex

- 10.2.4 LG Electronics

- 10.2.5 Panasonic Automotive

- 10.2.6 Seeing Machines

- 10.2.7 Smart Eye

- 10.2.8 Tata Elxsi

- 10.2.9 Tobii

- 10.2.10 Visteon

- 10.3 Emerging Technology Innovators

- 10.3.1 Affectiva

- 10.3.2 Allegro MicroSystems

- 10.3.3 Binah.ai

- 10.3.4 Cerence

- 10.3.5 Cipia

- 10.3.6 Guardian Optical Technologies

- 10.3.7 Ultraleap