PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876611

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876611

Dataflow AI Processor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

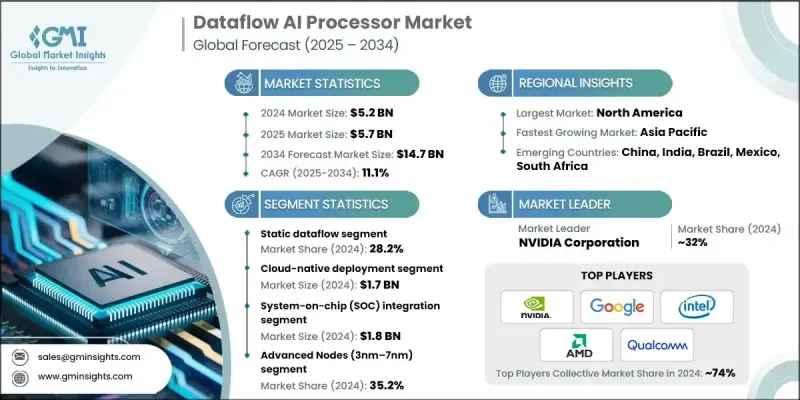

The Global Dataflow AI Processor Market was valued at USD 5.2 billion in 2024 and is estimated to grow at a CAGR of 11.1% to reach USD 14.7 billion by 2034.

The growth is fueled by the increasing demand for high-performance computing across AI inference, edge computing, and data center operations. The industry is witnessing rapid innovation through energy-efficient architectures, integration of advanced nodes ranging from 3nm to 7nm, and adoption of system-on-chip and chiplet-based designs. Dataflow processors are particularly well-suited for handling complex neural networks due to their parallel processing capabilities, supporting faster decision-making in critical sectors. As AI adoption expands in edge environments, the need for low-latency, energy-efficient processing is rising. These processors reduce data movement, maximize throughput, and are becoming essential for real-time analytics, IoT deployments, and robotics in bandwidth-constrained locations. Industries including automotive, healthcare, and telecommunications are increasingly leveraging AI for predictive analytics, automation, and intelligent control systems, driving sustained demand for dataflow AI processors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.2 Billion |

| Forecast Value | $14.7 Billion |

| CAGR | 11.1% |

The static dataflow segment held a 28.2% share in 2024, making it the largest segment. Its predictable execution model, simplified hardware requirements, and efficient resource utilization ensure consistent performance for AI workloads, making it a preferred choice for both cloud and edge deployments. Static dataflow architectures are highly valued for deterministic behavior, scalability, and reliability, especially in sectors requiring high-performance computing and consistent execution.

The cloud-native deployment segment generated USD 1.7 billion in 2024. Its scalability, flexibility, and cost-effectiveness allow seamless integration with AI platforms, dynamic workload management, and faster model training and inference. Cloud-native solutions also simplify infrastructure maintenance, enable collaborative workflows, and provide enterprises with the agility needed to meet growing AI adoption demands.

North America Dataflow AI Processor Market held a 40.2% share in 2024. The region's market expansion is driven by high demand for real-time AI workloads across sectors such as finance, healthcare, and autonomous systems. Advanced semiconductor research, strong cloud infrastructure, and strategic investments by leading technology companies further support growth. Government initiatives promoting AI innovation and edge computing adoption enhance the region's competitive position, creating opportunities for manufacturers to deploy highly efficient, scalable dataflow architectures optimized for real-time performance.

Key companies operating in the Global Dataflow AI Processor Market include NVIDIA Corporation, Intel Corporation, Advanced Micro Devices, Inc. (AMD), Qualcomm Technologies, Inc., Apple Inc., Google LLC, Microsoft Corporation, IBM Corporation, Samsung Electronics Co., Ltd., Huawei Technologies Co., Ltd., Graphcore Limited, Mythic, Inc., Cerebras Systems, Arm Holdings plc, MediaTek Inc., Fujitsu Limited, Alibaba Group Holding Limited, Baidu, Inc., Synaptics Incorporated, and CEVA, Inc. Companies in the Dataflow AI Processor Market are focusing on strategic R&D investments to improve processor efficiency, scalability, and energy performance. Collaborations and partnerships are being pursued to strengthen supply chains and integrate processors into broader AI ecosystems. Firms are diversifying their portfolios by developing specialized architectures optimized for edge, cloud, and hybrid deployments.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Type Trends

- 2.2.2 Deployment Mode Trends

- 2.2.3 Processor Integration Level Trends

- 2.2.4 Node Size Trends

- 2.2.5 Memory Type Trends

- 2.2.6 Performance Class Trends

- 2.2.7 End Use Industry Trends

- 2.2.8 Application Trends

- 2.2.9 Regional Trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for real-time data processing and analysis

- 3.2.1.2 Growing adoption of artificial intelligence and machine learning technologies

- 3.2.1.3 Rising need for energy-efficient and high-performance computing solutions

- 3.2.1.4 Expansion of Internet of Things (IoT) devices and applications

- 3.2.1.5 Advancements in cloud computing and big data analytics

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Competition from traditional hardware accelerators

- 3.2.2.2 Complexity in developing and optimizing AI applications

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of Dataflow AI processors in edge computing devices

- 3.2.3.2 Partnerships with AI software developers and cloud service providers

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.4.1 North America

- 3.5 Technology landscape

- 3.5.1 Current trends

- 3.5.2 Emerging technologies

- 3.6 Pipeline analysis

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.2.5 Latin America

- 4.2.6 Middle East and Africa

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Bn)

- 5.1 Key trends

- 5.2 Static dataflow

- 5.3 Dynamic dataflow

- 5.4 Neuromorphic/spiking

- 5.5 Spatial computing arrays

- 5.6 Coarse-Grained Reconfigurable Arrays (CGRAs)

- 5.7 Hybrid dataflow-control flow

Chapter 6 Market Estimates and Forecast, By Deployment Mode, 2021 - 2034 ($ Bn)

- 6.1 Key trends

- 6.2 Cloud-native deployment

- 6.3 Edge computing deployment

- 6.4 Embedded systems integration

- 6.5 Hybrid cloud-edge

- 6.6 On-premises enterprise

Chapter 7 Market Estimates and Forecast, By Processor Integration Level, 2021 - 2034 ($ Bn)

- 7.1 Key trends

- 7.2 Discrete processors

- 7.3 System-on-Chip (SoC) Integration

- 7.4 Chiplet-based systems

- 7.5 IP core licensing

- 7.6 FPGA-based solutions

Chapter 8 Market Estimates and Forecast, By Node Size, 2021 - 2034 ($ Bn)

- 8.1 Key trends

- 8.2 Advanced nodes (3nm-7nm)

- 8.3 Mature nodes (14nm-28nm)

- 8.4 Specialty nodes (40nm+)

- 8.5 Advanced packaging integration

Chapter 9 Market Estimates and Forecast, By Memory Type, 2021 - 2034 ($ Bn)

- 9.1 Key trends

- 9.2 In-memory computing

- 9.3 Near-memory processing

- 9.4 Traditional memory hierarchy

- 9.5 Hybrid memory systems

Chapter 10 Market Estimates and Forecast, By Performance Class, 2021 - 2034 ($ Bn)

- 10.1 Key trends

- 10.2 Ultra-low power (Edge/IoT)

- 10.3 High-performance (data center)

- 10.4 Real-time (embedded/critical)

- 10.5 Extreme performance (HPC/Supercomputing)

Chapter 11 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 ($ Bn)

- 11.1 Key trends

- 11.2 Automotive & transportation

- 11.3 Healthcare & life sciences

- 11.4 Financial services

- 11.5 Telecommunications

- 11.6 Aerospace & space

- 11.7 Energy & utilities

- 11.8 Others

Chapter 12 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Bn)

- 12.1 Key trends

- 12.2 AI inference workloads

- 12.3 Graph analytics & network processing

- 12.4 Scientific computing

- 12.5 Autonomous systems control

- 12.6 Industrial automation

- 12.7 Others

Chapter 13 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Bn)

- 13.1 Key trends

- 13.2 North America

- 13.2.1 U.S.

- 13.2.2 Canada

- 13.3 Europe

- 13.3.1 Germany

- 13.3.2 UK

- 13.3.3 France

- 13.3.4 Italy

- 13.3.5 Spain

- 13.3.6 Netherlands

- 13.4 Asia Pacific

- 13.4.1 China

- 13.4.2 India

- 13.4.3 Japan

- 13.4.4 Australia

- 13.4.5 South Korea

- 13.5 Latin America

- 13.5.1 Brazil

- 13.5.2 Mexico

- 13.5.3 Argentina

- 13.6 Middle East and Africa

- 13.6.1 South Africa

- 13.6.2 Saudi Arabia

- 13.6.3 UAE

Chapter 14 Company Profiles

- 14.1 NVIDIA Corporation

- 14.2 Intel Corporation

- 14.3 Advanced Micro Devices, Inc. (AMD)

- 14.4 Qualcomm Technologies, Inc.

- 14.5 Apple Inc.

- 14.6 Google LLC

- 14.7 Microsoft Corporation

- 14.8 IBM Corporation

- 14.9 Samsung Electronics Co., Ltd.

- 14.10 Huawei Technologies Co., Ltd.

- 14.11 Graphcore Limited

- 14.12 Mythic, Inc.

- 14.13 Cerebras Systems

- 14.14 Arm Holdings plc

- 14.15 MediaTek Inc.

- 14.16 Fujitsu Limited

- 14.17 Alibaba Group Holding Limited

- 14.18 Baidu, Inc.

- 14.19 Synaptics Incorporated

- 14.20 CEVA, Inc.