PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876581

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876581

AI Orchestration Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

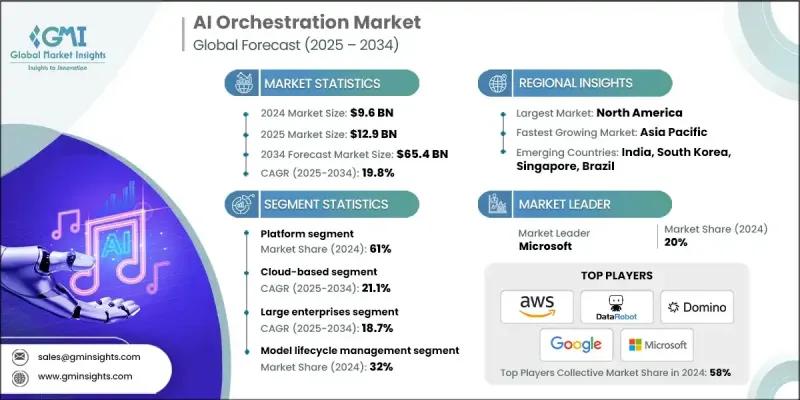

The Global AI Orchestration Market was valued at USD 9.6 billion in 2024 and is estimated to grow at a CAGR of 19.8% to reach USD 65.4 billion by 2034.

The growing complexity of AI workloads across research institutions, supercomputing centers, and industrial applications is driving the demand for orchestration solutions. AI orchestration enables seamless management of model training, simulations, and predictive analytics, improving efficiency and decision-making across sectors such as healthcare, manufacturing, and scientific research. Governments and public sector organizations are increasingly adopting AI orchestration for smart infrastructure, transportation management, and energy optimization. Countries including the US, China, Germany, and Brazil report that 40-55% of their agencies have implemented orchestrated AI systems to automate workflows, enhance operational performance, and streamline administrative processes. Integration with industrial AI applications supports predictive maintenance, adaptive production, and real-time monitoring, helping enterprises and government agencies maintain resilient, sustainable, and efficient operations. The growing collaboration between large enterprises and AI-focused start-ups worldwide is also accelerating the adoption of orchestration platforms.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.6 Billion |

| Forecast Value | $65.4 Billion |

| CAGR | 19.8% |

The platform segment held 61% share in 2024. Platforms are preferred for their ability to automate model deployment, intelligently allocate resources, integrate governance, and monitor model performance in real time. Surveys indicate that 70% of large organizations prioritize robust platform infrastructure to manage AI workflows effectively across multi-cloud and on-premise environments.

The cloud-based deployment segment is expected to grow at a CAGR of 21.1% through 2034. Cloud-based orchestration offers scalability, flexibility, and rapid resource provisioning, making it ideal for research institutions, enterprises, and small- to medium-sized businesses. Over 60% of AI projects in European research institutions reportedly utilize cloud orchestration to manage multi-cloud workflows and facilitate high-performance model training.

US AI Orchestration Market generated USD 3.3 billion in 2024. Strong federal investments in AI infrastructure and policies like the National AI Initiative Act are driving adoption. Multi-cloud strategies are increasingly popular, and orchestration tools are critical for managing AI workloads across platforms such as AWS, Azure, and Google Cloud while ensuring compliance with data sovereignty and cybersecurity standards, including FedRAMP and NIST frameworks.

Key players in the Global AI Orchestration Market include IBM, NVIDIA, Microsoft, Amazon (AWS), Palantir Technologies, DataRobot, Domino Data Lab, Oracle, Salesforce, and Google (Alphabet). Companies in the AI orchestration market are strengthening their presence by investing in advanced AI platforms with multi-cloud and hybrid capabilities, enabling seamless integration of AI workflows across diverse environments. Strategic partnerships with cloud providers, research institutions, and industry verticals allow them to expand their reach and enhance adoption. Many are enhancing automation, real-time monitoring, and governance capabilities to improve performance, compliance, and scalability. Mergers, acquisitions, and collaborative ventures help broaden their technological offerings while improving market penetration. Continuous innovation, customer-centric solutions, and global expansion strategies enable companies to solidify their foothold and maintain a competitive edge in the rapidly growing AI orchestration landscape.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Deployment

- 2.2.4 Organization Size

- 2.2.5 Application

- 2.2.6 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing enterprise adoption of generative AI & LLMs

- 3.2.1.2 Expansion of hybrid and multi-cloud deployments

- 3.2.1.3 Rising focus on operationalizing AI (MLOps + AIOps convergence)

- 3.2.1.4 Surge in AI application scaling for real-time decisioning

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Integration complexity across heterogeneous environments

- 3.2.2.2 High dependency on cloud providers & vendor lock-in

- 3.2.3 Market opportunities

- 3.2.3.1 Growth of AI orchestration for edge and IoT ecosystems

- 3.2.3.2 Rising demand for autonomous orchestration (self-optimizing workflows)

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 Pestel analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.9 Patent analysis

- 3.10 Sustainability & environmental aspects

- 3.10.1 Carbon Footprint Assessment

- 3.10.2 Circular Economy Integration

- 3.10.3 E-Waste Management Requirements

- 3.10.4 Green Manufacturing Initiatives

- 3.11 Use cases and applications

- 3.12 Best-case scenario

- 3.13 Market Adoption Patterns

- 3.13.1 Enterprise vs. SME adoption trends

- 3.13.2 Vertical-specific adoption

- 3.13.3 On-premise vs. cloud vs. hybrid deployment adoption

- 3.13.4 Use of no-code/low-code orchestration tools

- 3.14 Pricing and Licensing Models

- 3.14.1 Subscription vs. perpetual licensing

- 3.14.2 Cloud-based pay-per-use models

- 3.14.3 Enterprise negotiation trends

- 3.14.4 Pricing impact on adoption

- 3.15 Emerging Business Models

- 3.15.1 AI orchestration as a service (AIOaaS)

- 3.15.2 Platform monetization strategies

- 3.15.3 Vendor differentiation via service models

- 3.15.4 Subscription-based ecosystem models

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Platform

- 5.2.1 AI orchestration software

- 5.2.2 Workflow engines

- 5.2.3 MLOps integration tools

- 5.3 Services

- 5.3.1 Deployment

- 5.3.2 Integration

- 5.3.3 Maintenance

- 5.3.4 Consulting

- 5.3.5 Training

Chapter 6 Market Estimates & Forecast, By Deployment, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 On-Premise

- 6.3 Cloud-Based

- 6.4 Hybrid

Chapter 7 Market Estimates & Forecast, By Organization Size, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Large Enterprises

- 7.3 Small & Medium Enterprises (SMEs)

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 Model Lifecycle Management

- 8.3 Data Pipeline Orchestration

- 8.4 Workflow Automation

- 8.5 Resource Optimization

- 8.6 Monitoring & Governance

Chapter 9 Market Estimates & Forecast, By End use, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 BFSI

- 9.3 Healthcare

- 9.4 Automotive

- 9.5 Manufacturing

- 9.6 Retail & E-commerce

- 9.7 IT & Telecom

- 9.8 Government & Public Sector

- 9.9 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Alibaba Cloud

- 11.1.2 Amazon (AWS)

- 11.1.3 Google (Alphabet)

- 11.1.4 IBM

- 11.1.5 Intel

- 11.1.6 Microsoft

- 11.1.7 NVIDIA

- 11.1.8 Oracle

- 11.1.9 Salesforce

- 11.1.10 SAP

- 11.2 Regional Players

- 11.2.1 Baidu

- 11.2.2 Capgemini

- 11.2.3 DataRobot

- 11.2.4 Domino Data Lab

- 11.2.5 Fujitsu

- 11.2.6 Hitachi Vantara

- 11.2.7 Huawei Cloud

- 11.2.8 Palantir Technologies

- 11.2.9 ServiceNow

- 11.2.10 Tencent Cloud

- 11.3 Emerging Players / Disruptors

- 11.3.1 Algorithmia

- 11.3.2 C3.ai

- 11.3.3. H2O.ai

- 11.3.4 MindsDB

- 11.3.5 OctoML

- 11.3.6 Pachyderm

- 11.3.7 Paperspace

- 11.3.8 Run:AI

- 11.3.9 Spell

- 11.3.10 Verta.ai