PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876577

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876577

Microfluidics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

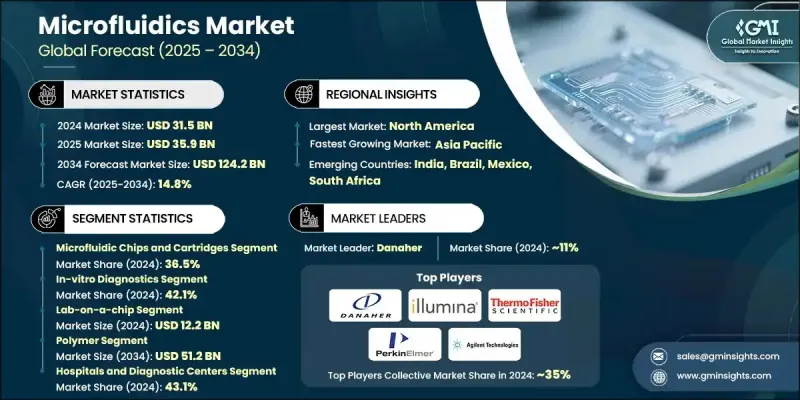

The Global Microfluidics Market was valued at USD 31.5 billion in 2024 and is estimated to grow at a CAGR of 14.8% to reach USD 124.2 billion by 2034.

The market's expansion is driven by increasing adoption of point-of-care diagnostic systems, the rise of precision medicine, and the growing demand for faster and more accurate sample analysis. The increasing prevalence of chronic diseases, including cancer, cardiovascular disorders, and diabetes, has significantly amplified the need for diagnostic technologies that deliver efficient results while ensuring patient comfort. Microfluidic devices are gaining widespread acceptance in clinical and research applications due to their ability to provide rapid results with high accuracy using minimal sample quantities. The emergence of innovations such as digital microfluidics, miniaturized lab-on-a-chip systems, and 3D cell culture models is extending the technology's use across diverse domains, including drug discovery, biomedical research, and clinical diagnostics. Furthermore, expanding healthcare infrastructure and strong R&D investments are accelerating the adoption of microfluidic technologies. Microfluidics, which involves manipulating extremely small fluid volumes within microscale channels, offers advantages such as precision control, low reagent consumption, and cost efficiency, making it indispensable for modern diagnostics and therapeutic development.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $31.5 Billion |

| Forecast Value | $124.2 Billion |

| CAGR | 14.8% |

The microfluidic chips and cartridges segment held 36.5% share in 2024, because of their critical role in enabling portable, efficient, and cost-effective diagnostic applications. These chips are vital for lab-on-a-chip systems and point-of-care testing, offering scalable solutions for decentralized healthcare settings. The rising adoption of microfluidic cartridges in regions with limited diagnostic infrastructure is further supporting this segment's growth, as these devices provide rapid, accurate results without requiring complex laboratory setups.

The in-vitro diagnostics segment held 42.1% share in 2024, fueled by increasing demand for affordable, precise, and high-throughput testing across chronic and infectious diseases. Microfluidic-based IVD solutions are widely used for liquid biopsies, genetic analyses, and infectious disease detection due to their multiplexing capabilities and exceptional sensitivity. Their integration into modern laboratory workflows enhances diagnostic efficiency while reducing turnaround times, contributing significantly to market expansion.

North America Microfluidics Market held a 43.5% share in 2024. The region's dominance stems from advanced healthcare systems, large-scale R&D spending, and strong adoption of innovative diagnostic technologies in the U.S. and Canada. Growing utilization of microfluidic platforms in research institutes, hospitals, and academic centers has created a fertile environment for continued technological development. Additionally, government-backed initiatives supporting molecular diagnostics, personalized medicine, and AI-based health analytics are further accelerating market penetration and enhancing the adoption of microfluidic devices across healthcare and life sciences sectors.

Key players active in the Global Microfluidics Market include Danaher, Illumina, Bio-Rad Laboratories, F. Hoffmann-La Roche, Qiagen, Becton Dickinson, Thermo Fisher Scientific, Agilent Technologies, bioMerieux, Bartels Mikrotechnik, Dolomite Microfluidics, Fluigent, Standard BioTools, PerkinElmer, Boston Pharmaceutical (Nanomix), Emulate, uFluidix, Sphere Fluidics, and Xona Microfluidics. To strengthen their foothold in the Global Microfluidics Market, major companies are focusing on product innovation, automation integration, and partnerships with diagnostic and pharmaceutical firms. Many are investing in the development of multifunctional lab-on-chip platforms, digital microfluidic systems, and scalable cartridge-based solutions designed for rapid, high-precision testing. Strategic collaborations between device manufacturers and biotechnology companies are helping expand product portfolios and accelerate clinical validation. Firms are also prioritizing miniaturization and connectivity to align with the growing trend of decentralized diagnostics and personalized medicine.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumption and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Application trends

- 2.2.4 Technology trends

- 2.2.5 Material trends

- 2.2.6 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for point-of-care diagnostics

- 3.2.1.2 Expansion of personalized medicine and genomics

- 3.2.1.3 Integration with AI and digital health platforms

- 3.2.1.4 Advancements in microfabrication and materials

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High development and manufacturing costs

- 3.2.2.2 Regulatory and standardization hurdles

- 3.2.3 Market opportunities

- 3.2.3.1 Growth in organ-on-chip and 3D cell culture platforms

- 3.2.3.2 Adoption in low-resource and decentralized settings

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Future market trends

- 3.6 Technological landscape

- 3.6.1 Current technologies

- 3.6.2 Emerging technologies

- 3.7 Patent analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Microfluidic chips and cartridges

- 5.3 Instruments and analyzers

- 5.4 Pumps, valves and sensors

- 5.5 Reagents and consumables

- 5.6 Other products

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Pharmaceuticals

- 6.3 Medical devices

- 6.4 In-vitro diagnostics

- 6.5 Other applications

Chapter 7 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Lab-on-a-chip

- 7.3 Organs-on-chips

- 7.4 Continuous flow microfluidics

- 7.5 Other technologies

Chapter 8 Market Estimates and Forecast, By Material, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Silicon

- 8.3 Glass

- 8.4 Polymer

- 8.5 Other materials

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals and diagnostic centers

- 9.3 Academic and research centers

- 9.4 Pharmaceutical and biotechnology companies

- 9.5 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Agilent Technologies

- 11.2 Bartels Mikrotechnik

- 11.3 Becton Dickinson

- 11.4 bioMerieux

- 11.5 Bio-Rad Laboratories

- 11.6 Boston Pharmaceutical (Nanomix)

- 11.7 Danaher

- 11.8 Dolomite Microfluidics

- 11.9 Emulate

- 11.10 F. Hoffmann-La Roche

- 11.11 Fluigent

- 11.12 Illumina

- 11.13 PerkinElmer

- 11.14 Qiagen

- 11.15 Sphere Fluidics

- 11.16 Standard BioTools

- 11.17 Thermo Fisher Scientific

- 11.18 uFluidix

- 11.19 Xona Microfluidics